UK BUSINESSES LOSING £197 MILLION THROUGH POOR QUALITY CONTACT DATA

Published by Gbaf News

Posted on April 1, 2014

8 min readLast updated: January 22, 2026

Published by Gbaf News

Posted on April 1, 2014

8 min readLast updated: January 22, 2026

Experian Data Quality Reveals Disconnect Between Corporate Data Quality Aspirations and Everyday Reality

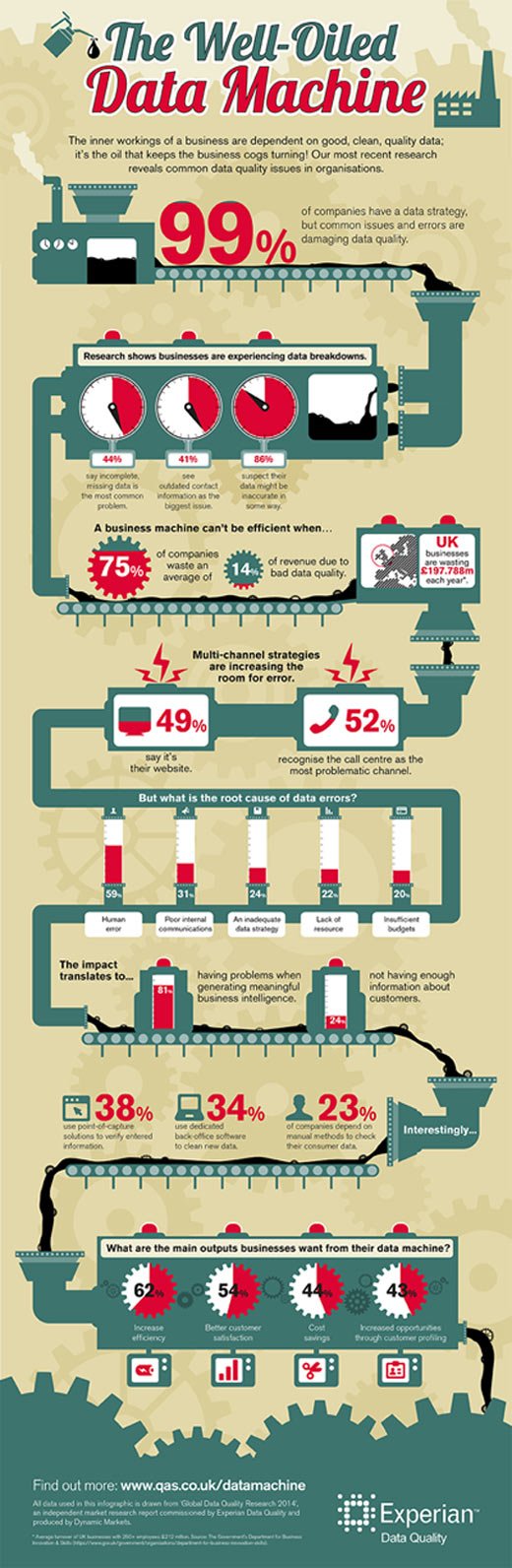

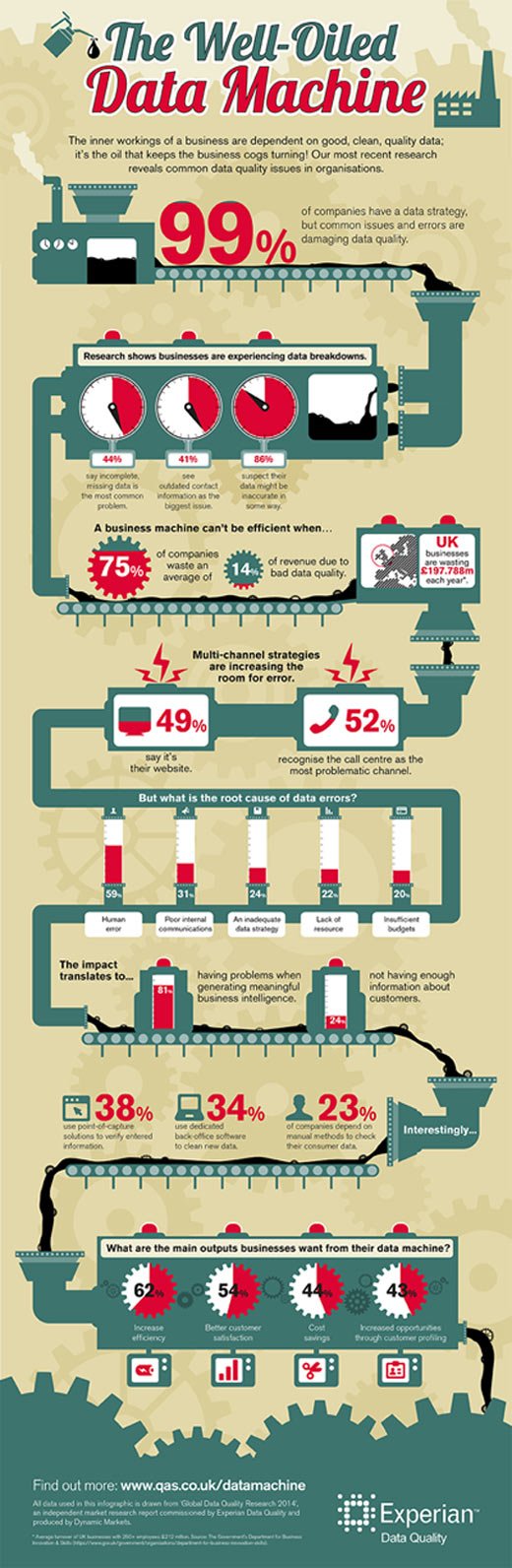

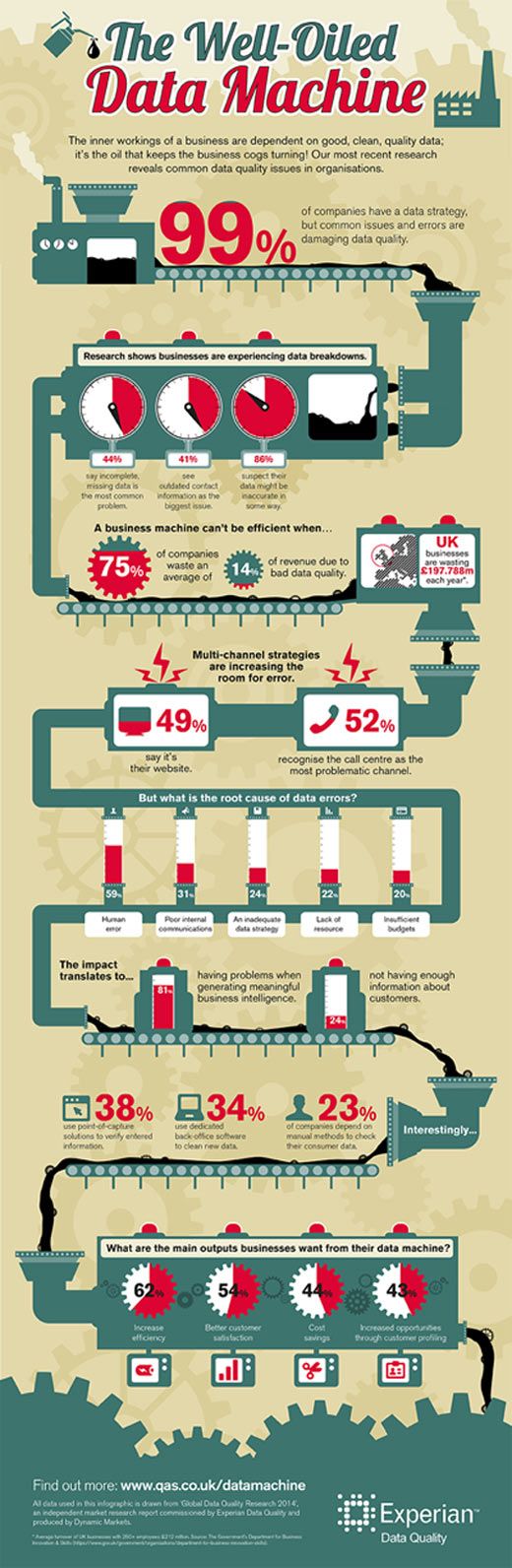

Experian Data Quality, formerly known as Experian QAS, today revealed that 75% of UK organisations are losing potential revenue as a result of poor quality contact data which is wasting both time and resources totaling nearly £200 million* collectively.

Each year, Experian Data Quality commissions the Global Research report, an independent assessment of how organisations across the UK, US and Europe manage the quality of their data assets, the challenges they face in keeping them accurate and complete, as well as how data quality issues impact their business. This year’s research, which surveyed 1,200+ organisations, reveals that while 99% of respondents have a strategy in place designed to maintain data quality, less than a third put a single director in charge of data quality for the whole organisation.

With 94% of respondents stating that they have poor quality data within their databases it is no surprise to find that a quarter of companies still rely entirely on manual processes, such as visually checking spreadsheets, to manage contact data held on customers.

Data Quality is the barrier to broader business initiatives

The results show that there has been an increase in the channels that companies are using to communicate with their customers this year, with the average of 3.4 channels being utilised. This increase in channel adoption escalates the potential for incorrect or duplicate data entering a company, which is an obstacle to UK organisations attempting to drive a cross-channel customer experience. Our research supports this reporting that lack of data quality is causing a barrier to those companies aspiring to cross channel marketing. 83% are experiencing issues in this area and 42% of respondents state that inaccurate data is the cause.

Organisations are also focused on making better management decisions through Business Intelligence (BI) and Analytics tooling. This is yet another initiative that data quality can significantly hinder. 81% of respondents have encountered problems generating meaningful BI/Analytics with 40% blaming data inaccuracies. The loss of the potential insight that BI/Analytics can deliver from good data on customers is a key business differentiator in the current recovering, and highly competitive environment.

Data Quality processes – Data doing the dirty

Companies are estimating, on average, a five per cent increase in the inaccuracy of contact data (up to 22% from 17% in 2013). Look closer and we see that 54% of those respondents are using manual entry sources, such as call centres, to collect contact information. Interestingly, call centres are not only one of the most popular ways to collect information on a customer (54%) but is also described by 52% as the ‘dirtiest’.

These findings seem apt when 59% of respondents claim human error as the biggest contributor to poor quality contact data. It follows then that human error through manual collection channels is directly affecting the data quality of businesses. With wasted revenue higher among those who only use manual processes verses those that use only automated checks. This shows the importance of understanding channels of data collection as part of an effective data strategy.

Enrichment playing a key role

Contact data tops the list of data businesses deem essential to marketing success (54%), followed by transactional data at 44%. But these sources are only providing a foundation, with an impressive 94% seeing value gained by enriching this data with additional insight gained from third party sources.

Joel Curry, Managing Director at Experian Data Quality concludes, “The need for measured data quality controls is not diminishing, and, if anything it is becoming increasingly imperative. More and more channels are becoming available for organisations to communicate with their customers and being able to link these interactions together sits at the heart of delivering a quality customer experience. Defining a data quality strategy is not a tick box exercise; improvement initiatives need processes and technology, that are enabled across the organisation, to ensure revenue streams and customer satisfactions are not adversely affected.”

Other Key Findings From the 2014 Global Research:

Strategy isn’t enough

Bad data is costing business

Getting the data right – too much is incorrect

For a copy of Experian Data Quality’s 2014 Global Data Quality Research Report please visit:

http://cdn.qas.com/media/marketing/downloads/pdf/whitepapers/uk/v6_WP_Landscape-12pp-Ext-Jan13.pdf

* Respondents were asked what percentage of their revenue / funding did they think inaccurate and incomplete customer or prospect data costs their organisation in terms of wasted resources, lost productivity or wasted marketing and communications spend?

Supporting Statistics – Source: The Government’s Department for Business Innovation & Skills (https://www.gov.uk/government/organisations/department-for-business-innovation-skills).

Business population estimates for the UK: Table 2, UK whole economy:

| Number of businesses | Turnover £ millions | Average t/o £ millions | |

| 250 or more | 8,885 | 1,886,912 | 212 |

Note: These total turnover figures exclude SIC 2007 Section K (financial and insurance activities) where turnover is not available on a comparable basis.

Research methodology

This survey was carried out for Experian Data Quality by research firm Dynamic Markets. They interviewed representatives of 1,206 organisations in the UK, US, France, Germany, Spain and the Netherlands. The sample ranges from small firms to organisations over 5,000 employees and includes industries such as manufacturing, automotive, transport, financial services, retail, utilities and the public sector.

Each organisation has at least one customer, citizen or prospect database that is managed and maintained internally. The average number of databases per organisation is 8. Respondents come from functions including marketing, CRM, data management, customer services, IT, sales, HR, finance and operations. All confirmed that they understood how their organisation handles its customer and prospect databases.

About Experian Data Quality

Experian Data Quality is renowned for assisting customers with their unique data quality challenges. Providing a comprehensive toolkit for data quality projects combining market leading software with a vast scope of reference data assets and services EDQ’s mission is to put customers in a position to make the right decisions from accurate and reliable data.

Established in 1990 with offices throughout the United States, Europe and Asia Pacific, Experian Data Quality has more than 13,500 clients worldwide in retail, finance, education, insurance, government, healthcare and other sectors.

About Experian

Experian is the leading global information services company, providing data and analytical tools to clients around the world. The Group helps businesses to manage credit risk, prevent fraud, target marketing offers and automate decision making. Experian also helps individuals to check their credit report and credit score, and protect against identity theft.

Experian plc is listed on the London Stock Exchange (EXPN) and is a constituent of the FTSE 100 index. Total revenue for the year ended 31 March 2013 was US$4.7 billion. Experian employs approximately 17,000 people in 40 countries and has its corporate headquarters in Dublin, Ireland, with operational headquarters in Nottingham, UK; California, US; and São Paulo, Brazil.

For more information, visit http://www.experianplc.com

Explore more articles in the Business category