RUSSIA’S TOUCH BANK – TAPPING BIG DATA FOR PERSONALIZED BANKING

Published by Gbaf News

Posted on November 19, 2015

3 min readLast updated: January 22, 2026

Published by Gbaf News

Posted on November 19, 2015

3 min readLast updated: January 22, 2026

In many global credit markets, credit bureau data is considered the state of the ar. Russia’s Touch Bank, a retail online bank of the international financial group OTP, is going further, using predictive analytics and Big Data to deliver a personalized experience to its customers.

“Touch Bank is focused on high-tech solutions, agility, flexibility and an individual approach to offering banking products and providing services to our clients,” said Andrei Kozliar, Touch Bank’s CEO. “We saw an opportunity to explore massive amounts of data obtained from various sources and build predictive models to drive customized offers for the bank’s clients.”

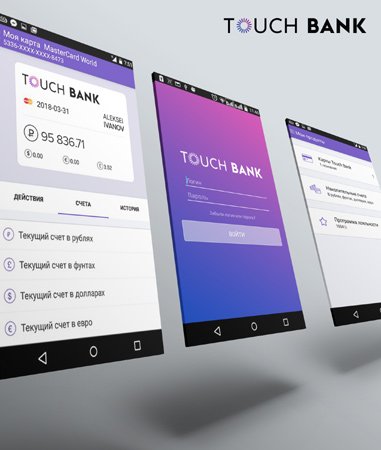

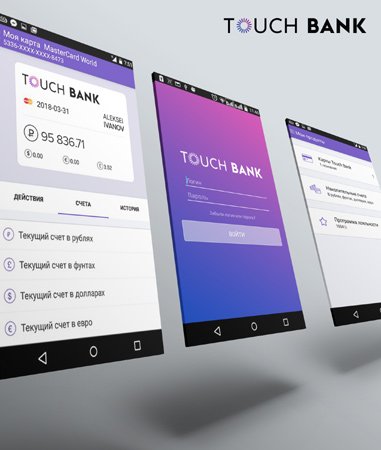

The analytic exploration fits with Touch Bank’s 21st-century business model. Launched in April 2015, Touch Bank is an online-only retail bank, an international project of OTP Group, a European financial group and one of the banking market leaders in Central and Eastern Europe. The main platform for interaction between the bank and its client is the Internet and other interactive communication channels that enable execution of all types of operations around-the-clock, 24/7, with no queues, at any place and at any time. These include convenient top-ups and management of deposits and accounts in multiple currencies, transfers, payments, and other options driving efficient personal finance management in real-time.

Touch Bank partnered with global analytics software firm FICO to build a financial services platform driven by customer insights derived from multiple Big Data sources, not just credit history. When all basic technology elements supporting Touch Bank’s card-based product offering are deployed, a client will be offered a range of customized financial services they can use at their discretion at any time, activating or deactivating any financial product. The bank will set a credit limit with a personalized rate to match an individual borrower’s profile or offer more favorable repayment terms.

This personalized approach to providing financing services is enabled by FICO® Model Builder, a software tool that Touch Bank’s analysts use to build predictive models. The entire technology platform operates in real-time, processing all client data automatically in FICO® Blaze Advisor® decision rules management system. FICO Blaze Advisor and FICO Model Builder are both components in the FICO® Decision Management Suite, a technology platform that provides an easy way for businesses to evaluate, customize, deploy and scale state-of-the-art analytics and decision management solutions.

”Touch Bank is using analytics and automation to deliver highly tailored services to its customers,” said Evgeni Shtemanetyan, who directs FICO’s operations in Russia from the company’s Moscow office. “This kind of innovation is making Touch Bank a rising star in Russia’s financial services sector.”

Explore more articles in the Banking category