PORTFOLIO RISK VS GOAL ACHIEVEMENT: A POTENTIAL TRADE-OFF?

Published by Gbaf News

Posted on June 19, 2014

6 min readLast updated: January 22, 2026

Published by Gbaf News

Posted on June 19, 2014

6 min readLast updated: January 22, 2026

Risk tolerance is often the first question wealth advisors assess in trying to help investors create the ideal asset allocation mix. Determining individual risk thresholds becomes, in effect, the foundation for portfolio planning. But can this focus on risk actually interfere with the attainment of personal financial objectives?

Even prior to 2008’s economic downturn that tended to heighten risk aversion, investors and their financial advisors often placed considerable focus on a single dimension of risk — the variability of portfolio returns (commonly measured by standard deviation). While there are many academic explanations for this obsession with portfolio return fluctuation, pain and fear of loss is perhaps the most common thread among investors, particularly as the current economic recovery continues to unfold. So, if risk aversion is a natural human trait, is a focus on portfolio risk counterproductive to achieving long-term financial goals? Are the two mutually exclusive, or is it a matter of balance and trade-off? Clearly, any long-term asset allocation strategy will have some degree of short-term volatility which an investor should be able to tolerate.

Let’s take a closer look at risk tolerance and how this might affect the ability to meet long-term financial objectives.

The “Risk” Dilemma

An individual investor zeroes in on a short-term risk perspective to estimate the potential downside of their portfolio in any given one-year period of time.

They construct an asset allocation based primarily on their short-term risk tolerance.  This would be a fine approach, if their goal was to minimize risk in any given one-year period of time. In fact, for most investors, financial goals have less to do with portfolio risk minimization and much more to do with maintaining a comfortable retirement lifestyle, not becoming a burden on loved-ones, providing for a grandchild’s college education, or fulfilling philanthropic goals, to name a few. The appropriate risk measurement in these cases is not the standard deviation of the portfolio, but rather the probability of success, based upon the portfolio, of achieving the actual goal. Increasing portfolio risk may actually increase the likelihood of achieving the real goal. See the example below.

This would be a fine approach, if their goal was to minimize risk in any given one-year period of time. In fact, for most investors, financial goals have less to do with portfolio risk minimization and much more to do with maintaining a comfortable retirement lifestyle, not becoming a burden on loved-ones, providing for a grandchild’s college education, or fulfilling philanthropic goals, to name a few. The appropriate risk measurement in these cases is not the standard deviation of the portfolio, but rather the probability of success, based upon the portfolio, of achieving the actual goal. Increasing portfolio risk may actually increase the likelihood of achieving the real goal. See the example below.

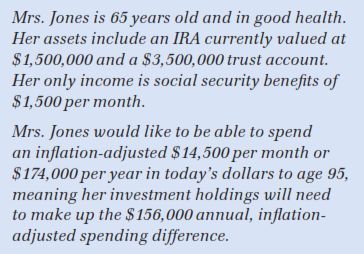

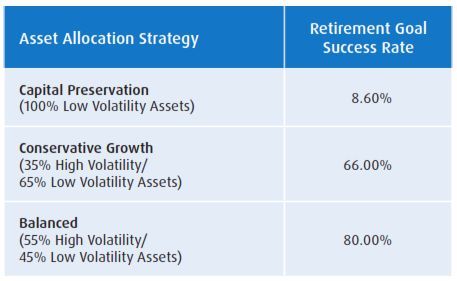

Using a statistical method called Monte Carlo analysis, we can apply randomly distributed return patterns to test the effect of different portfolio allocations on the likelihood of Mrs. Jones achieving her retirement spending goals.

The results are summarized below.

Monte Carlo analysis

As noted above, Mrs. Jones may have the greatest likelihood of realizing her retirement spending objectives — a projected 80% success rate — with the relatively more aggressive balanced portfolio. While this will not always be the case, the example above illustrates an important point about risk.

What is Mrs. Jones real risk? Is it standard deviation? Or is it the risk of not meeting her spending goals? Portfolios should be constructed to meet an investor’s personal objectives, in this case, Mrs. Jones retirement spending requirements. Portfolio standard deviation is only relevant when viewed through the lens of the client’s individual goals. In this example, the “riskiest” portfolio yielded Mrs. Jones the least amount of retirement risk. Conversely, what good is “protecting” her assets with the most conservative capital preservation portfolio if that allocation virtually guarantees retirement failure? She will “protect” her assets until they are all gone!

To be clear, we are not suggesting that investors take on more risk than is necessary to meet financial goals. What we are suggesting is that investors should determine their asset allocation based less on their one-year downside risk tolerance and more on minimizing the risk of “not accomplishing” their stated goals. As shown in the example, the relationship between short-term portfolio standard deviation and goal attainment can be contradictory.

A Closer Look at the Monte Carlo Analysis

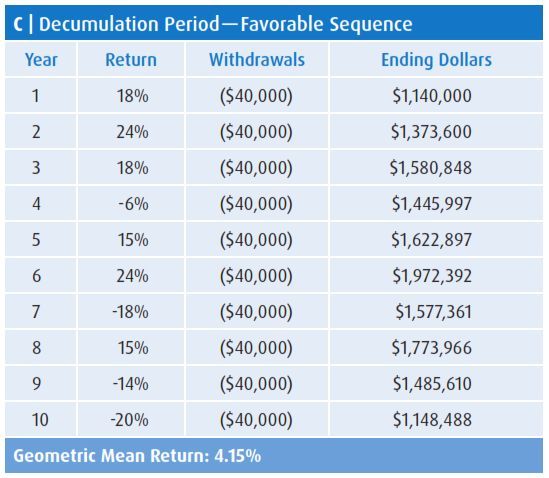

An effective tool in aiding this goal-oriented strategy is the aforementioned Monte Carlo analysis. With Monte Carlo analysis, investors can test the probability of success of meeting specific goals. The real power of this analysis is in the ability to generate different portfolio return patterns under which to test the goals. This is far superior to assuming a linear growth rate of the portfolio based upon a longterm average, which risks yielding more favorable results than one can reasonably expect. The distinction between analyses conducted in a deterministic or linear fashion and the more dynamic and variable Monte Carlo approach is particularly important during the withdrawal period of a portfolio, such as in retirement. This is due, primarily, to the sequence of returns risk, as the chart at right illustrates.

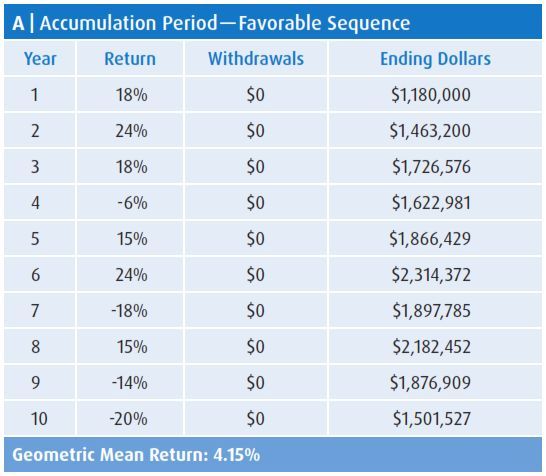

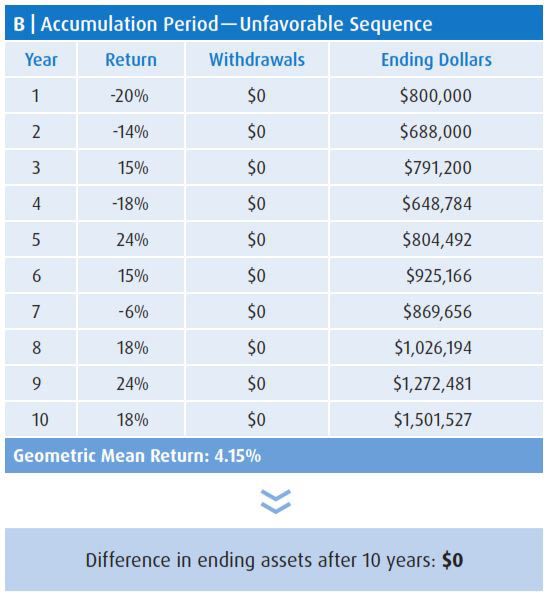

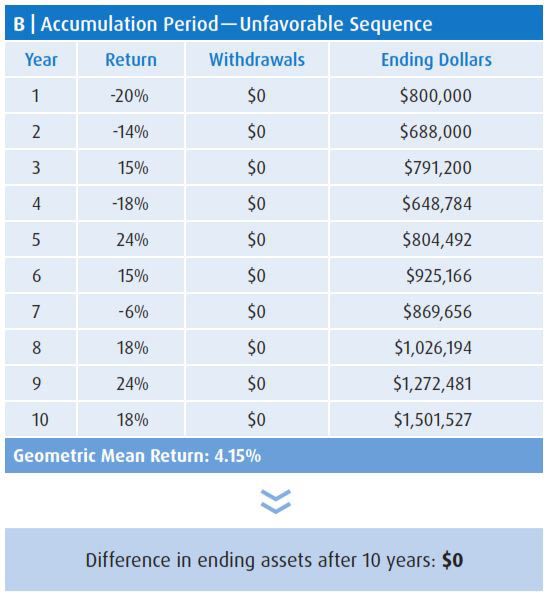

As noted above, when retirement or other personal financial shifts warrant portfolio withdrawal, understanding the impact of sequence of returns is imperative. If no withdrawals are put in play, sequencing might be irrelevant. For example, in quadrants A and B, two investors with the same valued portfolio each earn a series of returns in exactly opposite directions. If no withdrawals are taken from either of these portfolios, their respective compound returns and ending values are identical after ten years, or whatever the mirrored time horizon. If, however, withdrawals are taken from the portfolios, as reflected in quadrants C and D, the sequence of returns becomes critical. In these examples, two investors could have earned the same compound returns, but ended up with significantly different portfolio values due to the sequence of returns. Were this scenario played out over a longer time horizon, the results could become even more dramatic. This type of risk is difficult to model using linear growth assumptions. Thus, while Monte Carlo analysis is not perfect, it can be an extremely valuable decision tool in helping to analyze the effect of various return patterns on the achievement of portfolio goals..

Sequence of Returns Risk

Beginning Dollars $1,000,000

Conclusion

When determining the most effective asset allocation strategy to meet personal long-term financial goals, at least three fundamental questions should be asked. First, what is the probability of success in achieving these goals?

When determining the most effective asset allocation strategy to meet personal long-term financial goals, at least three fundamental questions should be asked. First, what is the probability of success in achieving these goals?

Second, what is the potential volatility of this portfolio as it works to meet those goals? And lastly, can I live with that volatility? If the portfolio’s volatility exceeds an investor’s comfort threshold, financial goals may need to be modified to fit a more tolerable portfolio. When determining asset allocation in this manner, investors become more aware of the effect of the portfolio decision on their actual goals. They can then make an informed asset allocation decision, balancing any trade-offs between short-term portfolio volatility and the achievement of longer-term goals.

Feel Confident About Your Future

BMO Private Bank — its professionals, its disciplined approach, its comprehensive and innovative advisory platform — can provide financial peace of mind.

For greater confidence in your future, call your BMO Private Bank Advisor today.

www.bmoprivatebank.com

BMO Private Bank is a brand name used in the United States by BMO Harris Bank N.A. Member FDIC. Not all products and services are available in every state and/or location.

Estate planning requires legal assistance which BMO Harris Bank N.A. and its affiliates do not provide. Please consult with your legal advisor.

Certified Financial Planner Board of Standards Inc. owns the certification marks CFP® , CERTIFIED FINANCIAL PLANNER™ and CFP in the U.S.

May 2014

Explore more articles in the Top Stories category