Paper Receipts Bound for the Bin

Published by Gbaf News

Posted on August 23, 2012

5 min readLast updated: January 22, 2026

Published by Gbaf News

Posted on August 23, 2012

5 min readLast updated: January 22, 2026

By Milly King

Apparently, we are in a digital age. We ‘write’ letters on our phones, read ‘books’ on plastic pads, and ‘talk’ to our friends through social media. We pay for goods without cash, access our bank accounts online and are told even our wallets will soon be digital. Yet in this undoubted digital age, rather bizarrely, we still get handed a paper receipt at the end of most transactions. Is the till receipt proving to be one of the last bastions of paper?

No, at least not if two London based entrepreneurs have anything to do with it. Andrew Carroll (Managing Director) and Giles Hankinson (Business Development Director) are the co-founders of Paperless Receipts Limited and are about to launch eReceipts™, a revolutionary technology that enables retailers and businesses to give their customers digital or as they call them eReceipts™, rather than paper receipts.

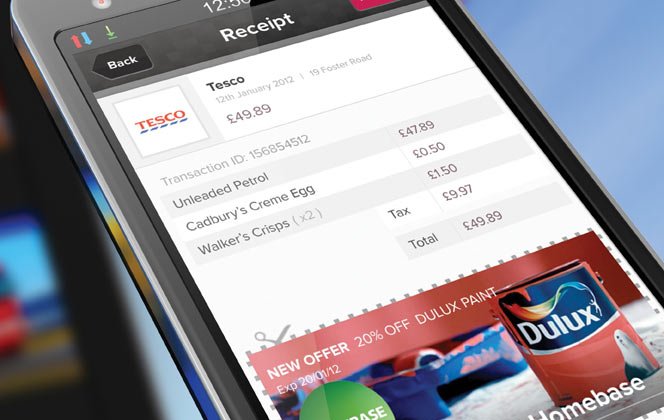

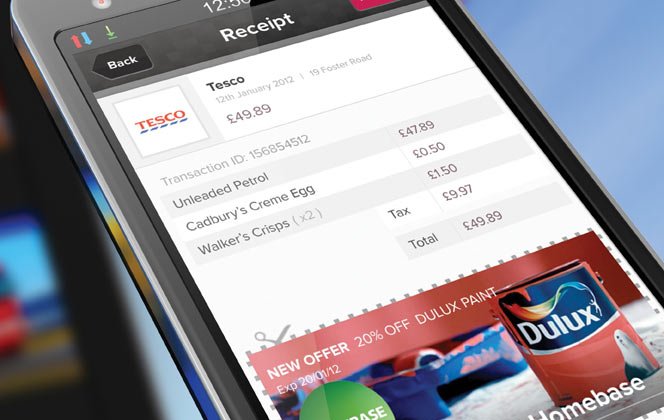

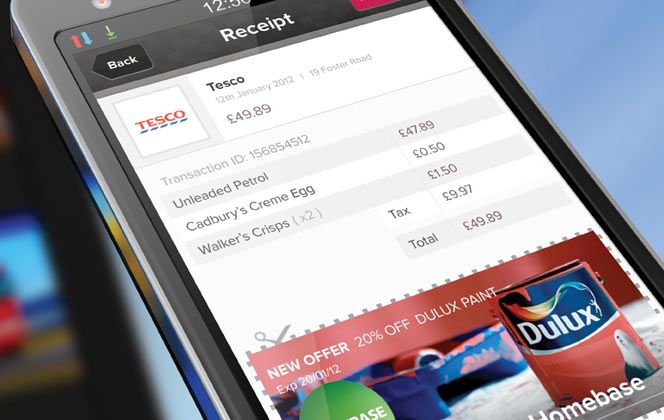

It works like this. The customer receives an electronic receipt which is then stored in a secure personal cloud based account that can be accessed anytime via mobile or computer. Whenever the customer needs to see, show or print a receipt they can simply log in and there it is. Imagine that – never having to keep a paper receipt again.

The pair of entrepreneurs first met at Cass Business School in London, when Andrew was struck with the idea for eReceipts™ after questioning the need for any one to print a paper receipt in todays digital world. Carroll said, “receipts cause unnecessary clutter and are a hassle for the individual when proving personal expenses and making returns. They are also a time-consuming nightmare for businesses when managing employees expenses and VAT returns.

“Over the past 18 months we have developed a game-changing disruptive technology to realize our vision. We are exceptionally lucky to have established a team of talented individuals who share this vision and who are helping us bring eReceipts™ to market”, said Carroll.

Paperless Receipts Ltd was founded in January 2011 and comprises a veritable “who’s who” of the retail and technology world. The company is Chaired by Lord Ian MacLaurin, formerly CEO of Tesco and the man who brought us the ClubCard. Other notables include Peter Gardner a serial technology investor and former HSBC Banker who was a seed investor at Last.FM; The Wright family who founded Kiddicare.com and recently sold to Morrisons Plc; and Robert Diamond, former CEO of EMNOS a global leader in the retail analytic and modelling space.

The company has recently integrated its eReceipt technology into the UK’s major Point-of-Sale provider, IBM. Hankinson stated that by integrating into IBM’s ‘Retail Industry Framework’, “we are effectively giving a significant proportion of the UK’s high street retailers the ability to issue eReceipts™ at the flick of a switch. We are now working with the other major POS providers to enable their systems too”.

So what impact will this technology really have on people’s everyday lives? “Significantly”, is the view of Hankinson. “Our research findings continue to astonish us. In our latest survey we asked over 400 consumers if they had a choice between a paper receipt or an eReceipt which would they prefer. 90% stated they would prefer an eReceipt. That’s emphatic”.

Seemingly this is just one of many results that confirm a resounding appetite to move from paper to paperless. “If you think about it, it’s logical that most of us would prefer to have a permanent digital copy of a receipt we can always access. It means we never need worry about keeping that receipt for the TV we just bought or similarly, for that pair of designer jeans just in case the zip breaks. It really is a no-brainer, especially if you’re a chap like me who doesn’t always keep the receipts he perhaps should” said Carroll.

The idea seems so obvious you would be forgiven for thinking that the technology already exists. “No it doesn’t” said Carroll. “Apple first ventured into the space by providing email receipts which are not the same. In fact we would go as far to say that email receipts are more onerous to manage than paper receipts. Think about it. You need to download the email, open the PDF, Tag it and file it and make sure you back it up. That is of course if the retailer sends it to the correct email address in the first place and your computer doesn’t crash in the meantime. The solution is to have a personal account where consumers receipts are stored seamlessly directly from the point of sale”.

The benefits are not just limited to bricks and mortar stores. Hankinson explained, “Most households now need to log onto at least 17 different online accounts to manage their receipts. This includes their bank accounts as well as other accounts for clothes, loyalty cards, petrol, electricity, water, rates, travel, phone, tv, to name just a few. In the future, we hope all these providers integrate with eReceipts and thus allow their customers to collect and store their receipts in a single account. This would save a huge amount of time and hassle in what is already a very busy digital life”.

Paperless Receipts starts rolling out its technology in September with a soft-launch in Kensington & Chelsea. At the time of going to press almost 100 retailers had signed up to the technology with a further 100 enquiries per month pouring in from retailers wanting to join and take advantage of this potentially game-changing technology. A full launch across the UK starts in January 2013.

Explore more articles in the Technology category