Global private equity activity remains subdued in first half of 2012 as UK bucks trend

Published by Gbaf News

Posted on July 31, 2012

5 min readLast updated: January 22, 2026

Published by Gbaf News

Posted on July 31, 2012

5 min readLast updated: January 22, 2026

By Chris Cummings, Chief Executive of TheCityUK

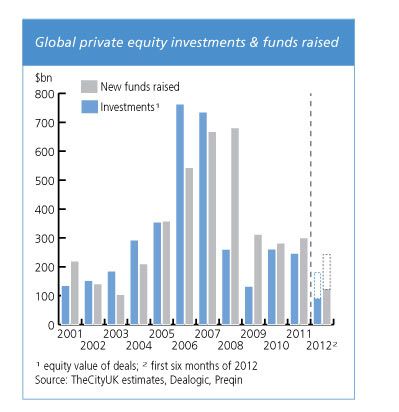

The global private equity sector has seen a significant downturn in activity since the start of the economic downturn. However, the industry is gradually recovering and remains an important source of funds for start-up and young firms, firms in financial distress and those seeking buyout financing.

Global trends

According to TheCityUK’s Private Equity 2012 report, global private equity investment was down by a quarter to $93bn in the first half of 2012, extending the decline seen in 2011 but up on the low level of activity seen at the outset of the credit crisis. Although UK private equity firms saw a similar decline in investments in 2011, buyouts increased to £8bn in the first half of 2012, 38% up on the second half of 2011.

Private-equity backed buyouts generated some 6.9% of global M&A volume in 2011 and 5.9% in the first half of 2012. This was down on 7.4% in 2010 and well below the all-time high of 21% five years earlier. Any global recovery in the second half of 2012 will largely depend on factors such as the stabilisation of the sovereign debt situation in Europe and improved growth prospects.

High yield bond issuance and leverage loans reached the highest levels since the start of the economic downturn during the first half of 2011, making it possible for private equity funds to secure financing on more favourable terms than in the previous three years. However, tightening of debt availability since then has contributed to a rise in the cost of financing. Global leverage finance in the first half of 2012, at $692bn, was 23% below the same period in the previous year.

The fund raising environment remained stable for the third year running in 2011 with $270bn in new funds raised, slightly down on the previous year’s total. Around $130bn in funds was raised in the first half of 2012, down around a fifth on the first half of 2011. The average time for funds to achieve a final close fell to 16.7 months in the first half of 2012, from 18.5 months in 2011. Private equity funds available for investment (also known as “dry powder”) totalled $949bn at the end of the first quarter in 2012, down around 6% on twelve months earlier. Including unrealised funds in existing investments, private equity funds under management probably totalled over $2.0 trillion.

Global exit activity totalled $252bn in 2011, practically unchanged from the previous year but well up on 2008 and 2009, as private equity firms sought to take advantage of improved market conditions at the start of the year to realise investments. Exit activity, however, has lost momentum since the peak of $113bn in the second quarter of 2011. TheCityUK estimates total exit activity of some $100bn in the first half of 2012, well down on the same period in the previous year.

UK trends

The UK is the largest and most developed private equity centre in Europe, and London is one of the two leading international centres for the management of private equity investments along with New York. Firms located in the UK have also attracted the largest proportion of European private equity investments in recent years. Many factors contribute to the UK’s attraction as a centre for private equity, such as: the availability of funds to invest; opportunities to make investments; people with the necessary skills to source, negotiate, structure and manage investments; and the availability of exit opportunities given the large and liquid equity market.

The UK private equity market accounted for 12% of global investments and 9% of funds raised in 2011. Trends in the UK largely mirrored global trends, with investments seeing a 9% decline during the year to £18.6bn. Figures from the Centre for Management Buyout Research show that 2012 started reasonably well with buyouts worth £8.0bn recorded in the first six months of the year, a 38% increase on the previous six months and 16% up on the same period in 2011.

The UK private equity industry has also become more global over the past decade. In 2011, UK private equity firms invested nearly two-thirds of their funds into businesses located overseas. Around 75% of these investments were in continental European countries, and most of the remainder in the US. The UK’s influence overseas is considerable, both through direct investment from the UK offices of private equity firms and through their offices overseas.

New funds raised in the UK totalled £4.5bn in 2011, down from £6.6bn in 2010 but up from £3.0bn in 2009. Overseas investors generated over two-thirds of the total. Fund-raising has lagged investments over the past three years, largely a result of an accumulation of funds by private equity firms in the years preceding the crisis which were not deployed as a result of the economic downturn.

The regional breakdown of investment activity shows that investments in firms located in London totalled around £2.9bn in 2011, down 16% on the previous year but nearly twice the amount invested two years earlier. London accounted for 44% of UK investments, up from 42% in the previous year. The share of investments elsewhere in the South-East increased to 17% from 14% in the previous year. London tends to attract larger investments as indicated by its smaller share of the number of UK investments (26%). Other regions which showed an increase in their share of UK investments by value in 2011 included the North-West, Scotland, the East of England, the East Midlands and Wales.

Private equity funds managed in the UK currently back around 3,800 companies, employing around 1.2m people across the world. Of these, around 515,000 are employed in the UK. In 2011, investments were made into more than 1,000 companies, employing some 300,000 people, of which 130,000 in the UK.

www.thecityuk.com

Explore more articles in the Top Stories category