The “Summit Bump” – Euro Policy & Its Effect on the Markets

Published by Gbaf News

Posted on July 31, 2012

5 min readLast updated: January 22, 2026

Published by Gbaf News

Posted on July 31, 2012

5 min readLast updated: January 22, 2026

By Gareth Parker – Senior Director, Research & Development, Russell Indexes Europe

Since the end of the financial crisis, the European markets have experienced a seemingly unending series of “fixes.” European leaders and policy makers gather and come up with various solutions to the financial issues plaguing the region, then communicate their plans to the media and the markets.

In recent years, these “fixes” have been greeted with an initial burst of market optimism, as demonstrated by the Russell Indexes, only to taper off in the following days. Recent index performance seems to indicate that this pattern may be changing, yet the overwhelming evidence points to the fact that Europe needs to fundamentally change before its markets will fully recover. And, furthermore, long-term investors may be better served by examining long-term market drivers underlying the European markets rather than looking for short-term market swings due to temporary swings in investor sentiment.

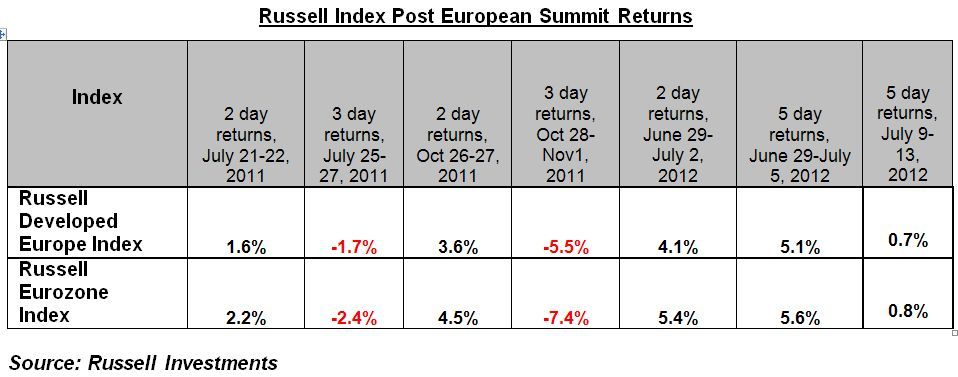

Index returns in recent years show the short-term nature of the quick fix. In the two trading days following the euro-area summit on May 21st 2011, the Russell Developed Europe Index and the Russell Eurozone Index were both positive, but turned negative over the following three trading days. Similarly, in the two trading days following the euro-area summit on October 26th 2011, the Russell Developed Europe Index and the Russell Eurozone Index were both positive, but turned negative over the following three trading days.

The aftermath of the most recent euro-area summit shows a different market reaction, with both Indexes showing positive returns over the five days including the day of the conference. And European markets appear to be building on this optimism, with positive returns for the Russell Developed Europe and Russell Eurozone Indexes following the meeting of euro-zone finance ministers in Brussels on July 9th.

Is this a short-term reaction to market news, or a longer term trend? Index performance appears to point to the latter, but investors shouldn’t be fooled by a burst of optimism. An upbeat proclamation and promised actions to improve the euro-situation can be beneficial to the markets, but it must be followed by substantive market reforms and actions that are followed through. The Russell Indexes show that the market impact of the European fiscal summits has to-date been short-lived, with optimism on the back of each successive proclamation demonstrating very little staying power. And, while recent market performance suggests this pattern may be changing, it remains to be seen whether this is an indication of constructive change on the part of EU leaders or a market driven by short-term political news rather than long-term fundamentals.

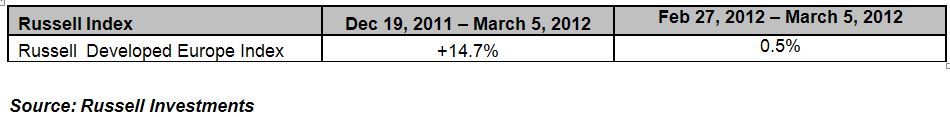

There is some reason to believe that substantive measures can be accompanied by strong market returns. We have seen a sustained positive market reaction to political and fiscal measures in the past. For example, the Russell Developed Europe Index returned +14.7% from December 19th, when the first round of long term repurchase operations, or LTRO, was announced by the European Central Bank through March 5th. The second round of LTRO was announced by the ECB on February 27th, and since then the Russell Developed Europe Index returned +0.5% through March 5th.

Yet, when viewed in the context of broader European market performance at the time, the market reaction to the LTRO could just as easily have been driven by overarching market forces at the time. The European markets were marching upward in the first quarter of 2012 along with the rest of the global equity markets. While the market’s reaction could be attributed in part to the favorable reception for LTRO, a large part of the performance can certainly be chalked up to positive global equity markets.

At the end of the day, while it can be interesting and sometimes enlightening to look for short-term market bumps in Europe following policy announcements or political summits, a more fundamental, research-driven approach to portfolio construction is advised when constructing and managing a global multi-asset portfolio.

Nothing contained in this material is intended to constitute legal, tax, securities or investment advice, nor an opinion regarding the appropriateness of any investments, nor a solicitation of any type. The general information contained in this publication should not be acted upon without obtaining specific legal, tax and investment advice from a licensed professional.

Opinions expressed by Mr. Parker reflect market performance and observations as of July 18, 2012 and are subject to change at anytime based on market or other conditions without notice. Please remember that past performance does not guarantee future performance.

The Russell Global Index includes more than 10,000 securities in 48 countries and covers approximately 98% of the investable global market. All securities in the index are classified according to size, region, country and sector. Daily Returns for the main components are available here: http://www.russell.com/indexes/data/daily_total_returns_global.asp

Please note: Indexes are unmanaged and cannot be invested in directly. Returns represent past performance, are not a guarantee of future performance, and are not indicative of any specific investment. Russell’s publication of the Indexes or Index constituents in no way suggests or implies a representation or opinion by Russell as to the attractiveness of investing in a particular security. Inclusion of a security in an Index is not a promotion, sponsorship or endorsement of a security by Russell and Russell makes no representation, warranty or guarantee with respect to the performance of any security included in a Russell Index.

Russell Investment Group is a Washington, USA corporation, which operates through subsidiaries worldwide, including Russell Investments, and is a subsidiary of The Northwestern Mutual Life Insurance Company.

Explore more articles in the Top Stories category