FTS LAUNCHES SMART PAYMENTS ENABLING SOLUTION FOR PAYMENTS SECTOR

Published by Gbaf News

Posted on March 7, 2014

3 min readLast updated: January 22, 2026

Published by Gbaf News

Posted on March 7, 2014

3 min readLast updated: January 22, 2026

Platform Dynamically Enhances e-Commerce Payment Processing, Revenue Sharing and Merchant Acquiring

FTS Smart Payments

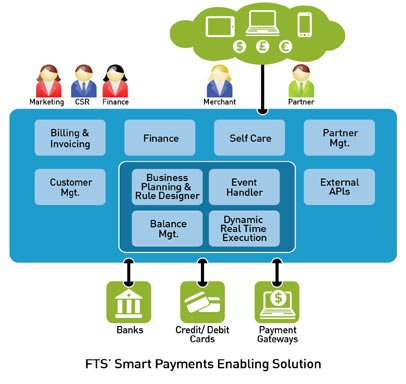

FTS has launched the FTS Smart Payments Enabling™ Solution to deliver smooth and effective card payment processing, digital merchant acquiring and revenue sharing procedures within the e-commerce and the m-commerce arenas.

FTS’ Smart Payments Enabling Solution automates the billing and settlement functionality of payment systems, working with payment service providers (PSPs), independent sales organizations (ISOs), online merchants and merchant acquirers to make the payment process, especially those involving multiple parties, smoother, easier and simpler to manage.

The Smart Payments Enabling Solution can also help providers and merchants to go beyond the simple and rapidly develop new and creative customized plans for each of their partners and merchants, enabling:

FTS’ Leap Billing is a feature-rich platform that meets the diverse and expanding requirements of the various players in the payments, e-commerce and m-commerce industry. The rapid time to market, flexibility and vendor-independence provided by Leap Billing are key elements in the effective deployment of billing and revenue sharing business models. This new payments solution moves FTS’ Leap™ Billing platform into new markets, alongside the company’s core market of telecom billing and customer care.

FTS Launches Smart Payments Enabling Solution For Payments Sector

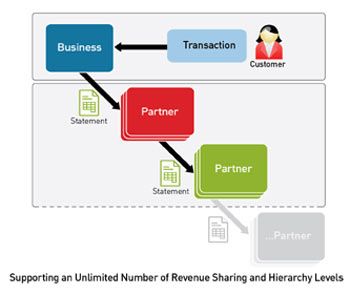

FTS’ Smart Payments Enabling Solution provides the diversity and speed needed to fully automate and independently manage revenue sharing and settlement processes, making it possible to effortlessly deliver fully customized business logic for every partner. It also enables faster digital onboarding of acquirers’ ISO and merchant service provider (MSP) partners and merchants – each with its own business logic – supporting dynamic and flexible creation of individual contracts with an unlimited number of hierarchy levels.

“FTS has now shifted Leap Billing into the realm of card payment processing, digital merchant acquiring and innovative revenue sharing procedures,” said Nir Asulin, CEO of FTS. “The versatility of Leap Billing has allowed us to move beyond traditional telecom billing and successfully contend with the rapidly changing needs of the dynamic payments market’s business challenges, especially in regard to sophisticated new commercial models and revenue sharing schemes.”

Delivered via cloud or on-premise models and available on Linux and a broad range of hardware to keep costs to a minimum, FTS’ Smart Payments Enabling Solution is an all-inclusive tool for payment processing, revenue sharing and acquiring processes enabling.

Explore more articles in the Top Stories category