FICO DATA: LATE PAYMENTS REACH TWO-YEAR LOW AMONG UK CARDHOLDERS

Published by Gbaf News

Posted on March 31, 2015

2 min readLast updated: January 22, 2026

Published by Gbaf News

Posted on March 31, 2015

2 min readLast updated: January 22, 2026

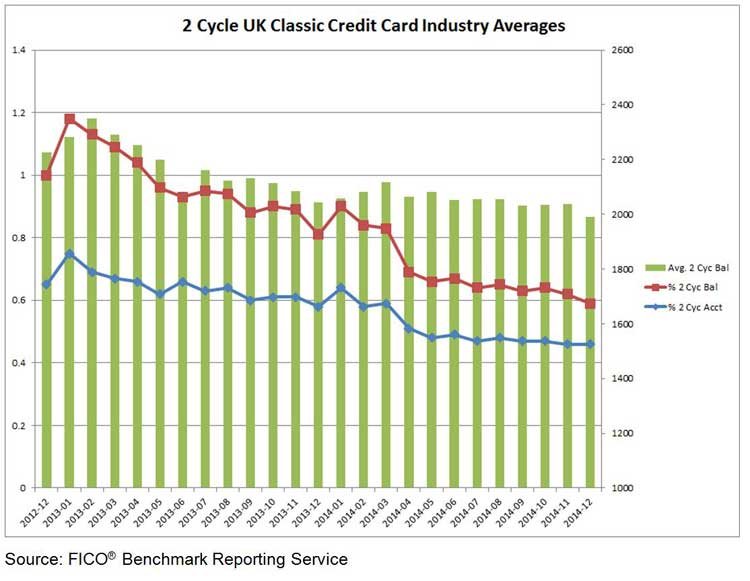

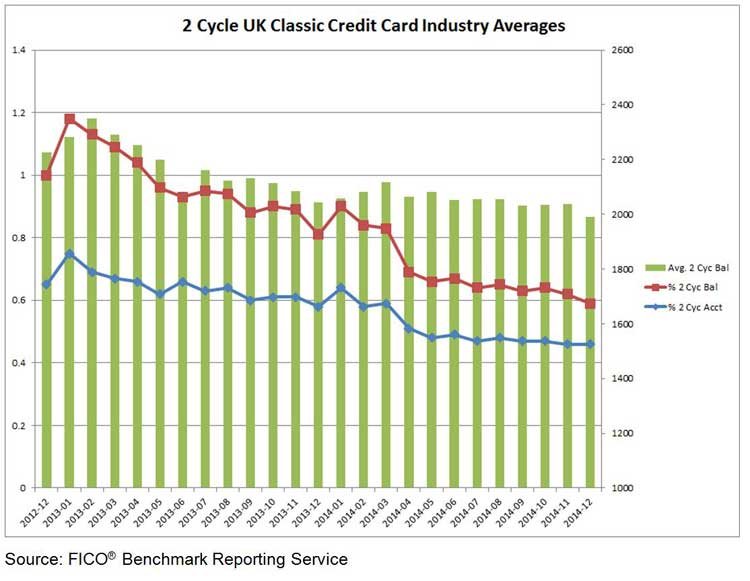

New data from FICO (NYSE:FICO), the predictive analytics and decision management software company, showed that late credit card payments have continued to decline in the UK, reaching the lowest point in more than two years. FICO’s analysis of around 80 percent of all credit cards issued in the UK showed a continued decline in the percentage of accounts that are delinquent, matched by a decline in the balances that are delinquent.

For example, the snapshot from December 2014 shows that 0.6 percent of accounts were two cycles (60+ days) delinquent, compared to 0.8 percent in December 2013 and 1.0 percent in December 2012. The impact of seasonal spending on key metrics will be available in the next benchmarking report.

“These figures indicate a sustained positive trend that matches the steady growth in the UK economy, helped in part by a decline in oil prices that’s leaving more money in consumers’ pockets,” said Stacey West, a Fair Isaac® Advisors business consultant who works with UK card issuers. “For card issuers, this trend provides an opportunity to analyse their data in more depth, and identify the best targeted treatments for specific account segments that are experiencing delinquencies.”

West noted that overlimit accounts were also down compared to December 2013, but the average amount overlimit increased by £12.80 in the last year. Average total sales rose £56 over the year from December 2013 to December 2014, driven by a rise among established accounts (open 1 to 5 years) and veteran accounts (open more than five years).

“For the first time since at least 2002, average spend on veteran accounts rose above £700, yet utilisation overall continues to fall,” said West. “In this environment, lenders should closely evaluate not just affordability but also the cardholder’s likelihood to use a higher limit, in order to maximise profits.”

Explore more articles in the Top Stories category