Digesting Biden exit, markets focus on earnings, data

By Yoruk Bahceli and Tom Westbrook

(Reuters) -World markets steadied on Tuesday as investors looked beyond Joe Biden’s exit from the U.S. presidential race, turning their focus to corporate earnings and economic data.

Biden’s exit from the race has cast some doubt over a Republican victory under Donald Trump and could see investors unwind trades betting that such a win would add to U.S. fiscal and inflationary pressures.

Vice President Kamala Harris will campaign in the battleground state of Wisconsin on Tuesday as the Democrats’s presumed nominee.

The pan-European STOXX index was up 0.2%, while U.S. stock futures were down 0.1% following a 1.1% rise in the S&P 500 on Monday.[.N]

The U.S. dollar was up 0.1% against a basket of currencies..

Having digested the news of Biden quitting the race, “markets appear to be in a bit of a holding pattern,” said Michael Brown, senior strategist at broker Pepperstone in London.

Investors will now focus on whether the polls show a closer race against Trump than when Biden was the Democratic candidate, Brown said.

“You’d expect that, were polls to narrow, and the race be seen as a closer contest, volatility to tick higher, and perhaps some downside creep into the equity space too,” he added.

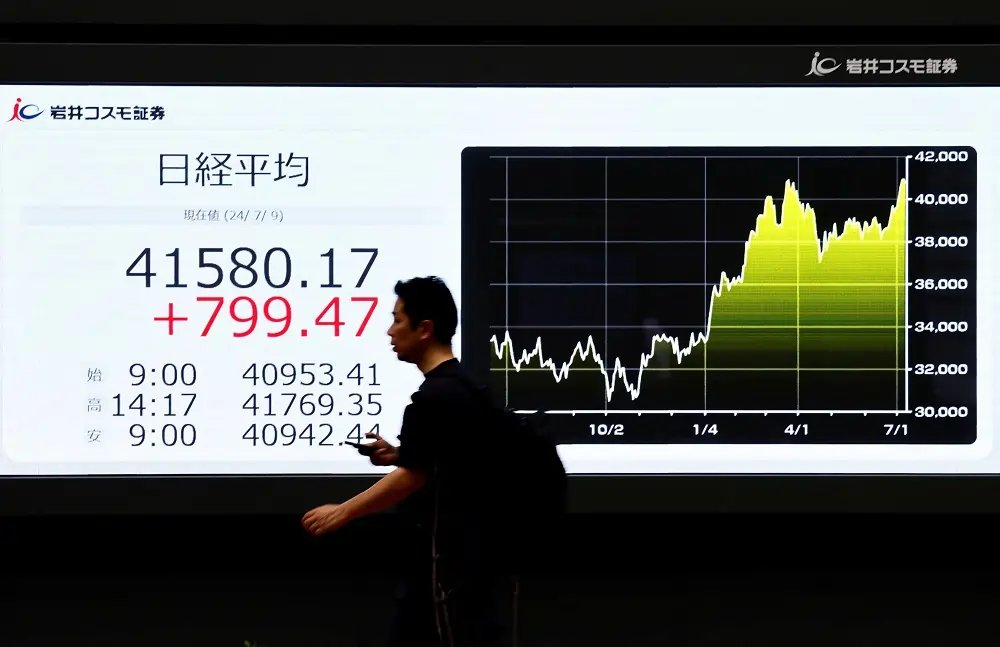

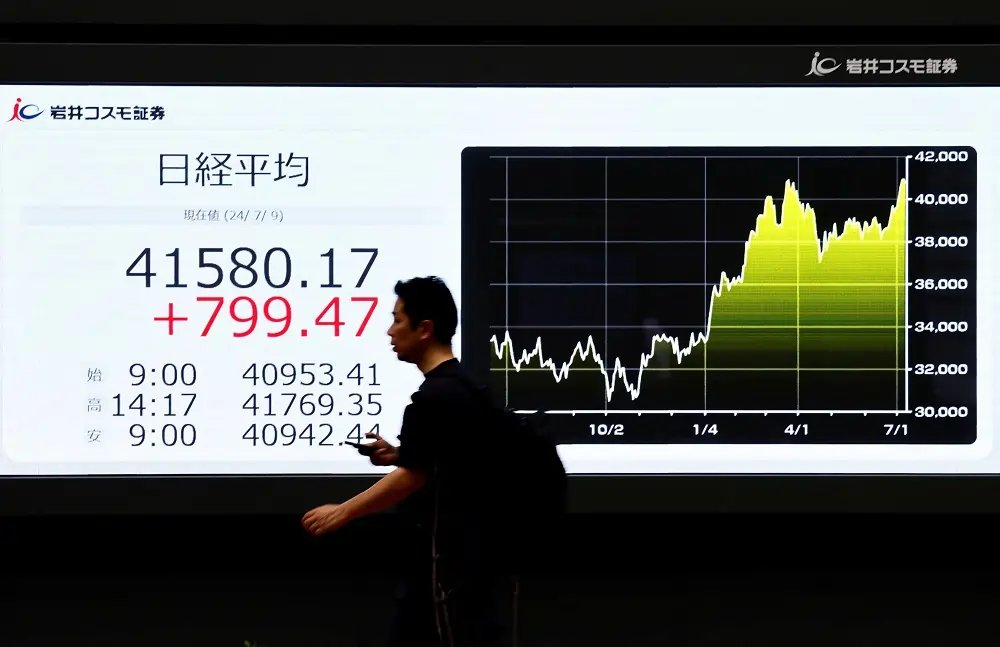

Still, Asian markets remained supported on Tuesday, with Taiwan’s benchmark snapping five sessions of losses, rising over 2%.

That tracked a broader rebound in chipmaking shares and recovering some of the $100 billion in market value that was wiped off TSMC, the world’s largest contract chipmaker, over the previous few sessions following Trump’s comments on Taiwan. [.T]

Focus was firmly on earnings on Tuesday, with Tesla and Alphabet due to report after the session close in New York, beginning the season for the “Magnificent Seven” megacap group of stocks.

The tech sector is projected to increase year-over-year earnings by 17%, while profit for the communication services sector is seen rising about 22%, according to LSEG IBES.

Big movers in premarket trading on the back of earnings so far on Tuesday included Spotify, which leapt around 14%, and United Parcel Services, which slumped over 10%.

In Europe, France’s LVMH, will be closely-watched as sliding demand from China has pummelled the sector.

DATA WATCH

In currency markets the yen was in focus, last up 0.7% against the dollar at 155.96.

Comments form a senior Japanese politician on Monday added to the pressure on the Bank of Japan, which meets on July 31, to keep hiking rates to help boost its currency, which Tokyo has intervened to prop up this month.

China’s surprise interest rate cuts on Monday, putting a spotlight on weakness in the world’s second largest economy, continued to hurt markets on Tuesday.

Chinese stocks recorded their biggest single-day drop in six months, copper prices dropped to their lowest in 3-1/2 months, while Australia and New Zealand’s currencies, often seen as liquid proxies for the Chinese yuan, also fell.

The euro was down 0.3% at $1.086.

Focus remained on central banks. Markets have priced in two U.S. rate cuts this year with the first in September, but expectations could be ruffled by growth and consumer price data due later in the week.

Having ticked up on Monday, benchmark 10-year U.S. Treasury yields fell three basis points to 4.23%. Two-year yields, sensitive to interest rate expectations, were down 2 bps at 4.50%.

Advance U.S. gross domestic product is forecast to show growth picking up to an annualised 2% in the second quarter on Thursday, while the closely watched Atlanta Fed GDPNow indicator points to growth of 2.7%, suggesting some risk to the upside.

On Friday, the core personal consumption expenditures index, the Fed’s preferred inflation measure, is seen rising 0.1% in June, pulling the annual pace down a tick to 2.5%.

Gold prices were pinned around $2,400 after peaking above $2,450 last week. Brent crude futures, which hit a one-month low on Monday, were down 0.8% at $81.77.

Bitcoin, which has rallied on bets a Trump administration would take a light-touch approach to cryptocurrency regulation, was down over 2% at $66,428.

(Reporting by Yoruk Bahceli and Tom Westbrook; Editing by Sam Holmes, Angus MacSwan and Emelia Sithole-Matarise)

Corporate profits refer to the earnings of companies after all expenses have been deducted from total revenue, reflecting the financial performance of businesses.

Inflation is the rate at which the general level of prices for goods and services rises, eroding purchasing power and often measured by the Consumer Price Index (CPI).

Central banks are national financial institutions that manage a country's currency, money supply, and interest rates, and oversee the banking system.

Financial markets are platforms where buyers and sellers engage in the trading of assets such as stocks, bonds, currencies, and derivatives.

Explore more articles in the Top Stories category