CRITEO REPORTS RECORD RESULTS FOR THE SECOND QUARTER 2014 AND INCREASES FULL-YEAR 2014 GUIDANCE

Published by Gbaf News

Posted on August 8, 2014

10 min readLast updated: January 22, 2026

Published by Gbaf News

Posted on August 8, 2014

10 min readLast updated: January 22, 2026

Criteo S.A. (Nasdaq:CRTO), the performance advertising technology company, announced its financial results for the second quarter ended June 30, 2014.

[1]Variations at constant currency exclude the impact of foreign currency fluctuations and are computed by restating 2014 figures with the 2013 average exchange rates.

Executive Quote

“We delivered another record quarter exceeding our expectations, driven by focused execution across the business in all regions” said JB Rudelle, Criteo’s co-founder and CEO. “We are very pleased by the success of our significant technology enhancements and the broadening of our client base across geographies.”

Operating Highlights

o In the Americas: Orvis, PartyCity

o In EMEA: Abritel (Homeaway group), ING, PayPal, Samsung, VoyageSNCF.com

o In Asia-Pacific: AB Road, music.jp

Revenue ex-TAC

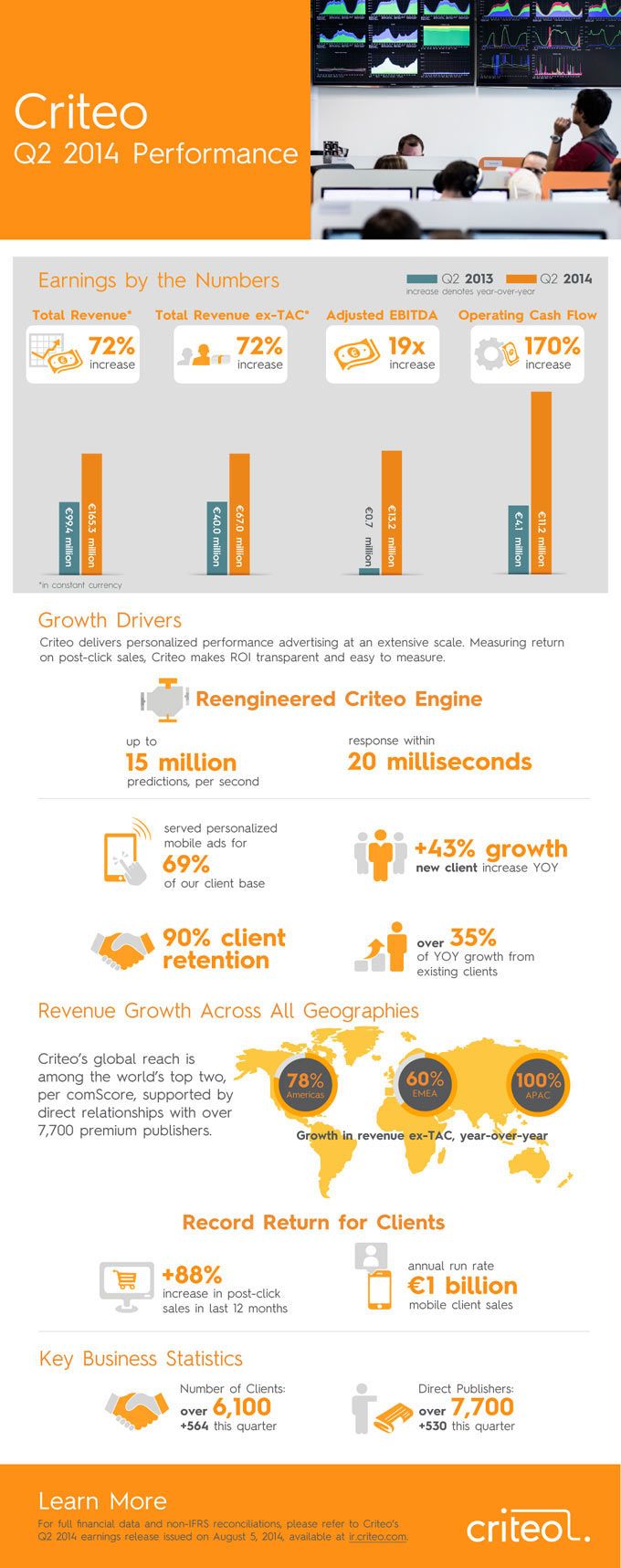

Revenue ex-TAC grew 67.4% in the second quarter 2014, or 72.1% at constant currency, to €67.0 million, compared with €40.0 million in the second quarter 2013. This year-over-year performance was primarily driven by the broad-based growth of operations across our geographies, the expansion of our client base, particularly in the midmarket segment, and the continued roll-out of our product set to a greater share of clients across all markets.

Revenue ex-TAC margin as a percentage of revenue in the second quarter 2014 was at 40.5%, representing a 0.2 percentage point increase compared with 40.3% in the second quarter of 2013.

Adjusted EBITDA and Operating Expenses

Adjusted EBITDA for the second quarter 2014 was €13.2 million, an increase of €12.6 million, or €12.6 million at constant currency, compared with €0.7 million in the second quarter 2013. This year-over-year increase in Adjusted EBITDA is primarily the result of the strong revenue ex-TAC performance in the quarter, as well as the favorable impact of some exceptional items, primarily an increase in R&D tax credit to be recognized in 2014, which were partially offset by our continued strong investments in the quarter.

Operating expenses in the second quarter of 2014 increased by 43.6% to €53.7 million, compared with the second quarter 2013. Excluding the impact of share-based compensation, pension costs, depreciation and amortization and acquisition-related deferred price consideration, which, taking all exclusions together, we reference as operating expenses on a “Non-IFRS basis”, our operating expenses in the second quarter 2014 were €49.1 million, an increase of 38.6% compared with the second quarter of 2013. This increase in operating expenses over the period was principally related to headcount growth across our three main functions – Research & Development, Sales & Operations and General & Administrative – as we continued to scale the whole Criteo organization to support anticipated future growth. In particular, our headcount in Sales & Operations increased by 60% year-over-year in an effort to capture market opportunity in our geographies, especially in our mid-market organization. We intend to continue to invest significantly through the remainder of the year, as well as accelerate our investments in Research & Development and Sales & Operations, as we progress toward our full potential.

Net Income and Adjusted Net Income

Net income for the second quarter 2014 was €2.4 million, representing a €8.0 million increase compared with a net loss of €5.6 million in the second quarter 2013. Net income available to shareholders of Criteo S.A. for the second quarter 2014 was €2.2 million, or €0.04 per diluted share, compared with a net loss of €5.6 million, or €0.11 per diluted share, in the second quarter 2013.

Adjusted Net Income for the second quarter 2014, or our net income adjusted to eliminate the impact of share-based compensation expense, amortization of acquisition-related intangible assets and acquisition-related deferred price consideration and the tax impact of these adjustments, was €5.5 million, representing a €10.0 million increase compared with an Adjusted Net Loss of €4.4 million in the second quarter 2013.

Cash Flow and Cash Position

Business Outlook

The following forward-looking statements reflect Criteo’s expectations as of August 5, 2014.

Third Quarter 2014 Guidance:

Fiscal Year 2014 Guidance:

The above guidance assumes no additional acquisitions are completed during the quarter ending September 30, 2014 or the fiscal year ending December 31, 2014.

Non-IFRS Financial Measures

This press release and its attachments include the following financial measures defined as non-IFRS financial measures by the U.S. Securities and Exchange Commission (SEC): Revenue ex-TAC, Adjusted EBITDA, Adjusted Net Income, Free Cash Flow, Non-IFRS Operating Expenses and Revenue ex-TAC margin. These measures are not calculated in accordance with IFRS.

Revenue ex-TAC is our revenue excluding traffic acquisition costs (TAC) generated over the applicable measurement period. Revenue ex-TAC is a key measure used by our management and board of directors to evaluate our operating performance, generate future operating plans and make strategic decisions regarding the allocation of capital. In particular, we believe that the elimination of TAC from revenue can provide a useful measure for period-to-period comparisons of our core business. Accordingly, we believe that Revenue ex-TAC provides useful information to investors and the market generally in understanding and evaluating our operating results in the same manner as our management and board of directors.

Adjusted EBITDA is our income (loss) from operations before interest, taxes, depreciation and amortization, adjusted to eliminate the impact of share-based compensation expense, pension service costs and acquisition-related deferred price consideration. Adjusted EBITDA is a key measure used by our management and board of directors to understand and evaluate our core operating performance and trends, to prepare and approve our annual budget and to develop short- and long-term operational plans. In particular, we believe that the elimination of non-cash compensation expense, pension costs and acquisition-related deferred price consideration in calculating Adjusted EBITDA can provide a useful measure for period-to-period comparisons of our core business.

Adjusted Net Income is our net income adjusted to eliminate the impact of share-based compensation expense, amortization of acquisition-related intangible assets and acquisition-related deferred price consideration, and the tax impact of these adjustments. Adjusted Net Income is not a measure calculated in accordance with IFRS. In particular, we believe that the elimination of share-based compensation expense, amortization of acquisition-related intangible assets and acquisition-related deferred price consideration and the tax impact of these adjustments in calculating Adjusted Net Income can provide a useful measure for period-to-period comparisons of our core business. Accordingly, we believe that Adjusted Net Income provides useful information to investors and the market generally in understanding and evaluating our results of operations in the same manner as our management and board of directors.

Please refer to supplemental financial tables provided in the appendix of this press release for a reconciliation of Revenue ex-TAC to revenue, Adjusted EBITDA to net income and Adjusted Net Income to net income, the most comparable IFRS measurements. Our use of non-IFRS financial measures has limitations as analytical tools, and you should not consider them in isolation or as a substitute for analysis of our financial results as reported under the International Financial Reporting Standards (IFRS), as issued by the International Accounting Standards Board.

With respect to our expectations under “Business Outlook” above, reconciliation of Revenue ex-TAC and Adjusted EBITDA guidance to the closest corresponding IFRS measure is not available without unreasonable efforts on a forward-looking basis due to the high variability, complexity and low visibility with respect to the charges excluded from these non-IFRS measures; in particular, the measures and effects of stock-based compensation expense specific to equity compensation awards that are directly impacted by unpredictable fluctuations in our stock price. We expect the variability of the above charges to have a significant, and potentially unpredictable, impact on our future IFRS financial results.

These measures may be different than non-IFRS financial measures used by other companies. The presentation of this financial information is not intended to be considered in isolation or as a substitute for the financial information prepared and presented in accordance with IFRS. Explanations of the Company’s non-IFRS financial measures, and reconciliations of these financial measures to the IFRS financial measures the Company considers most comparable, are included in the accompanying tables below.

Explore more articles in the Top Stories category