Corporate Governance Reform in Japan leads to Activism

Published by Gbaf News

Posted on September 26, 2018

2 min readLast updated: January 21, 2026

Published by Gbaf News

Posted on September 26, 2018

2 min readLast updated: January 21, 2026

Joe Bauernfreund, fund manager for British Empire Trust plc and the new proposed AVI Japan Opportunity Trust

Asset Value Investors (AVI) the management group responsible for the £1bn British Empire Trust plc has a long history of engagement with investee companies in Europe and Asia, where we often interact with the Board and management to unlock shareholder value and promote high standards of corporate governance.

At AVI these interactions take place behind-closed-doors, where we discuss the various avenues available for improving corporate value. Discussions include increasing dividends; buying back shares; selling or reducing non-core assets; winding up investment vehicles without a viable future; or reducing the complexity of holding companies through simplifying the corporate structure.

Efforts to engage with companies are always constructive, and have a strong track record of generating value for shareholders. AVI has been investing in Japanese equities for three decades, observing the slow development of the corporate governance agenda, which has now reached critical mass.

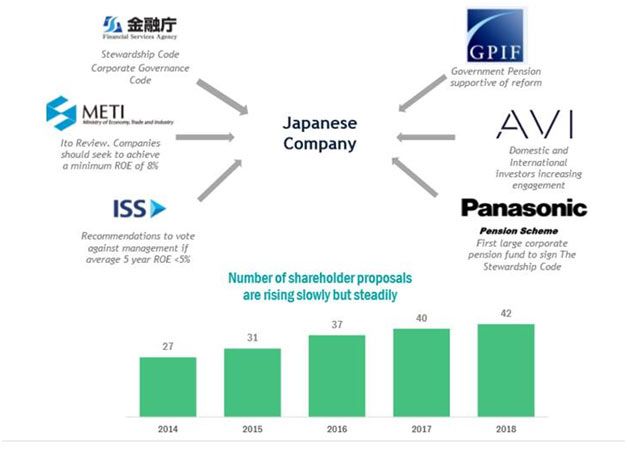

Starting with the introduction of the Stewardship Code in February 2014, a host of private and government bodies, including Japan’s FSA, the Ministry of Economy, Trade & Industry, the Government Pension Investment Fund, ISS and Panasonic, have initiated efforts and reforms which are slowly pushing Japanese companies towards improving their corporate governance and balance sheet efficiency. While change will not happen overnight in Japan, there is nonetheless growing evidence that the tide of public and private opinion in Japan has changed; the ripples from the seismic shift will spread slowly, but should have broad and deep effects on how Japanese companies operate, for the benefit of all stakeholders involved.

Explore more articles in the Top Stories category