‘Adult toys’ auction market tells us about the rich and famous as consumers

Published by Gbaf News

Posted on September 25, 2018

7 min readLast updated: January 21, 2026

Published by Gbaf News

Posted on September 25, 2018

7 min readLast updated: January 21, 2026

BARNEBYS AUCTION SEARCH ENGINE TRACKS WHAT WEALTHY BUYERS

“REALLY REALLY WANT”

There has been an explosion in the value of toys for grown ups -. classic cars, watches, jewellery. All this inessential stuff that those with huge wallets are collecting and investing in.

Barnebys – the leading global art and collectables search engine – has been monitoring this front for the past year. It represents billions of dollars of luxury item buying.

1962 Ferrari 250 GTO, sold at auction in August 2018 for a record US$48 million. Photo: RM Sotheby’s

Barnebys is the worlds leading auction aggregator, monitoring a database second to none of what is selling around the world for record prices and tracking sales of art, antiques and collectables from 3,000 auctioneers client subscribers to their system in Europe, Asia and the USA

Pontus Silfverslope, one of the founders of Barnebys says: “Interest in the top end, the very very best of each collecting category has gone through the roof in the last 25 years. Much in evidence in many of our auction house clients around the world is bidding at the highest level for items that are really coveted by the billionaires. There is no sign that we can see of any lessening of the desire to acquire the ultimate in everything of value.”

“The main action now lies with wine, cars, diamonds and watches. Thanks to the increased global market, greater transparency in the auction sector and a favorable economic situation with good growth in major parts of the world interest in the auction market has increased. Many wealthy people see these new collectibles as a good investment and also a fun investment where the return is more than money in the bank.”

“I would say that you should not invest in art to speculate, but to consume. The same applies when buying a Ferrari from the 1960s or a Rolex Daytona watch. The cars are beautiful in the garage and wristwatch in the wardrobe, but the biggest benefit is being able to make use these things – to drive the car and to wear the watch.

“These collecting areas have skyrocketed in recent years and growth has been enormous. Many millionaires have discovered the pleasure and excitement of the auction market thanks to these categories – cars, wine, watches and jewellery. And some people have become millionaires thanks to their forgotten treasures in the attic or the the basement.”

CLASSIC CARS

The number of classic cars sold at auction every year keeps on rising, so if you are looking for something classic, auction houses are a very good place to start your search. Top classic car auction houses include RM Sotheby’s, Bonhams, H&H Classics, Gooding & Co, Barrett Jackson, Artcurial, Aguttes, Russo and Steele.

The most famous automotive brands like Ferrari, Porsche, Aston Martin or Bugatti, to name just a few, have been attracting a broader audience each year and are the object of fierce auctions. With the internationalisation of auction houses sales are increasing and spreading all around the globe.

According to “The Wealth Report” published by Knight Frank, classic cars are, in the long-term, a better investment than art and show an impressive progression of 334 % over the past ten years.

A good example of the strength of this sector is the 1962 Ferrari 250 GTO, which sold at auction just a month ago in August for a record US$48 million. Photo: RM Sotheby’s

WATCHES:

Not since the Renaissance has the fascination with watches been as great as now says Barnebys, the worlds leading auction search engine which offers 65 million prices achieved at auctions worldwide.

This astonishing database is a goldmine for tracking down trend information and currently the watch market is going balistic according to Barnebys figures. Barnebys affiliated auction houses and traders offer approximately one million searchable items daily.

It’s the exclusive watch brands that are the hottest ticket on the auction market which continue to make records at auction. This classic status symbol worn on one’s wrist has become a popular collector’s item and is now one of the most collectable of categories which include wine, cars, art and antiques.

The most searched for watch brand is Rolex, followed by Omega and Patek Philippe. Unlike most other collecting areas, wrist watches attract a younger audience. Over 90% of the searches on Barnebys are made by men between 18-34. But more and more women are also looking for exclusive wristwatches. Today, the watch market is one of the hottest in the auction world.

Paul Newman Rolex Daytona, made in the late 1960s, sold at auction in 2017 for a record US$17.75 million. Photo: Phillips

$17M ROLEX WATCH ONCE OWNED BY PAUL NEWMAN

Paul Newman’s legendary Rolex “Paul Newman” Daytona sold for £13,545,848 ($17,752,500; €15,228,0950), a new world record for a wristwatch at auction. The timepiece sold to an anonymous bidder on the phone after 12 minutes of spirited bidding at Phillips in New York last year.

JEWELLERY:

Jewellery has continued to perform well over the past decade. Jewellery is as subject to fashion as any other commodity says Barnebys and ewellery from the 1960s and 1970s is extremely desirable at the moment. There is also a real interest for signed art deco jewellery, viewed by collectors as small works of art. But it is the great white diamonds, the coloured diamonds, the coloured gemstones – sapphires, emeralds and rubies – and the very best pearls that are currently commanding the most excitement in auction rooms.

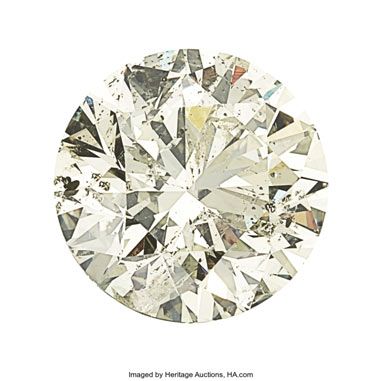

A round brilliant-cut diamond measuring 19.23 x 12.06mm and weighing 28.18 carats. Photo: Heritage Auctions

$28M pink diamond ring and the $6.7M blue sapphire JEWEL OF KASHMIR

This fancy Vivid Pink diamond sold by Christie’s last year for $28.5m was described as the Rolls Royce of diamonds.

Jewellery is as subject to fashion as any other commodity says Barnebys, the one-stop shop auction search engine. Jewellery from the 1960s and 1970s is extremely desirable at the moment. There is also a real interest for signed art deco jewellery, viewed by collectors as small works of art. But it is the great white diamonds, the coloured diamonds, the coloured gemstones – sapphires, emeralds and rubies – and the very best pearls that are currently commanding the most excitement in auction rooms.

And this 27.68-carat Kashmir sapphire and diamond ring, The Jewel of Kashmir, sold for $6.7m at Sotheby’s.

WINE& WHISKY:

There has been something of an earthquake in the wine world with the major sales now taking place in Hong Kong where enormous air conditioned cellars keep premier crus cool for even cooler customers. And where the world record price for Whisky is now held by a Japanese brand. A bottle of Japanese whisky sold at Hong Kong’s Bonhams Whisky Sale for $343,000 (US), toppling both its estimated sale price and the previous world record for a single bottle of Japanese whisky.

The bottle in question was a 50-year-old Yamazaki, a rare single malt. Yamazaki is Japan’s oldest whisky distillery, and first opened in 1923. The Drinks Business notes that the bottle, first released in 2005, is one of only 50 made by the distillery; it was matured in mizunara (Japanese Oak) casks and is “thought to be the oldest Yamazaki on the market.”

When it comes to wine nothing has topped the Jeroboam of 1945 Chateau Mouton Rothschild that sold for $310,700 in February 2007 at Sotheby’s.

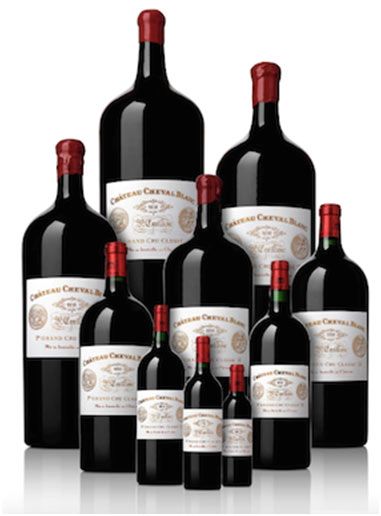

Château Cheval Blanc 2010. Selling by Sothebye September 30 2018

CHATEAU CHEVAL BLANC 2010

HANDBAGS – BAGS OF INVESTMENT VALUE

The value of branded women’s handbags have gone through the roof and today are one of the most collectable alternate investment categories at auction say Barnebys.

“So next time your partners says that she wants a handbag and the price horrifies you, just think that it may in fact prove to be an investment,” says Pontus Silfverstolpe, co-founder of Barnebys.

The new world record is held by a matte white Himalaya Niloticus Crocodile Diamond bag by Hermès Birkin designed by Jean Paul Gaultier. It sold at a Christie’s Hong Kong auction in June 2016 for £208,250. It was described by Christie’s as the “rarest, most sought-after, most valuable bag. Only one or two of the Diamond Himalayas are produced each year.”

Current world record holder at £208,250

Find out more at Barnebys.co.uk

Explore more articles in the Top Stories category