WHY IS STERLING BREAKING OUT OF ITS 5 YEAR RANGE AGAINST THE DOLLAR?

Published by Gbaf News

Posted on May 16, 2014

2 min readLast updated: January 22, 2026

Published by Gbaf News

Posted on May 16, 2014

2 min readLast updated: January 22, 2026

The most frequently cited explanation is that this is a function the improvement in UK growth and interest rate differentials.

There are risks however in being too parochial when explaining the move in sterling.

The reality is that sterling is a small satellite currency that nestles between the two key reserve currencies – the dollar and the euro.

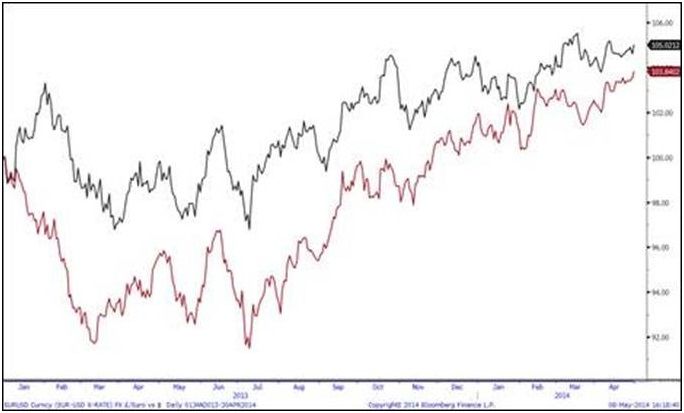

The real story has been the dollar weakness against the euro

The chart below shows that there has been a close directional correlation in returns between the €/$ (black) and £/$ (red) – implying that the pound needs to see the euro weaken to help drag it down against the dollar.

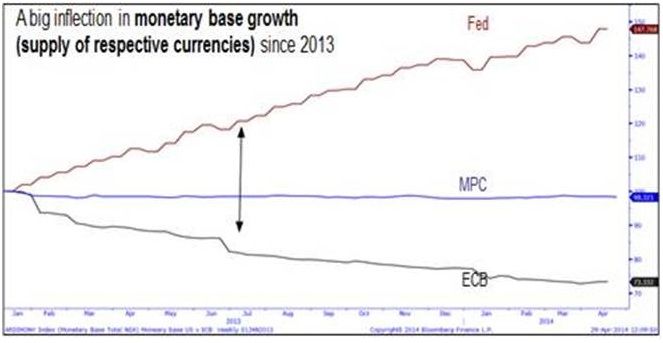

Why has the euro been so strong – this is a function of a reduction in Eurozone breakup risk premia and a big divergence in the supply of euros relative to dollars as represented by the growth of the respective monetary bases of the central banks see chart below.

Why has the euro been so strong – this is a function of a reduction in Eurozone breakup risk premia and a big divergence in the supply of euros relative to dollars as represented by the growth of the respective monetary bases of the central banks see chart below.

If the ECB seeks to counter the deflationary headwinds (and imported price deflation) confronting the region by easing monetary policy and expanding their monetary base then this could be an important catalyst for a correction in the currencies.

If the ECB seeks to counter the deflationary headwinds (and imported price deflation) confronting the region by easing monetary policy and expanding their monetary base then this could be an important catalyst for a correction in the currencies.

A possible sting in the tail for the pound however is that if the euro devalues at a faster rate against the dollar relative to the pound this implies further appreciation of the £/€ cross rate.

Explore more articles in the Top Stories category