WHAT’S THE ROI? BUILDING YOUR CASE FOR REAL-TIME ATM MONITORING & TRANSACTION ANALYTICS

Published by Gbaf News

Posted on July 18, 2014

13 min readLast updated: January 22, 2026

Published by Gbaf News

Posted on July 18, 2014

13 min readLast updated: January 22, 2026

Introduction

Most banks are at a crossroads with their ATM strategies. While some maintain ATMs as deposit takers and cash dispensers, many others are investing in the channel so it plays a broader role in their branch transformation and self-service initiatives.

This investment must be coupled with a robust ATM management strategy that includes proactive, real-time monitoring and transaction analytics. With extended visibility into lost opportunities and failed customer interactions, channel management and operations teams can expand revenue generating capabilities and continue to deliver amazing consumer experiences at the ATM – all in the most efficient, cost effective way possible.

To build a business case for any investment in the ATM channel, you need to demonstrate the ability to achieve operational efficiency improvements, increase revenue, or deliver a better consumer experience (resulting in more return visits, higher net promoter scores). This whitepaper will provide examples of how INETCO’s customers have achieved these benefits with real-time ATM monitoring and transaction analytics.

The problem with ATM availability as a measurement

The problem with ATM availability as a measurement

ATM availability was the ideal metric when ATMs did one or two things (e.g. take deposits, dispense cash) and talked directly (and only) to an ATM switch. If the machine and the network, both carefully monitored by ATM management software, had green lights, you could safely assume that customers would be able to transact. Availability is a one-dimensional metric for what was a one-dimensional piece of equipment with embedded software.

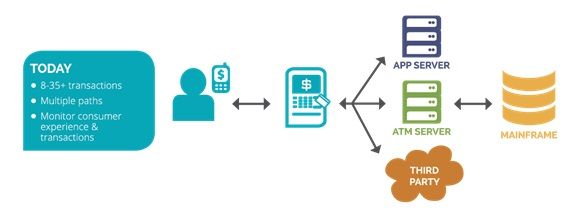

Today’s ATM is a complex, multi-dimensional device. It often combines hardware and software from different vendors, communicates with multiple networks and services, and provides a much richer set of transactions. It’s also much more resilient in its design, architecture, and servicing requirements. As a result, it is much more likely that when there is a problem, it has to do with a particular service, network communications link or card bin range, as opposed to the machine performance itself.

This is where ATM availability begins to break down as a golden metric. Is an ATM “available” if…

This is where ATM availability begins to break down as a golden metric. Is an ATM “available” if…

ATM availability is simply not expressive enough to capture the diverse range of things that result in lost revenue opportunities or poor customer experience at a modern ATM.

Measuring failed customer interactions

This challenge has led a number of leading banks to look at ATM performance from the customer’s perspective. In addition to availability they measure failed customer interactions: the number of times a customer attempted to use an ATM though was unsuccessful.

Measuring failed customer interactions is a great starting point for understanding ATMs from the customer’s perspective. It measures a range of issues that are masked by a one-dimensional focus on ATM availability.

However, measuring failed customer interactions also raises a number of questions such as:

Understanding failed customer interactions with real-time ATM monitoring and transaction analytics

Real-time ATM monitoring and transaction analytics provides the direct view channel managers and operations teams need into lost revenue opportunities and the actual consumer experience at the ATM. It allows you to look behind availability issues and failed consumer interactions to answer deeper questions: why issues are happening, how you can resolve them faster, and what you can do to prevent them in the future.

Real-time ATM monitoring and transaction analytics can transform the way you manage the ATM channel from both a technical and a business perspective. This whitepaper focuses on the technical perspective exclusively, but it’s important to recognize that ATM transaction analytics also enable you to build a powerful base of consumer experience and interaction data that allows you to better understand the role an ATM plays in your customer service strategy and who this channel is serving.

Let’s begin with a definition of real-time ATM monitoring and transaction analytics. This involves capturing a record of every consumer interaction, at every ATM in your fleet, as it occurs (i.e. in real-time). Meta data is then inserted into this record to make it easier to understand and use: ATM names are substituted for cryptic terminal IDs that might appear on the network, status codes are mapped to descriptors like “approved” or declined”, diverse transaction codes are mapped to transaction types like “withdrawal” or “balance inquiry”.

Then, the data is made available and actionable through:

Real-time ATM monitoring and analytics benefit customers in three areas:

In the next section, we’ll explore each of these benefits and how they can be measured.

1. Proactive problem discovery

When customer interactions begin failing or slowing down at an ATM, the clock starts ticking. You may be losing revenue, profits, and customer satisfaction. Even worse, you may not yet be aware of the problem.

You’re not alone. In a typical enterprise, 2 of 5 performance incidents are spotted first by users/customers, who then report them to IT helpdesks[1].

On the positive side, this gap between problem occurrence and discovery is an untapped opportunity for increasing profitability and improving the end customer experience. Real-time ATM monitoring and transaction analytics can help you shrink this gap significantly by spotting the very first case of a failed consumer interaction so that lost revenue opportunities and customer complaints can be minimized and the appropriate personnel notified to immediately act on this information. Customers that have purchased and deployed the INETCO Insight real-time monitoring and transaction analytics software have reported reductions of up to 26% in failed transactions in their first year of product use.

Below is an example that demonstrates the potential financial impact of improving mean time to repair and reducing failed consumer interactions.

| Environment | |

| Number of ATMs | 2000 |

| Number of transactions per month | 6000 |

| Aggregate volume of all ATM’s per month | 12,000,000 |

| Availability | 98.50% |

| Failed consumer interactions per month | 180,000 |

| Financial metrics | |

| Off us surcharge revenue | $2.00 |

| On us surcharge credit[2] | $0.60 |

| On us failed transactions (80%) | 144,000 |

| Off us failed transactions (20%) | 36,000 |

| Current revenue lost/at risk (144K transactions x $0.60) + (36K transactions x $2.00) | $158,400 |

| Reduction in failed consumer interactions with real-time monitoring and transaction analytics | 26% |

| Results | |

| Recovered consumer interactions (26% of 180K) | 46,800 |

| Improved availability ((12M-46.8K)/12M) | 98.89% |

| Recovered monthly revenue (26% of $158.4K) | $41,184 |

| Recovered annual revenue ($41.2K x 12) | $494,208 |

Using the example above, a business case can be based on two factors:

2. Faster troubleshooting

Once a pattern of failed consumer interactions is detected, the pressure is on to find the root cause and restore services as fast as possible. For many banks, this is a labor intensive, time-consuming, trial-and-error process.

In a typical IT organization, 46 hours per month is spent in “war rooms”[3] with multiple team members gathered to determine the root cause of application performance problems.

This gap between problem discovery and problem resolution often requires a coordinated effort across multiple teams: ATM operations, network operations, applications support, 3rd party service providers, and others. Many diagnostics tools are not routinely run in production (because they add too much overhead to system operation). As a result, information on the problem is fragmented and not immediately forthcoming. Everyone has to wait for it to happen again or attempt to reproduce it. All of these activities add significant latency and operational overhead to the problem resolution process.

Customers of INETCO Insight real-time monitoring and transaction analytics software report a 65-75% improvement in mean time to repair (MTTR) and can often resolve issues without assembling a war room or engaging in “blamestorms”.

Let’s use a similar example to show the potential financial impact of improving MTTR in a case where consumer interactions are failing.

| Support Cost Impact (IT Ops and App Support) | Before INETCO Insight | After INETCO Insight |

| # of transaction performance incidents per year | 50 | 50 |

| Number of staff engaged per incident | 2.5 | 1 |

| Avg. time to isolate performance incidents (days) | 3 | 1 |

| Total person-days utilized in incident isolation (50 x 2.5 x 3) vs (50 x 1 x 1) | 375 | 50 |

| IT staff labor rate (loaded cost per year) | $100,000 | $100,000 |

| Total incident isolation cost assuming 235 annual working days ($100K / 235 x 375) vs (100K / 235 x 50) | $159,575 | $21,277 |

| Savings with real-time ATM monitoring and transaction analytics software | $138,298 |

3. Better data mining and performance awareness

At any given moment, your ATM fleet is enabling hundreds or thousands of consumer interactions. Being able to capture and analyze these interactions provides you with powerful data to optimize your fleet, improve profitability and serve customers better.

In this section we’ll look at several examples of how ATM transaction analytics can be aligned with key business initiatives in the ATM channel.

Example #1: Fine-tuning service offerings per ATM

The most common ATM configurations run by retail banks and credit unions are cash dispensers and full service. Interactive tellers are also gaining popularity. Some banks run a few variations of the full service / interactive model. Full service ATMs are more expensive and complex and there are often significant differences in performance and availability across different transaction types and services.

ATM transaction analytics allow you to understand the availability characteristics and usage patterns for each service at a full service ATM. As a result you can make much more granular decisions about which services to offer where. For instance you may notice that 3rd party bill payment is a troublesome service that is only lightly used at 30 of your ATMs. Why not eliminate that service on those ATMs and direct customers to nearby locations that already handle a high volume of these transactions?

Example #2: Capturing real-time marketing campaign performance

One INETCO Insight customer views their ATM fleet as a strategic vehicle for customer acquisition. They have exclusive access to a number of high-profile, high-volume locations in the United Arab Emirates.

They frequently run marketing campaigns at the ATM to encourage their competitors’ customers to use their machines (often through fee reductions), and to deepen their existing customers’ relationship with the bank. It often took weeks to receive campaign reporting, making it impossible for the marketing team to effectively evaluate and adjust campaigns to meet business objectives.

With ATM transaction analytics, this bank is able to capture usage data in real-time. This in turn makes detailed campaign results available to the marketing team immediately, allowing them to evaluate and adjust campaign performance on the fly.

Example #3: Improving transaction times to reduce fleet sprawl

For many banks, the only way to understand customer throughput is to hire someone to sit in the ATM lobby and time customer interactions. This is expensive, and not particularly scalable across a large ATM fleet.

ATM transaction analytics allows you to understand how long customers spend at the ATM and how this varies by location, customer type, and transactions attempted. Using this information you can look for ways to reduce transaction times during peak periods or move more customers through a particular location. This may drive changes in screen flow, new favorite transaction options on the home screen, or an investigation of ways to reduce network latency or transaction processing times.

The net result is that you can extract more value out of your existing ATM fleet, and build out expansion plans that better meet both revenue goals and customer demand.

Building a business case based on performance awareness

These examples demonstrate how you can align an investment in ATM transaction analytics with key business initiatives in the ATM channel. ATM transaction analytics can also become an enabler or an accelerant to an existing initiative with a well-founded business case.

We’ve compiled a list of the top ten questions we’ve heard customers ask that ATM transaction analytics can answer. As you’re reviewing your current business initiatives in the ATM channel, you may want to ask yourself:

Conclusion

The role of the ATM is rapidly evolving as banks embrace omni-channel strategies. A more robust ATM management strategy is required if banks are to make the most of the ATM channel going forward. This whitepaper introduced a number of different ways to drive a business case for investment in enhanced real- time monitoring and transaction analytics.

For many banks, assembling ATM data for analysis is labor-intensive, and inflexible. The data is likely scattered across multiple systems, owned by different teams, and updated at different intervals. The means of accessing it are often labor intensive and inflexible as well, meaning that requests for new slices of data go into a queue for delivery that may stretch to weeks or months. Real-time ATM monitoring and transaction analytics software allows banks to build and own a rich base of data to guide smarter decisions that make their ATM channel more profitable.

Improving the availability of ATM transaction data can help you discover problems earlier, resolve them faster, and gain better awareness of how your ATMs are used so that you can provide an amazing customer experience.

[1] TRAC Research. APM Spectrum Report. 2013.

[2] Many banks measure ATM financial performance for on us transactions by factoring in a percentage of what it would cost to execute the transaction at another bank’s ATM.

[3] TRAC Research. APM Spectrum Report. 2013.

Explore more articles in the Banking category