What’s the actual cost of the cloud in 2018/19?

Published by Gbaf News

Posted on October 23, 2018

4 min readLast updated: January 21, 2026

Published by Gbaf News

Posted on October 23, 2018

4 min readLast updated: January 21, 2026

Matthew Beale, Datacentre Solutions Specialist, Ultima

As companies look ahead to 2019 and where they should be investing in IT, cloud is bound to be on the agenda. But what do the latest cloud cost comparisons look like and who should be investing in cloud?

How does cloud stack up against on-premise?

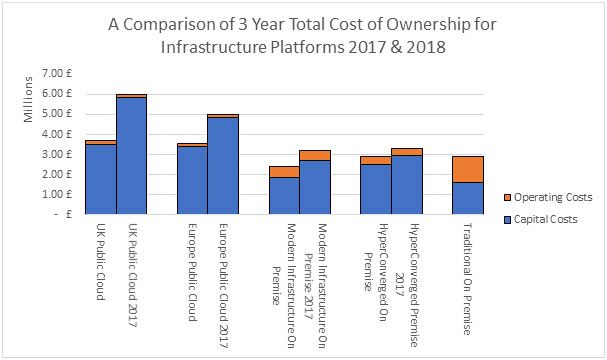

Ultima has recently researched the cost of cloud vs on-premise computing and found some interesting comparisons. Importantly, because of advancements in software that can be deployed, the functionality of on-premise platforms has increased drastically allowing organisations to consume on-premise IT in a similar manner to public cloud.

The comparison looked at a similar sizing for the infrastructure (for both on-premise and cloud) as follows:

There are five different platforms that have been considered for this, each with their own benefits and pitfalls:

Good news

Even with the additional functionality all of the on-premise, costs have dropped. The same can also be said for the cloud costs, given how new the UK platform was last year the costs here have dropped drastically. The graph shows how some costs have been changing at a far more rapid rate than others.

If a different style of migration was applied the graph would look very different; the cloud becomes much more cost-efficient additional services, auto-scaling instances and rapid scaling are being leveraged. However, these services require a much more complex, and therefore more costly, migration.

SME vs large business

For smaller businesses despite this year’s reductions the cost of running on-premise systems is still a prohibitive overhead, therefore SaaS (Software as a Service) and IaaS (Infrastructure as a Service) still work more effectively.

* NB: Traditional On Premise wasn’t on 2017 costs.

For those businesses needing to scale quickly there might be a need to provide bespoke applications to suit specific business use cases. The need to run these applications and build platforms to support a diverse range of applications becomes paramount.

Another important aspect of this analysis is based on a static and predictable workload, however, in the ‘real’ business world not every application is of this nature and businesses need to take this into account. Workloads that vary widely throughout their lifecycle may well end up as hybrid or fully public cloud workloads. As businesses evolve and grow in the next year there may be a need to use applications that can leverage alternative capabilities that cloud services can provide, such as machine learning, if this doesn’t exist on-premise.

n-premise

The research highlighted the public cloud should be used when it allows businesses to augment its on-premise capabilities. Every workload has its own characteristics and requirements and it should be based on this mix that businesses select the best option.

For example, if a business is using VDI (Virtual Desktop Infrastructure), but it is only being used between 9am-5pm in the UK, it could utilise the cloud and auto scaling to reduce the cost during the night; whilst still enabling the business to utilise the number desktops needed during the day. The other option is to re-architect applications to take advantage of PaaS (Platform as a Service) and SaaS technologies. If this is carried out, then the costings will improve too.

Businesses using cloud services might not look to pocket these savings, but to reinvest them in order to gain a higher level of functionality within the platform. This could include software for automation and network virtualisation.

Looking Ahead

Saving the best news for last, it is highly likely that these costs will continue to decrease in 2019. This is due to the increasing supply of flash drives from the new fabrication plants that have come online in 2018 and which will lessen hardware costs. This, coupled with the new competitive nature of AMD (Advanced Micro Devices) within the server market, means the costs for both on-premise and public cloud will decrease.

Increased competition in the network virtualisation world with two goliaths fighting for control (Cisco with ACI and VMWare with NSX) should also be good news for businesses looking at these types of technology.

Over the next 12 to 24 months there will be a big change in how applications are built and designed. A distinct move away from monolithic applications into a world built on microservices which will allow businesses to take advantage of a hybrid workload which is being load-balanced across both public and private platforms.

Explore more articles in the Technology category