WHAT IS YOUR FUTURE IN BANKING? ASK LLOYDS, BARCLAYS OR RBS

Published by Gbaf News

Posted on March 27, 2014

6 min readLast updated: January 22, 2026

Published by Gbaf News

Posted on March 27, 2014

6 min readLast updated: January 22, 2026

With the ground still shifting, those who choose to remain in the banking sector are going to require a good sense of balance.

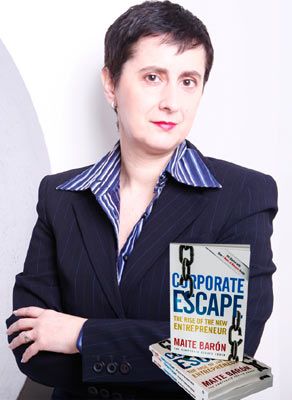

By Maite Barón, CEO, The Corporate Escape™

No sector of the economy can resist change forever, and any immunity that used to come with size is long gone.

Maite Barón, CEO, The Corporate Escape™

The downturn we have just experienced has led to a substantial restructuring of the banking and finance sector, as corporate organisations have sought ways to ‘rebalance’ their investment in resources and personnel. Inevitably, one of the headline consequences is the wholesale loss of banking jobs. According to Switzerland-based global financial union UNI Finance, this adds up to 193,000 fewer jobs over the last two years in the 26 countries where it has a presence.

And these figures pre-date Lloyds’ and Barclays’ announcements of further job losses. Part state-owned Lloyds said last Tuesday that it will be cutting around 1,000 jobs as it pushes on with its three-year cost-cutting plan. Meanwhile, Barclays is set to cut 1,800 investment banking jobs, most of them expected to be at managing director level. And don’t forget Royal Bank of Scotland, which is planning to shrink its investment banking and international operations still further, including shedding up to 30,000 jobs.

What has happened since 2007/8 could be likened to an earthquake – pressure building up on a point of geological weakness, which is able to withstand the pressure for only so long before succumbing with a dramatic and sudden shift in the structural plates.

But, in fact, much smaller, incremental changes happen on a daily basis. Large businesses, given their size, often choose to ignore these, since constantly trying to adjust would be time-consuming, costly, and would create fundamental instability as the organisation sought to adapt.

And in any event, as a result of innate conservatism, the natural reaction is to put off making changes, however necessary they may be, for as long as possible. Sometimes for too long.

The blame for the recent failure of Lloyds’ ATM infrastructure was placed squarely on the shoulders of out of date or inadequate computer systems that have failed to keep up with the demands of an increasingly cashless society – a shifting undercurrent that either went unnoticed, or has been ignored.

That’s just one example. What other underlying trends are flying beneath the radar, but are likely to be instrumental in driving transformation?

The recent simplification of the bank account switching process is simply oiling the wheels of change for those upset and unsettled by breakdowns in service such as widespread ATM and website malfunctions. That alone could be the catalyst for sudden, large scale customer migration, leaving even the biggest names vulnerable and exposed. Add in concerns about out and out dishonesty, lack of support for small business, excessive pay and ethical opacity, and it’s little wonder there is growing momentum for switching to less mainstream, more transparent, accountable and customer-focused banking.

Even before that, changes in banking habits had already led to losses like the 1,700 jobs cut by Barclays as a consequence of the rise in online banking, meaning fewer customer-facing staff are required at branch level.

Clearly, large scale job losses are being driven by new technology and the rise of ‘big data’ – the wealth of digitised information now available for analysis. One 2013 Oxford University study suggests that 47% of today’s jobs could become automated over the next two decades, including those in the finance and legal arenas – echoing the ‘technological unemployment’ that doyen of economists John Maynard Keynes talked of in the 1930s.

That said, while making people redundant is one consequence of sector downsizing, the other size of the coin is that banks, along with other corporate organisations, may find it increasingly difficult to recruit high-quality employees in the first place. While graduates in decades gone by may have been lured through the doors by the promise of high salaries, big pensions, and career opportunities, these benefits have been eroded to the point where the corporate world is far less attractive than it once was.

Not surprisingly, many ‘bright young things’ are heading for more dynamic and exciting businesses that are more in keeping with the zeitgeist.

Inadvertently perhaps, banks and other large organisations may also have empowered workers to move on, should they choose. One of the simplest and most effective ways for large enterprises to make themselves more flexible – leaner and meaner – is to hire freelance staff on a contract basis. Great for easing the payroll burden in hard times, but a two-edge sword that makes it easier for ‘employees’ to walk away. No pension? No strings.

For some, that means moving to another job, but for a growing number it means going in a new direction entirely, either to provide high-level consulting services using their knowledge and expertise, or to set up in business for themselves.

So that same low cost technology that’s leading to job losses is also creating previously unknown markets, where local businesses are now able to operate globally. So who can blame those with talent for increasingly turning their back on traditional employment and deciding to take their chances on going it alone?

Above all, working for yourself gives you the one thing that has been palpably lacking in the banking and finance sectors over the last few years, and that’s security – when you work for yourself, it’s you who holds your destiny in your hands, not someone else.

And with the British economy surging forward, with a predicted growth rate for 2014 of 2.4%, there may be many more looking to grab their piece of the entrepreneurial pie.

These and similar unsuspected undercurrents are constantly reshaping every business and its marketplace, ensuring that uncertainty is the only truth we can bank on.

At The Corporate Escape, preparing professionals for success in a future world of work is our passion. You can start to retake control of your career by downloading our free guide – ‘7.5 Strategies to Thrive in Your Career or Business’. And for more valuable resources on how to break free and find independence outside the corporate world as a business owner, go to TheCorporateEscape.com.

Explore more articles in the Banking category