STUDY REVEALS BANKS MUST ENCOURAGE MORE VOCAL CUSTOMERS TO AVOID THE BIG SWITCH

Published by Gbaf News

Posted on July 23, 2014

3 min readLast updated: January 22, 2026

Published by Gbaf News

Posted on July 23, 2014

3 min readLast updated: January 22, 2026

Offering Rewards on the Same Scale as Retail Can Help Encourage More Vocal Customers and Brand Loyalty

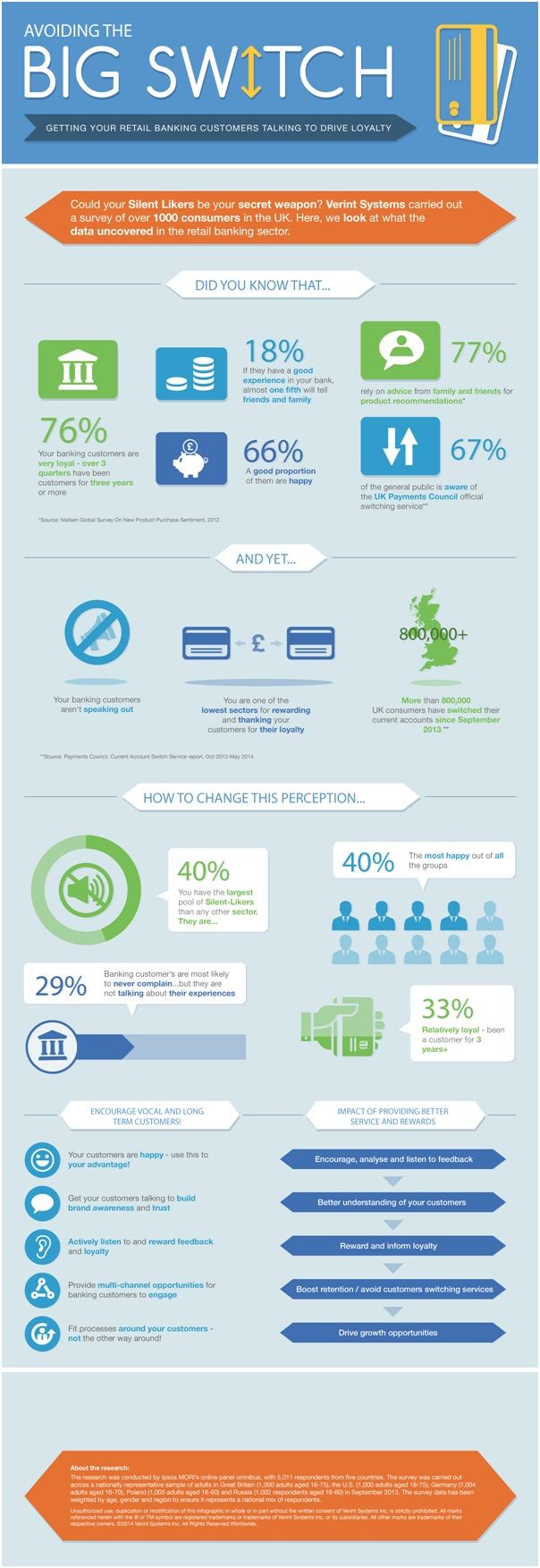

Many consumers don’t communicate with their banks, because they don’t feel they are being heard. Meanwhile, a UK research study carried out by Verint® Systems Inc. (NASDAQ: VRNT) and the Customer Contact Association (CCA) found that financial organisations are capturing the voice of their customers and trying to boost retention following account switching regulations. A survey of 1,000 GB consumers carried out by Ipsos MORI*reveals over half (55%) have never made a complaint to their bank in the last three years. However, the research also uncovered an opportunity for banks to encourage more vocal customers and nurture their “Silent Likers” – those customers that overall are the happiest with the service receive, but aren’t engaging with their banks.

Additionally, the research revealed that the sector fails to provide the “feel good” factor amongst its customers – just 3% of consumers have received vouchers or rewards as a “thank you” (jointly ranked lowest with insurance providers). In contrast, supermarkets emerged as the stars, offering the most rewards (38% have received these), and as a result experienced the highest performing levels of happy customers (78%). What’s more, the study surfaced a significant group of customers that are happy but reluctant to speak out about their banks – 40% are “Silent Likers.”

Despite this, at a time when banks are working hard to regain customer trust, they are actually performing better in terms of retention when compared to other sectors. Consumers are most loyal to banks with 76% staying for three years or more, and 66% reporting that they are happy with the service they receive overall. However, the tides are changing with recent figures from the UK Payments Council, which have shown that over half a million UK customers have switched bank accounts, a 14% increase from last year. This follows new regulations that were specifically introduced to take away the “fear factor” from changing service providers and make it easier for consumers to change banking providers.

Marije Gould, VP at Verint comments, “With customer churn now on the rise, banks need to do all they can to listen to the voice of their customers, engage and unify the entire process across all channels. They must encourage customers to be more vocal, act on what they say and specifically communicate this to them, while offering rewards when they are due. Given that 18% will tell friends and family if they have a positive experience with their bank, there is a good opportunity here to incentivise recommendations and conversations. Banks can really learn from other sectors that have gone this route, such as retailers that already do this well in order to convert ‘Silent Likers’ into loyal brand advocates.”

Explore more articles in the Top Stories category