Shares climb, bonds rally as September Fed rate cut chances grow

By Lawrence White

LONDON (Reuters) -Shares climbed and bond yields dipped on Wednesday following cautious but encouraging remarks on inflation by Federal Reserve Chair Jerome Powell the day before, which raised expectations for imminent U.S. rate cuts.

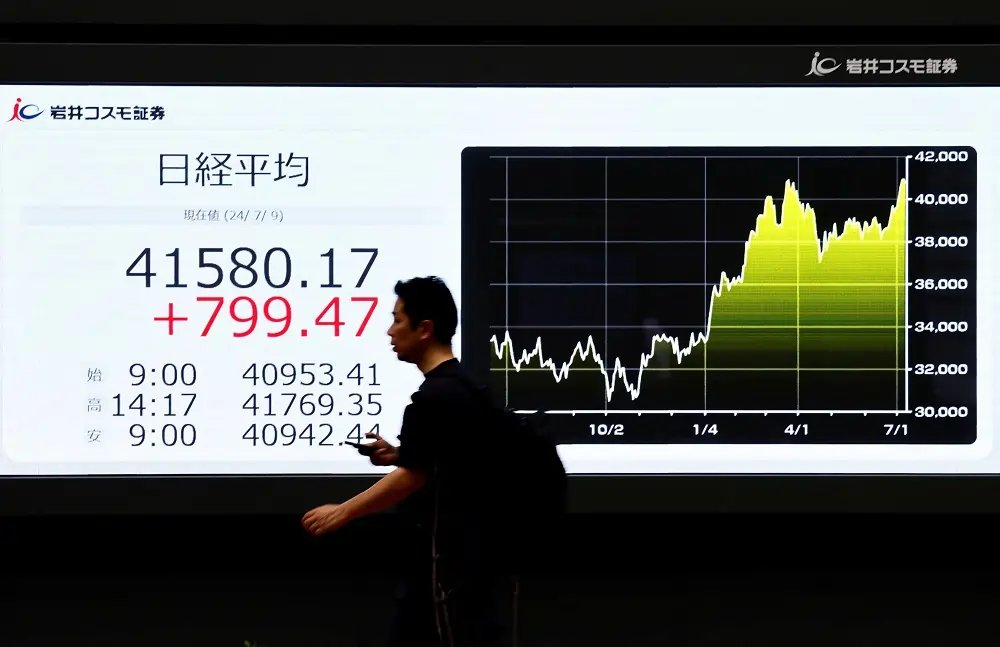

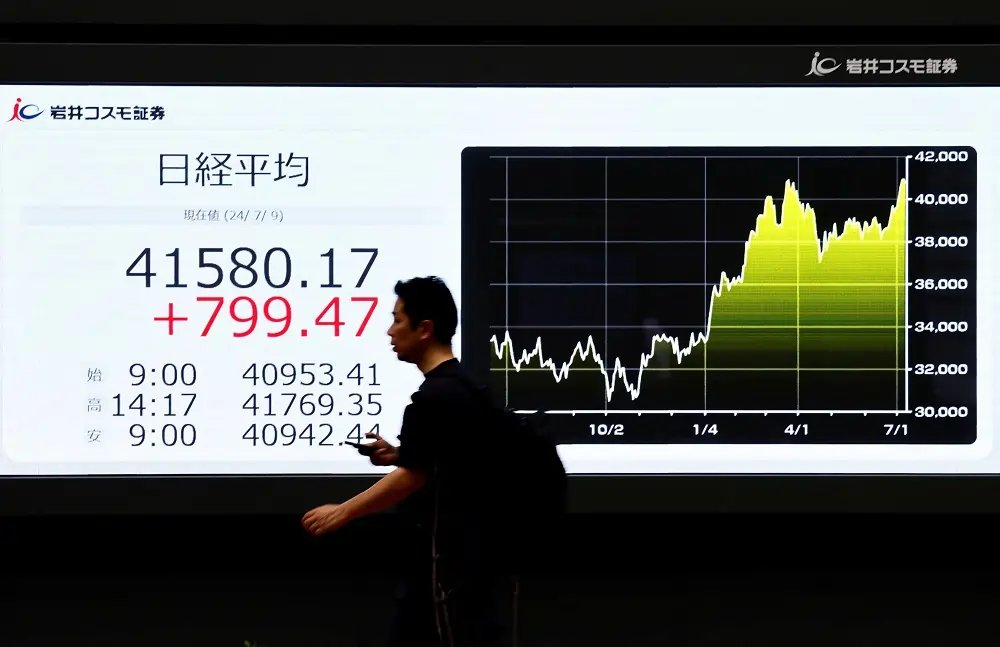

The pan-European STOXX 600 index rose 0.6% by 1040 GMT, led by gains in travel and leisure shares. MSCI’s broadest index of Asia-Pacific shares outside Japan eased 0.08%, but remained close to the more than two-year high hit at the start of the week.

Euro zone bond yields dipped in France and Italy in particular, as investors unwound the political risk premium they had attached to the countries before French parliamentary elections which had suggested gains for the far right.

Germany’s 10-year bond yield, the benchmark for the euro zone bloc, fell 6 basis points (bps) to 2.52%, France’s 10-year yield dropped 9 bps to 3.163% and Italy’s 10-year yield was lower by 10 bps at 3.858%.

Yields, which move inversely to prices, had risen on European bonds at the end of June as investors feared a win for the French far right would drive up spending. Italian yields also rose as investors avoided countries with high debt levels.

In the end in France a surprise left-wing surge left the country facing a hung parliament.

Globally, speculation around the timing of interest-rate cuts has been dominating markets this year, as investors try to ascertain the moment at which policymakers feel they are bringing inflation under control.

The New Zealand dollar slid on Wednesday after its central bank held its cash rate steady at 5.5% on Wednesday as expected, but signalled confidence inflation was expected to return to its target range of 1% to 3% in the second half.

The kiwi fell around 0.8% after the decision and was last at $0.6071, as traders sharply ramped up bets of RBNZ rate cuts later this year.

Swaps now imply more than 30 basis points worth of easing in October, as compared to 16 bps before the outcome.

The Aussie, meanwhile, rallied 0.9% to an over one-year high against the New Zealand dollar, with the former underpinned by wagers that the next move in Australian rates might be up given inflation is proving stubborn.

WAKE ME UP WHEN SEPTEMBER ENDS

Stocks, having slumbered for much of the year, have been energised on growing expectations of a Fed easing cycle likely to commence in September, with Powell saying on Tuesday that the United States was “no longer an overheated economy”.

However, he provided little clues on how soon those rate cuts could come.

“If the labour market shows signs of cooling, so long as inflation data doesn’t move higher and stays where it is, that might be enough to still deliver some music from the Fed,” said Rob Carnell, ING’s regional head of research for Asia Pacific.

The chances of a September cut have risen to more than 70% compared to a near-even chance a month ago, according to the CME FedWatch tool.

The closely-watched monthly U.S. inflation report is due on Thursday, where core consumer prices are expected to hold steady in June.

S&P 500 futures gained 0.15%, while Nasdaq futures firmed 0.29%, as heavily weighted stocks such as AI chipmaker Nvidia and carmaker Tesla rose in pre-market trading.

DOLLAR DITHERS

The dollar traded close to three-week lows, meanwhile, as the cautious nature of Powell’s remarks kept risk sentiment grounded.

The dollar index, which measures the U.S. currency against six others including the euro and yen, was little changed at 105.09, after rising about 0.1% on Tuesday.

Against the yen, the dollar rose 0.1% to 161.515, as the Japanese currency remained under pressure from the stark interest rate differentials between the U.S. and Japan.

But data on Wednesday showed Japan’s wholesale inflation accelerated in June as the yen’s declines pushed up the cost of raw material imports, keeping alive market expectations for a near-term interest-rate hike by the central bank.

The Bank of Japan said on Tuesday some market players called on the central bank to slow its bond buying to roughly half the current pace under a scheduled tapering plan due this month.

In commodities, oil prices were jittery as expectations that U.S. crude and gasoline inventories fell last week, bullish for prices, contended against the resumption of output in the U.S. Gulf in the aftermath of Hurricane Beryl.

Brent futures fell 0.17% to $84.53 a barrel, while U.S. West Texas Intermediate (WTI) crude eased 0.09% to $81.31 per barrel.

Gold gained 0.36% to $2,372.12 an ounce. [GOL/]

(Reporting by Lawrence White in London, Rae Wee in Singapore and Sameer Manekar in Bengaluru, Editing by Muralikumar Anantharaman, Arun Koyyur and Emelia Sithole-Matarise)

A central bank is a financial institution that manages a country's currency, money supply, and interest rates. It oversees the banking system and implements monetary policy to achieve economic stability.

Inflation is the rate at which the general level of prices for goods and services rises, eroding purchasing power. It is typically measured by the Consumer Price Index (CPI) or Producer Price Index (PPI).

Bond yields represent the return an investor can expect to earn from holding a bond. They are inversely related to bond prices; as prices rise, yields fall, and vice versa.

A rate cut occurs when a central bank lowers the interest rate it charges commercial banks for loans. This action is intended to stimulate economic activity by making borrowing cheaper.

A stock index is a statistical measure that tracks the performance of a group of stocks, representing a particular market or sector. Examples include the S&P 500 and the Dow Jones Industrial Average.

Explore more articles in the Top Stories category