NEW REPORT FROM MAZARS REVEALS SIX SUCCESS FACTORS TO HELP SMES STAND OUT FROM THE CROWD

Published by Gbaf News

Posted on May 27, 2014

3 min readLast updated: January 22, 2026

Published by Gbaf News

Posted on May 27, 2014

3 min readLast updated: January 22, 2026

Mazars, a leading specialist in audit, tax and advisory services, has today released a comprehensive performance study of the EU SME sector. Amongst its other findings, the report includes a number of interesting insights into the specific actions that SMEs need to take to stand out from the crowd.

The study, which covers the period from 2008 through 2013, provides analysis, insights, lessons learnt and guidance to SMEs across the globe, as well as the similarities and differences of SME performance in Germany, Sweden, Netherlands, Portugal, Spain, France, Ireland and the UK.

New Report From MAZARS Reveals Six Success Factors To Help Smes Stand Out From The Crowd

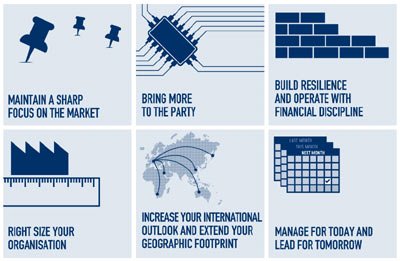

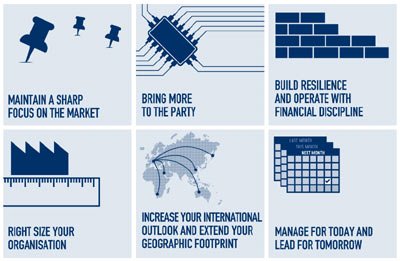

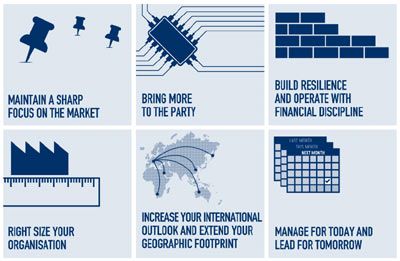

The findings, based on detailed information provided by the Mazars’ clients as well as extensive EU and national level research, highlight six success factors that can help SMEs reach the bar of superior performance and differentiate themselves from competitors.

The six success factors are identified as follows:

Dave Smithson, UK head of SMEs at Mazars says:

“There is no doubt that SMEs are and will always be the backbone of every economy in

Europe, as they consistently generate substantial income, employment, outputs, innovation and new technologies. However, since a European SME is one of almost 21 million, it can be hard to be seen and to really stand out. Today’s SMEs will therefore need to review these six success factors very carefully, identify the key priorities for their business, and then put a strategic action plan in place to ensure that they are able to stand out from the crowd.”

Explore more articles in the Banking category