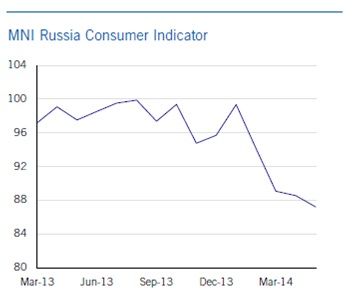

MNI RUSSIA CONSUMER INDICATOR FALLS TO 87.2 IN MAY FROM 88.5 IN APRIL

Published by Gbaf News

Posted on June 12, 2014

2 min readLast updated: January 22, 2026

Published by Gbaf News

Posted on June 12, 2014

2 min readLast updated: January 22, 2026

The MNI Russia Consumer Indicator fell to a new low in May amid growing concerns from consumers about their household finances, spending on big ticket items and long-term business conditions.

The Consumer Indicator fell to 87.2 in May from 88.5 in April, the lowest level since the series began in March 2013. This was the fourth consecutive monthly decline, and left confidence 12.2% below the level seen at the start of the year amid growing fears that Russia could fall into recession and the tense situation in Ukraine.

Against a backdrop of stagnant economic growth, most of the components of the MNI Consumer Indicator declined to a series low in May, or very close to it. Consumers’ views on the current state of their personal finances led the decrease in sentiment in May, impacted by high inflation and increased loan costs. An increasing number of consumers felt they could not afford to buy items like large white goods or cars.

Against a backdrop of stagnant economic growth, most of the components of the MNI Consumer Indicator declined to a series low in May, or very close to it. Consumers’ views on the current state of their personal finances led the decrease in sentiment in May, impacted by high inflation and increased loan costs. An increasing number of consumers felt they could not afford to buy items like large white goods or cars.

The weak economy meant views on current business conditions were the most pessimistic since the series began in 2013.

Commenting on the latest survey, Philip Uglow, Chief Economist of MNI Indicators said, “The collapse in Russian consumer sentiment continued in May as consumers faced increased inflation and higher interest rates. With Russia set to plunge into recession, our survey shows consumers becoming increasingly negative on the employment outlook suggesting a weakening in the labour market ahead. Meanwhile the central bank finds itself in the unenviable position of having to keep monetary policy tight while growth flounders.”

“There’s no short-term solution to Russia’s ills, and while it may have found a friend in China, it needs to ensure its relations with Europe are not damaged further.”

Explore more articles in the Top Stories category