LATE PAYMENT CULTURE HINDERS GROWTH FOR GLOBAL BUSINESSES

Published by Gbaf News

Posted on September 5, 2014

3 min readLast updated: January 22, 2026

Published by Gbaf News

Posted on September 5, 2014

3 min readLast updated: January 22, 2026

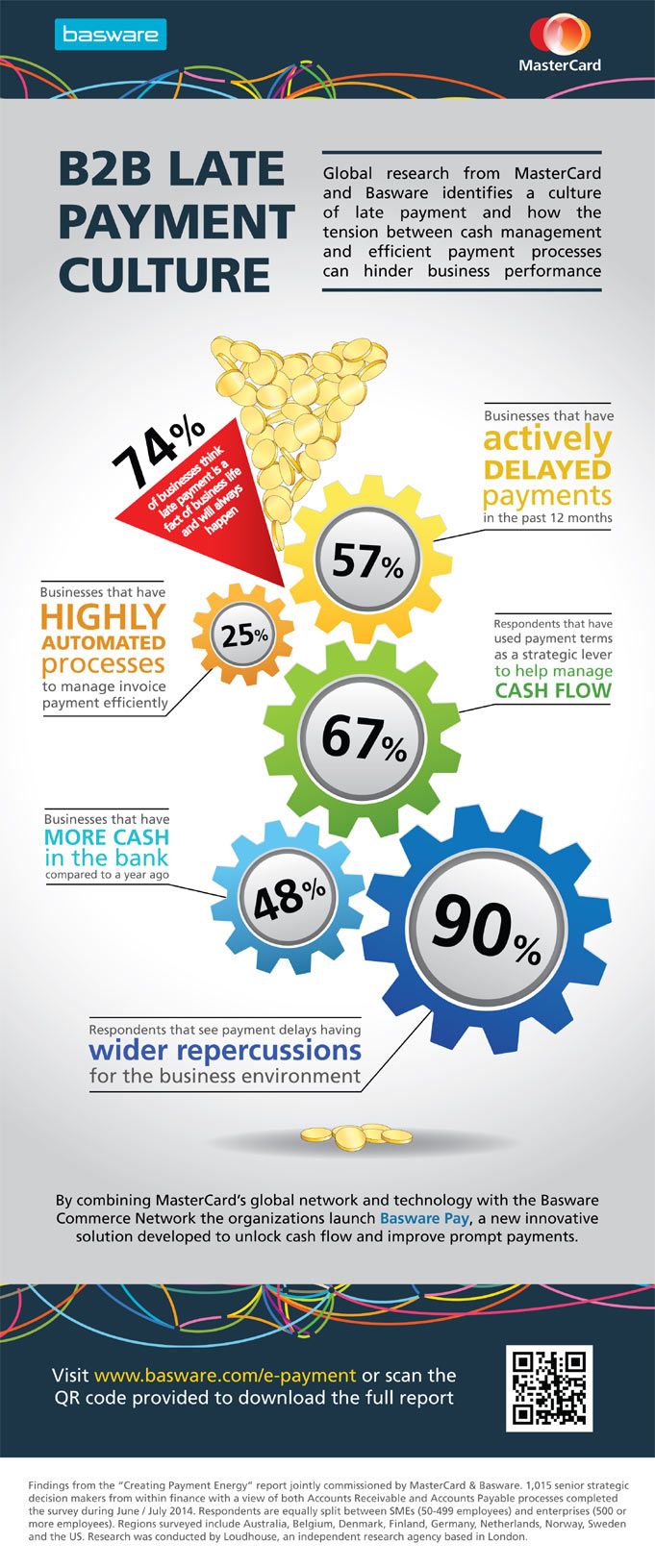

MasterCard and Basware launch solution to unlock cash flow and improve prompt B2B payments

Over half (57%) of international businesses surveyed by Basware and MasterCard admit to having actively delayed paying their suppliers in the past 12 months. The findings underscore a late payment culture, which three out of four businesses now consider normal practice that is hampering in particular small and medium-sized enterprises (SMEs). In order to break this cycle, Basware and MasterCard introduce Basware Pay, a solution that connects buyer and supplier payment processes and enables working capital optimisation. It allows buyers to better manage their cash flow and allows suppliers to get paid sooner.

“When three quarters of businesses have more than 50 suppliers and about two thirds send and receive more than 100 invoices a month, a culture of late payments impacts individual organisations as well as the economy as a whole,” said Esa Tihilä, Chief Executive Officer, Basware. “While a certain level of cash hoarding may be understandable given the financial climate, it also reflects inefficient processes and poor practices. Businesses have a responsibility to themselves and their supply chain to unlock value and keep money moving.”

Building on their existing partnership, Basware and MasterCard have combined their expertise and capabilities to launch Basware Pay, a new innovative solution developed to optimise working capital. Basware Pay extends the value of the purchase-to-pay process by providing a unique, global e-payment solution. The solution connects buyers’ and suppliers’ payment processes through the Basware Commerce Network. Suppliers’ invoices are sent via the Basware Commerce Network, approved by the buyer and once approved become available for payment through a virtual MasterCard account number. The supplier receives an early payment while the buyer typically has extended payment terms. Both parties benefit from richer settlement data and full process and payment visibility – leading to less chasing or being chased for payment.

“More than ever, global businesses rely on a complex network of partners and suppliers, and the ability to interact with agility is key to taking advantage of a fast moving environment,” said Hany Fam, President, MasterCard Enterprise Partnerships. “Integrating invoicing and payments processes can take friction out of the system and boost the broader economy. Combining MasterCard’s global network and innovative technology with Basware’s industry-leading purchase-to-pay platform has the potential to enable transformative change.”

Over 1,000 strategic decision makers across Australia, Europe and the US participated in the “Creating Payment Energy” research. The results highlight the tension between cash management and efficient payment processes. Here are some of the top findings:

MasterCard Basware

Explore more articles in the Top Stories category