HIGH CHANCE OF INFLATION FALLING BELOW ONE PER CENT IN 2015

Published by Gbaf News

Posted on November 28, 2014

4 min readLast updated: January 22, 2026

Published by Gbaf News

Posted on November 28, 2014

4 min readLast updated: January 22, 2026

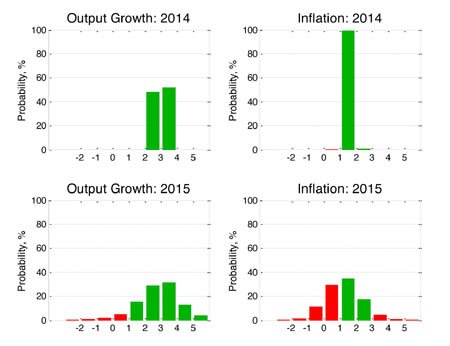

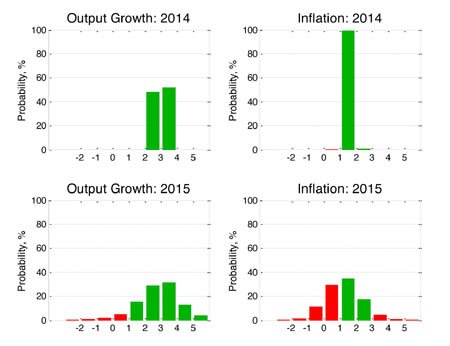

There is close to a one-in-two chance that inflation will breach the Bank of England’s target range and fall below one per cent in 2015, according to the newly launched Warwick Business School Forecasting System (WBSFS).

It forecasts that inflation in 2014 will, in all probability, fall within the Bank of England’s target range of one to three per cent per annum. But the downside risks to a breach of the inflation target in 2015 remain high – with a probability of inflation falling below one per cent per annum of 42 per cent. UK inflation in 2015 is likely to fall below the levels recently forecast by both the IMF and the HMT Panel of Independent Forecasters.

The WBSFS also predicts that the UK economy is most likely to grow between three and four per cent per annum in 2015, following GDP growth of around three per cent in 2014. But there is close to a one-in-four chance that growth will be less than two per cent in 2015.

Instead of using a single forecasting model or relying on the judgement of the Bank of England’s Monetary Policy Committee the WBSFS combines five state-of-the-art econometric models to produce judgement-free macroeconomic forecasts for UK GDP growth and CPI inflation.

Instead of using a single forecasting model or relying on the judgement of the Bank of England’s Monetary Policy Committee the WBSFS combines five state-of-the-art econometric models to produce judgement-free macroeconomic forecasts for UK GDP growth and CPI inflation.

By using model averaging, following well-established methods in statistics, meteorology and economics, the WBSFS takes a weighted combination of each models’ forecasts, where higher weights are awarded to models which show the better recent forecasting performance. The WBSFS quantifies and communicates the forecast uncertainties by producing probabilistic forecasts. (See attached graphs).

Commenting on the latest Warwick Business School forecasts, timed to coincide with publication of the latest GDP data from the ONS, Professor James Mitchell, of the Economic Modelling and Forecasting (EMF) Group at WBS, said: “The risks to a breach of the Bank of England’s inflation target in 2015 remain high – close to a one-in-two chance.

”This is because, according to our judgement-free forecasting system, the probability of inflation falling below one per cent in 2015 has risen sharply – from 13 per cent a quarter ago – to the current expectation of 42 per cent.

“This follows UK inflation recently falling to five-year lows due to weaker oil, food and import prices; and is consistent with continued stagnation and possible deflation in many of the UK’s export markets. Business and policymakers should remain alert to these downside risks; accordingly, we do not expect the Bank of England to change the Bank Rate any time soon.”

Professor Ana Galvao, of the EMF Group at WBS, said: “The latest GDP data for 2014Q3 from the ONS confirms that the economic recovery in the UK continues. Warwick Business School’s forecasts, which condition on these latest GDP data from the ONS, show that looking forward to 2015 the most likely outcome is for annual growth to continue at between three and four per cent.”

But Professor Anthony Garratt, of the EMF Group at WBS, added “There are downside risks to economic growth prospects in 2015. There is close to a one-in-four chance that growth will be less than two per cent in 2015. This suggests that one cannot presume annualised growth will pick up to historically ‘normal’ levels of growth of around 2.5 per cent.”

The graph of the WBSFS’ latest (as of November 26) probabilistic forecasts for real GDP growth and inflation – for 2014 and 2015 – as histograms. ‘Favourable’ outcomes are coloured green; with ‘unfavourable’ ones coloured red. For GDP growth, ‘favourable’ outcomes are defined as GDP growth greater than 1% p.a. For inflation, ‘favourable’ outcomes are defined as inflation within the Bank of England’s target range of 1%-3%, such that the Governor does not have to write a letter of explanation to the Chancellor.

Explore more articles in the Top Stories category