FICO INFOGRAPHIC: HOW DO PAYMENT FRAUD ANALYTICS STOP CRIMINALS?

Published by Gbaf News

Posted on March 14, 2014

2 min readLast updated: January 22, 2026

Published by Gbaf News

Posted on March 14, 2014

2 min readLast updated: January 22, 2026

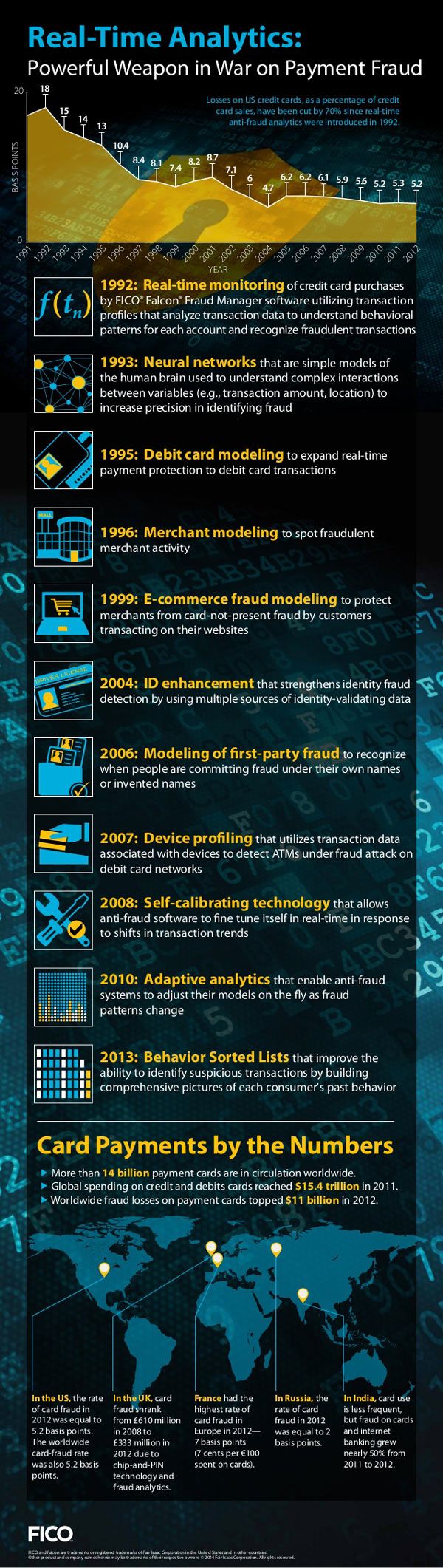

Anti-fraud innovations engender global economic growth

FICO (NYSE:FICO), a leading predictive analytics and decision management software company, released an infographic showing how 20+ years of analytics innovations have protected consumers from payments fraud. The infographic tracks the evolution of real-time fraud monitoring for payment cards from its inception in 1992 through today. During that time, for example, payment fraud as a percentage of all credit card transactions in the U.S. has dropped by more than 70 percent.

“The problem of payments fraud is simple and universal, yet the technology required to combat it is quite sophisticated,” said Dr. Andrew Jennings, chief analytics officer at FICO and head of FICO Labs. “We all want our financial lives to be safe and secure, and that security is vital for the growth of both established and developing economies. The evolution of fraud analytics has played a key role in global economic growth by helping consumers around the world feel confident enough to use payment cards for their purchases – not just in shops and on web sites, but increasingly, for text, email and other forms of mobile payment.”

FICO’s infographic highlights the most significant innovations in anti-fraud analytics for card payments, and offers interesting facts about payment fraud in major countries, including France, India, Russia and the UK. The innovations discussed are used in FICO® Falcon® Fraud Manager, which protects 2.5+ billion payment cards worldwide.

Explore more articles in the Top Stories category