Fed still in crisis-fighting mode as recovery appears to moderate

Published by linker 5

Posted on January 28, 2021

5 min readLast updated: January 21, 2026

Published by linker 5

Posted on January 28, 2021

5 min readLast updated: January 21, 2026

By Howard Schneider and Ann Saphir

WASHINGTON (Reuters) – The Federal Reserve on Wednesday left its key overnight interest rate near zero and made no change to its monthly bond purchases, pledging again to keep those economic pillars in place until there is a full rebound from the pandemic-triggered recession.

That hasn’t happened, and in the statement released after the end of their latest two-day meeting, U.S. central bank policymakers flagged a worrying slowdown in the pace of the recovery.

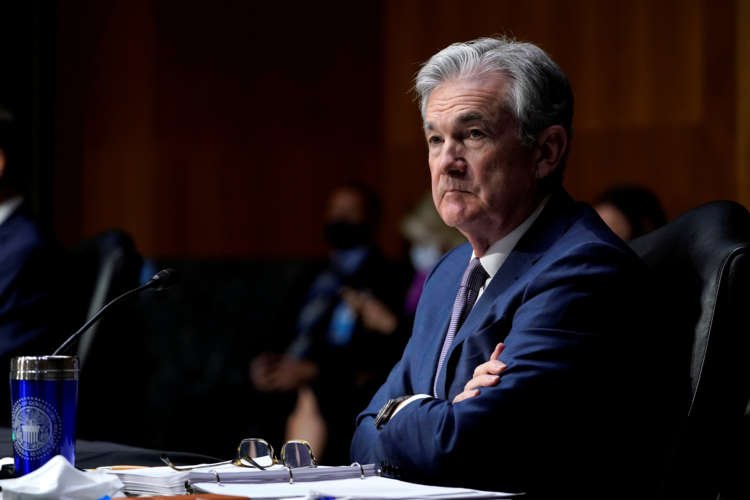

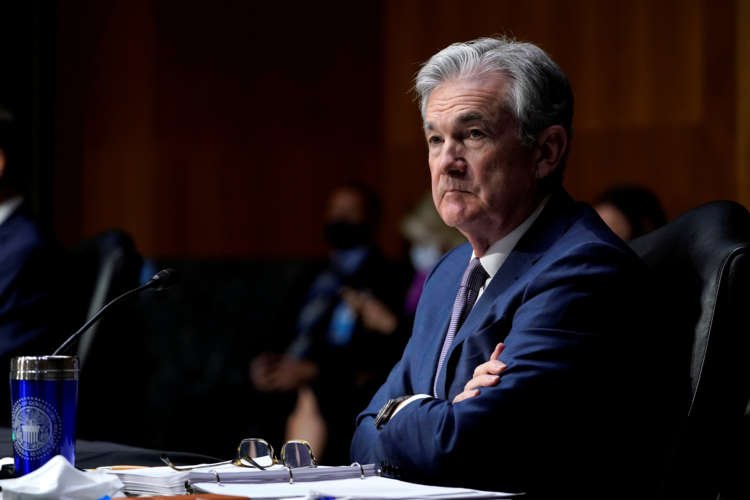

In a news conference after the meeting, Fed Chair Jerome Powell noted the economy’s resilience, with major industries like housing, financial services and others adapting to the coronavirus pandemic with new technologies and strategies.

But the economy also lost jobs in December, a large chunk of the workforce will likely remain sidelined until the health crisis eases, and Powell said the Fed’s rescue effort will not end until those Americans are working again.

“You cannot adapt motels, sports venues, movie theaters, restaurants, bars,” to function during a pandemic, Powell said. “That is millions and millions of people. You are just going to have to defeat the pandemic … We have not done it yet. We need to finish the job. It is within our power to do that as a country this year.”

His language marked a shift in the Fed’s rhetoric to both take full account of the potential boost to the economy that could come through widespread vaccinations and immunity, and to acknowledge the long slog the country faces on the road back to full employment.

Coronavirus vaccines were just being approved when the Fed held its last policy meeting in December. About 25 million doses of vaccine have been administered since then – Powell said he had taken the first of two shots – and the Biden administration is moving to accelerate distribution.

The sense of an approaching endgame to the crisis prompted the Fed to remove a reference in its statement to “medium term” risks from the pandemic, the most tangible incorporation so far of the impact of the vaccine into the central bank’s thinking.

“The risks are in the near term, frankly,” as the U.S. vaccine program ramps up and new disease variants threaten to spread more quickly, Powell told reporters. “There is good evidence to support a stronger economy in the second half of this year.”

The Fed’s decision to leave its benchmark overnight interest rate in a target range of 0 to 0.25% and to keep buying at least $80 billion of Treasury bonds and $40 billion of mortgage-backed securities each month was unanimous.

‘ACCOMMODATIVE’ STANCE

The Fed’s worries about the pace of the recovery put even more weight behind its pledge to keep monetary policy in an “accommodative” stance for what may be months or even years to come.

While largely hailed as a new and welcome commitment to the country’s labor force, the promise of cheap and plentiful credit has also sparked criticism that Fed policy has inflated asset prices, and stock markets in particular, to unsustainable levels.

Powell said on Wednesday that efforts by a central bank to “lean against” potential asset bubbles could do more harm than good.

He specifically declined to comment on the soaring share price of video game retailer GameStop Corp, which has surged in recent days as the result of a battle between retail investors and professional investors shorting the stock.

The Fed chief stressed that the central bank prefers to use macroprudential tools, including stress tests and liquidity levels, to address financial stability risks, and did not think those risks were presently outsized.

“We don’t really think we’d be successful in every case in picking the exact right time to intervene in markets,” Powell said. “We monitor financial conditions very broadly, and while we don’t have jurisdiction … over many areas in the non-bank sector, other agencies do.”

‘NOTHING MORE IMPORTANT’

The United States lost jobs in December, and many indicators of hiring and spending have stalled since the surge in coronavirus infections began in the fall.

The Fed said again that it would leave its bond-buying program untouched until there has been “substantial further progress” towards recovery and would keep the federal funds rate near zero until inflation hits its 2% target and is expected to stay there.

U.S. stocks fell further after the release of the Fed statement and Powell’s comments, with the benchmark S&P 500 index closing down about 2.6%, its biggest one-day percentage drop in three months.

Yields on U.S. Treasury securities remained lower on the day, and the dollar ticked higher against a basket of trading partner currencies.

“Both dials of Fed policy, forward guidance on rates and asset purchases, will be left on an ultra-dovish setting for ‘some time,'” said JP Morgan economist Michael Feroli. “It’s a long way to taper-ary,” he said of any Fed decision to trim bond purchases.

(Reporting by Howard Schneider; Additional reporting by Stephen Culp and Jonnelle Marte in New York and Ann Saphir in San Francisco; Editing by Dan Burns and Paul Simao)

Explore more articles in the Top Stories category