Dunn Loren Merrifield Advisory Partners announced as Sole Arranger/Issuing House for the First Future Flow Securitisation Transaction.

Published by Gbaf News

Posted on January 24, 2019

3 min readLast updated: January 21, 2026

Published by Gbaf News

Posted on January 24, 2019

3 min readLast updated: January 21, 2026

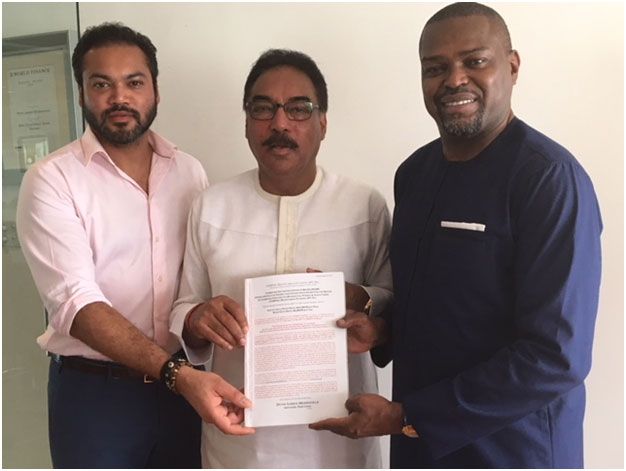

The formal signing for the First Future Flow Securitisation transaction sponsored by Continental Transfert Technique Limited held on Monday 29th January 2018 with Dunn Loren Merrifield Advisory Partners taking the lead as Sole Arranger/Issuing House for the transaction.

The event which held at the executive board room of Dunn Loren Merrifield Group, had in attendance representatives of the executing parties that included DLM Advisory Partners – Sole Arranger/Issuing House, Perchstone & Graeys -Solicitors to the transaction, Banwo & Ighodalo -Solicitors to the Trustees, DLM Trust Company – Bond Trustee, Dr. Benoy Berry – Chairman, Continental Transfert Technique Limited, Mr. Sonnie Ayere – Chairman, Dunn Loren Merrifield Group, Mr. Roheen Berry – Managing Director, Continental Transfert Technique Limited, Mr. Tor Langoy – Chairman, BD Globe Capital and Adewole Adebayo – Company Secretary/Legal Adviser, Continental Transfert Technique Limited.

African Prudential Plc are named as Registrars to the transaction while Data Pro, Global Credit Rating Co. Ltd and Agusto & Co. were mentioned as rating agencies in the prospectus among others.

The Chairman, Contec Global Group, Dr. Benoy Berry during the signing event said “I am very pleased at the outcome of this transaction. It took slightly longer than I had anticipated but I am very happy with the outcome and what DLM has been able to accomplish for the Contec Global Group. We hope that this is our first of many foyers into the Nigerian Capital Markets and probably also into the other African Capital markets as our operations span different countries across the continent”.

In addition, Mr. Sonnie Ayere, Chairman/Founder, Dunn Loren Merrifield Group (“DLM”) said “This is the first domestic future flow securitisation to be successfully executed in Nigeria and probably on the African continent. We were successfully able to get the Issue to be four credit notches above that of the originator – Continental Transfert Technique Limited, a member of the Contec Global Group”.

It would be recalled that Continental Transfert Technique Limited, the technical partner to the Nigeria Immigration Service, had in September 2017 remitted to the Federal Government of Nigeria N1.2 bn generated in one year from the sale of the Combined Expatriate Residence Permit and Aliens Card (CERPAC) to foreigners living and working in the country.

CERPAC otherwise known as green card, is mandatory for all expatriates in the country and is renewable every year. Continental Transfer Technique Limited is in charge of the scheme on behalf of the Nigerian government.

(L-R) Mr Roheen Berry, Managing Director, Continental Transfert Technique Ltd, Dr. Benoy Berry, Chairman/Founder, Contec Global Group and Mr. Sonnie Ayere, Chairman/ Founder, Dunn Loren Merrifield Group at the formal signing for the First Future Flow Securitisation transaction held in Lagos.

Explore more articles in the Top Stories category