CROWDCUBE CELEBRATES THREE YEARS OF PROVIDING EQUITY INVESTMENTS IN BRITISH SMALL BUSINESSES

Published by Gbaf News

Posted on February 28, 2014

2 min readLast updated: January 22, 2026

Published by Gbaf News

Posted on February 28, 2014

2 min readLast updated: January 22, 2026

THE WORLD’S BIGGEST EQUITY CROWDFUNDING PLATFORM HAS 60,000 REGISTERED MEMBERS

Crowdcube Was The World’s First Crowdfunding Platform To Offer Shares To Investors.

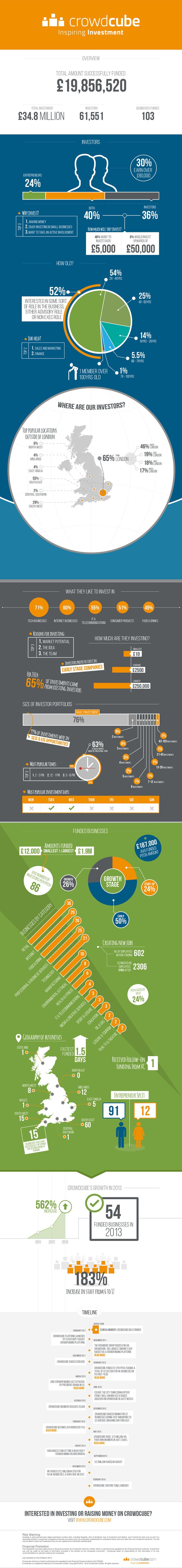

Crowdcube, the world’s first equity crowdfunding platform, celebrates its third birthday this month. Since it launched in 2011, the company has raised over £19.9 million for 103 start-ups as well as small and growing businesses. These companies are set to boost the British economy with the creation of around 1900 new jobs over the next three years, and some fast-growth businesses are contributing to Britain’s exports, supporting the Chancellor’s challenge to double Britain’s exports to £1 trillion by the end of the year.

Crowdcube was the world’s first crowdfunding platform to offer shares to investors.

Funding now totals nearly £20 million with over 60,000 registered members, making it the biggest equity crowdfunding website on the planet.

In addition, the following interesting facts have emerged from analysis of Crowdcube’s active investors:

Darren Westlake, CEO and co-founder comments, “When Luke and I founded Crowdcube equity crowdfunding didn’t exist; now it’s all over the media and is a mainstream source of capital for many businesses. In 2013 we grew 562% on the year before, securing over £12 million for 54 deals which is phenomenal. With over 100 applying to us to seek finance each month, it is clear that Britain is not short of entrepreneurial spirit.”

Along the way, Crowdcube has established several ‘firsts’ including:

Crowdcube infographic 2014

Explore more articles in the Top Stories category