CMA SIGNS MOU TO INTRODUCE CERTIFICATION STANDARDS FOR CAPITAL MARKETS

Published by Gbaf News

Posted on September 19, 2014

3 min readLast updated: January 22, 2026

Published by Gbaf News

Posted on September 19, 2014

3 min readLast updated: January 22, 2026

MOU signed with the Chartered Institute for Securities & Investment

As part of its drive to enhance the positioning of Kenya as a premier investment destination, the Capital Markets Authority (CMA) has signed a Memorandum of Understanding (MOU) with the Chartered Institute for Securities & Investment (CISI) for the introduction of international certification standards in the capital markets industry.

The CMA Acting Chief Executive, Mr Paul Muthaura, said the MOU will pave the way for the introduction of a certification programme that will ensure that practitioners in the capital markets industry have the requisite skills, operate with high standards and apply best practice as Kenya takes its position as the hub for the African capital markets.

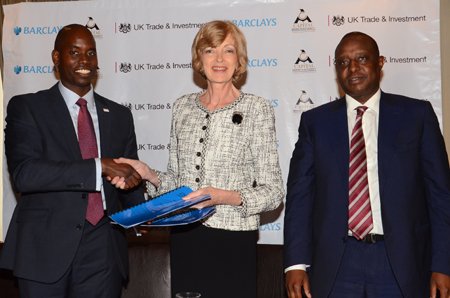

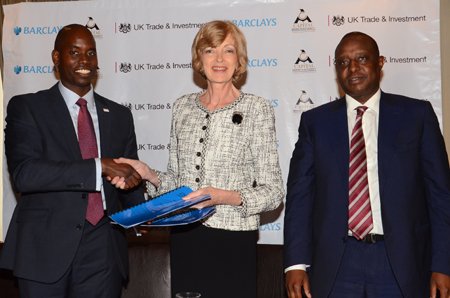

The Capital Markets Authority Acting Chief Executive, Mr Paul Muthaura (left), and the Lord Mayor of the City of London, Alderman Fiona Woolf (centre), exchange documents after signing the Memorandum of Understanding (MOU) between the Capital Markets Authority and the Chartered Institute of Securities & Investment in Nairobi today. Looking on is the Cabinet Secretary to the National Treasury, Mr Henry Rotich (right). The MOU paves the way for the introduction of international certification standards for the capital markets in Kenya and the region.

Mr Muthaura observed; ‘’For Kenya to be competitive and attract international funds flows, key staff in capital market intermediaries need to adopt international certification standards to support the introduction of more diversified products in the market as well as to ensure that engagement with investors is consistent and to the highest possible standards’’. He disclosed that the introduction of certification standards, aimed at creating a highly skilled talent pool, is aligned to the Capital Market Master Plan, the ten-year blue print for the Kenyan capital markets industry, and the ambition of the country to become a regional and International Financial Centre.

The implementation of the MOU will lead to the adoption of CISI’s International Introduction to Securities and Investment (IISI) program, as an industry recognised certificate for Kenya with intention to support its adoption within the wider East African Community (EAC) region, as capital market players increasingly operate across different markets. In this regard, the learning manual will be expanded to include concepts and issues related to the EAC region.

Simon Culhane, Chartered FCSI, CEO of CISI said: “We are very pleased to work with CMA to enhance and promote professionalism and professional standards in the capital markets industry in Kenya which will extend to the EAC region.”

Funding for the proposed initiative will be provided by FSD Africa which is already collaborating with CMA on a wide-ranging programme of technical support. Skills development across financial markets in sub-Saharan Africa is a core priority for FSD Africa.

Mark Napier, Director of FSD Africa, said: “We are delighted to be able to assist with the introduction of this certification programme which is an important step forward for Kenya and the wider EAC region in boosting the professionalism of its capital markets and enhancing their attractiveness as a place for investors to do business.’’

Explore more articles in the Top Stories category