CLIENT DEMAND TAKES CLOUD ACCOUNTING ADOPTION TO 65%

Published by Gbaf News

Posted on May 16, 2014

3 min readLast updated: January 22, 2026

Published by Gbaf News

Posted on May 16, 2014

3 min readLast updated: January 22, 2026

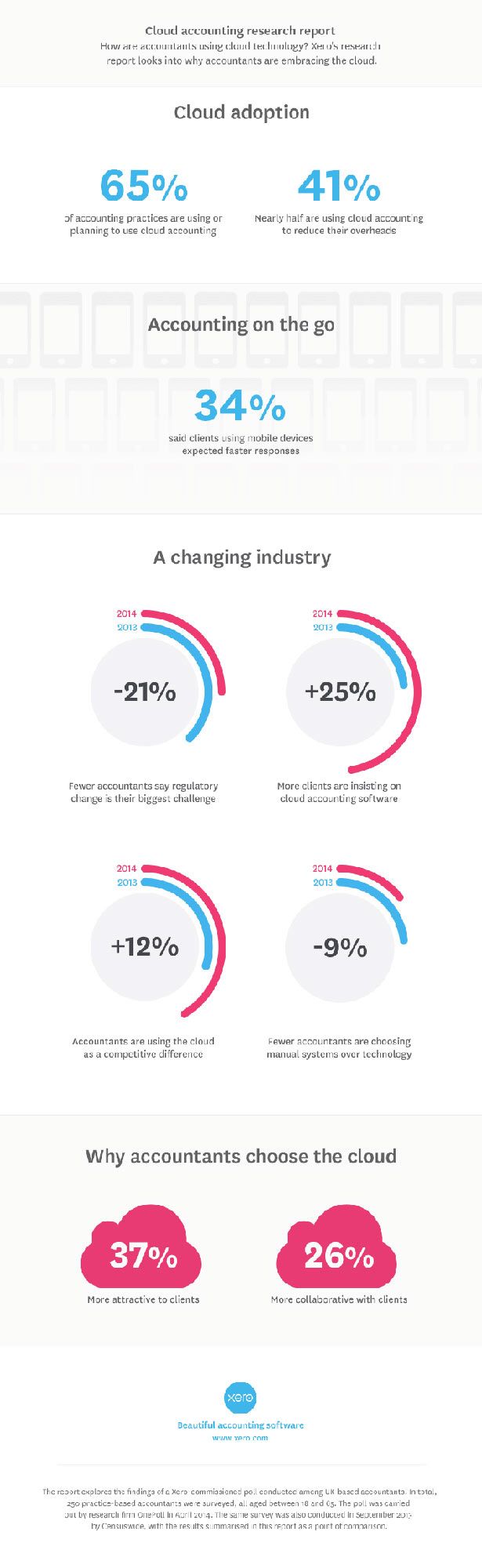

Two-thirds of UK accounting practices to offer cloud accounting, with 48% motivated by client pressure, OnePoll survey reveals

Almost half of clients (48%) are demanding their accountant offers cloud-based services, driving higher adoption among UK practices, a new survey carried out by OnePoll on behalf of Xero has shown. This figure is more than double the 23% reported in 2013. In all, 65% of accounting practices said they have adopted cloud-based accounting software or plan to soon.

Many accountants polled believed offering cloud accounting would help put them ahead of the competition (42%) and cut overheads (41%), such as the cost of travelling to clients’ offices and manual admin tasks. Over a quarter (26%) said they were aware of the broader shift towards cloud accounting and didn’t want their practices to get left behind.

The findings represent a rise in adoption compared to 2013’s original poll, with 34% of practices having switched to cloud accounting compared with 28% surveyed last year. The number of practices planning to adopt rose by five per cent, from 26% in 2013 to 31% in 2014.

There was also a marked change in attitude towards the technology, with just 13% of accountants concerned about security compared with 27% of those polled in 2013. Similarly, there was a drop in the number of accountants who felt the technology wasn’t as good as desktop software at 14%, compared with 23% last year.

“Cloud accounting is having a massive impact in the UK, particularly within small businesses,” commented Xero managing director Gary Turner. “The research findings support what we’re seeing in the market – many practices are responding to demand by partnering with a well-known technology provider, which helps differentiate them from the competition.

“2,000 UK accounting and bookkeeping practices have switched to Xero compared with 1,200 in 2013, and over 47,000 UK firms use it to collaborate more easily with their accountants and financial advisors – up from 30,000 last year. Compared with spreadsheets or desktop packages, the platform gives users the real-time information and insight they need to make more effective business decisions.

“KPMG’s decision to select Xero as its preferred UK SME software partner earlier this year also confirms cloud accounting’s standing as a mainstream technology.”

Simon Kallu, principal and founder of London-based SRK Accounting, confirmed the positive impact the technology has had in terms of growing his firm’s client base and the types of services it offers: “We’re a 100% Xero practice – and that’s helped us achieve the high levels of growth that we’re seeing,” he said. “Everyone is on board with the same system, that system works and our clients like it. That’s made it much easier to sell our services to potential clients.”

Explore more articles in the Technology category