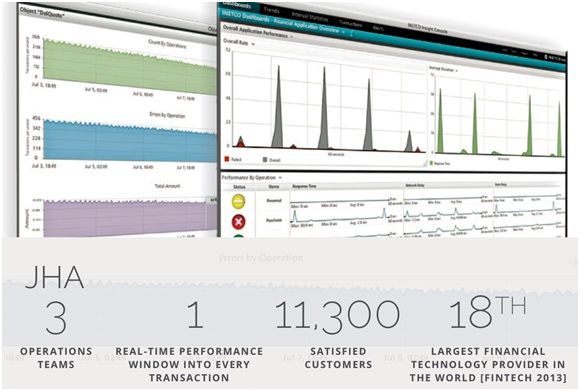

CASE STUDY: HOW JACK HENRY & ASSOCIATES ENHANCES PAYMENT PROCESSING SERVICE RELIABILITY FOR 11,300 CUSTOMERS

Published by Gbaf News

Posted on August 1, 2014

3 min readLast updated: January 22, 2026

Published by Gbaf News

Posted on August 1, 2014

3 min readLast updated: January 22, 2026

When providing payment processing services for banks and credit unions, you understand how integral it is to ensure service consistency. You also know that when (inevitably) there is a performance slowdown, the problem must be isolated and addressed quickly, before revenues and the end customer experience are affected.

With a rapidly expanding customer base and acquisition of other payment processing solutions, JHA needed to manage growing transaction volumes, disparate switch platforms, and a wide array of service applications. Along with this growth came increased operational complexities that threatened to disrupt ATM and POS transaction performance. Being proactive, JHA set out to find a solution to manage this complexity.

With a rapidly expanding customer base and acquisition of other payment processing solutions, JHA needed to manage growing transaction volumes, disparate switch platforms, and a wide array of service applications. Along with this growth came increased operational complexities that threatened to disrupt ATM and POS transaction performance. Being proactive, JHA set out to find a solution to manage this complexity.

Early in their search, JHA realized that relying on legacy transaction monitoring solutions would lead to high operational costs, as well as hurt customer relations as when transaction issues arose:

JHA realized the need to streamline its intelligence gathering activities, and to find a proactive monitoring approach that would:

JHA realized the need to streamline its intelligence gathering activities, and to find a proactive monitoring approach that would:

Following a successful proof of concept that resulted in an immediate return in improved problem isolation and troubleshooting, JHA chose a real-time transaction monitoring and analytics software from INETCO Systems as their solution.

Per Aaron Blevins, Senior Director Of Technology Services for JHA Payment Processing Solutions:

“INETCO Insight has become a powerful source of transactional data for JHA Payment Processing Solutions. Our customers expect us, as their service provider, to have readily accessible details about their transactions. INETCO Insight offers us expedited access to that data, which we can share with our valued customers promptly. This, in turn, leads to better customer service, better resource management, and overall business efficiency.”

With real-time transaction monitoring and analytics software, JHA has replaced standard tracing tools, and can now easily monitor all of their 11,300 customers’ respective transactions in real-time and on one screen. This software provides rich operational intelligence, grouping and displaying JHA transaction traffic by acquirers, issuing banks, card type, switch, ATM or POS terminal IDs, or customer locations. JHA can now track transaction volumes in real-time, and be alerted to when and where bottlenecks and failures are occurring so problems are resolved before customer experience is affected.

Leveraging real-time monitoring and transaction analytics software, Jack Henry is able to:

Download the full case study to learn more about how Jack Henry & Associates has enhanced their customer service reliability with real-time monitoring and transaction analytics.

Explore more articles in the Top Stories category