Cameroon’s largest bank selects Temenos to power digital transformation and growth

Published by Gbaf News

Posted on September 28, 2018

3 min readLast updated: January 21, 2026

Published by Gbaf News

Posted on September 28, 2018

3 min readLast updated: January 21, 2026

Afriland First Bank chooses Temenos to offer enhanced end-to-end banking experience

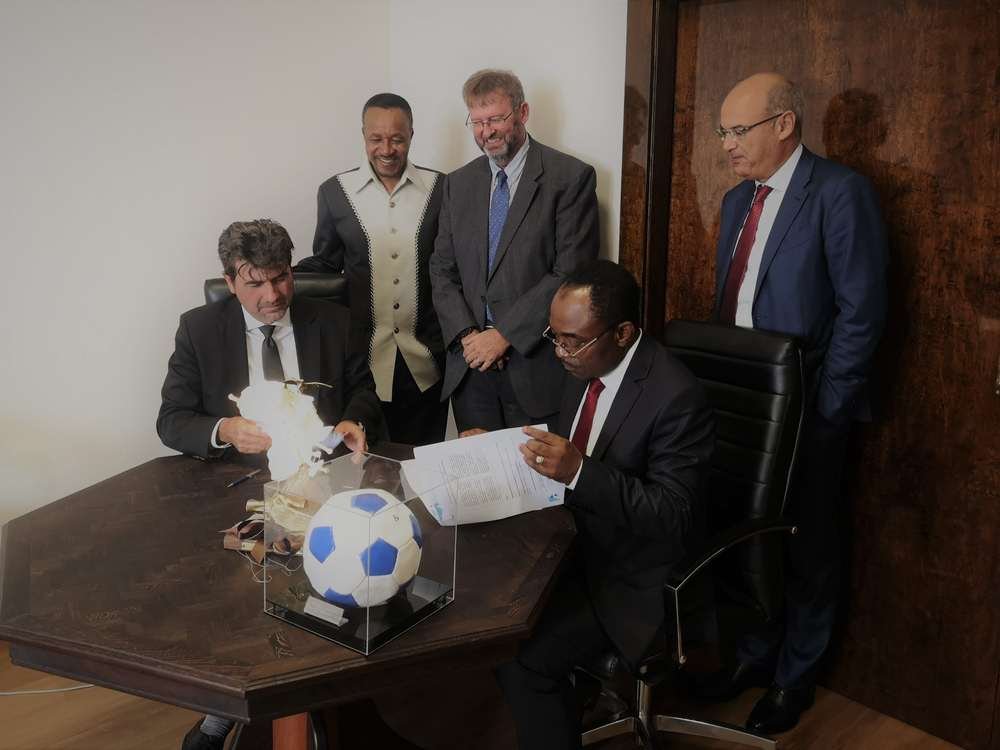

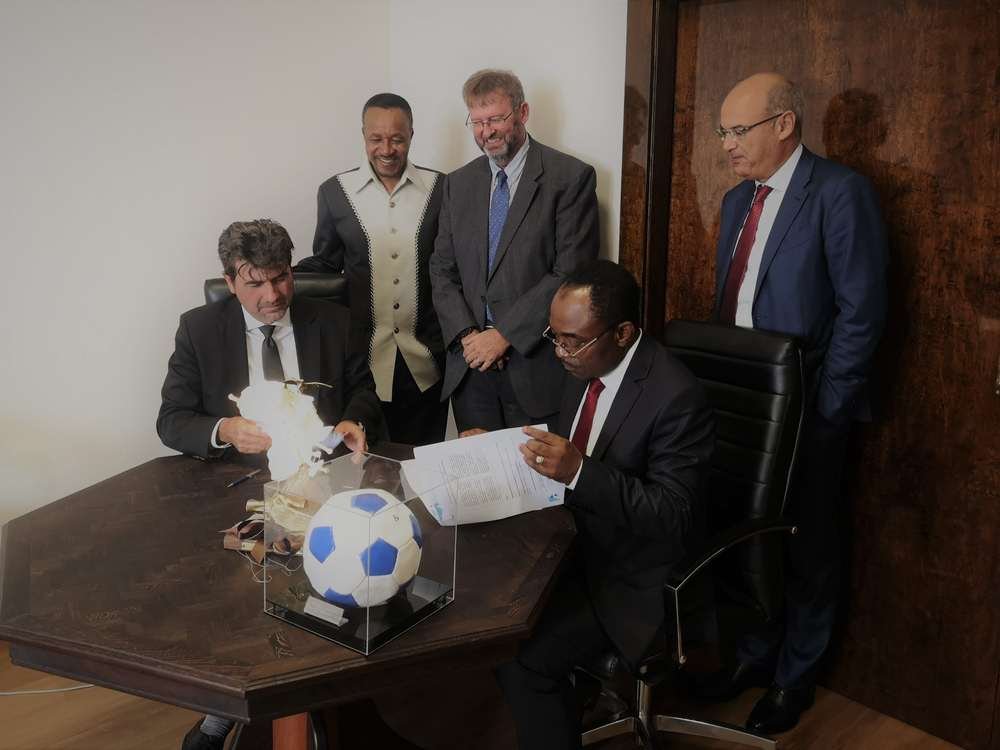

Temenos (SIX: TEMN), the banking software company, today announced that Afriland First Bank, the largest financial services group in Cameroon, has chosen Temenos T24 Core Banking platform to power its digital transformation journey.

The bank has opted for a complete IT renovation using Temenos T24 Core Banking as well as a host of additional solutions including, Temenos’ Front Office Suite, Analytics & Reporting, Payments Hub and Islamic banking capabilities.

Established in Cameroon in 1987 under the name “Caisse Commune d’Epargne et d’Investissement” (CCE), Afriland First Bank chose Temenos to replace its IT legacy systems after a rigorous competitive evaluation. By implementing Temenos software, the bank will be able to introduce new products and services more quickly, support its growth ambitions and continue to pursue its vision to become the most innovative African bank. The bank will also be able to offer market-leading services to its customers through enhanced digital channels.

The Temenos regional model bank approach, which includes pre-configured local functionality and best practices, will enable Afriland First Bank to cater for the specific regulatory requirements in the UEMOA zone (Mali, Burkina Faso, Senegal, Guinea Bissau, Côte d’Ivoire, Benin, Togo and Niger) and the six countries of the CEMAC (Cameroon, Gabon, Congo, Equatorial Guinea, CAR and Chad. The bank counts about 40 branches across the 10 regions of Cameroon and has operations in Equatorial Guinea, São Tomé and Príncipe, Democratic Republic of the Congo, Liberia, South Sudan, Zambia, Guinea. The bank will leverage Temenos’ global expertise and 25 years of experience in providing integrated, scalable packaged software, as well as Temenos’ continuous investment in R&D, which is 20% of revenues – the highest in the industry

Jean Paulin Fonkoua Kake, President, Afriland First Bank, commented: “At Afriland First Bank, we constantly strive to deliver the best customer experiences. We selected Temenos as our strategic technology partner because of their deep local expertise combined with the global experience in supporting digital transformation projects. Temenos’ digital banking platform will allow us to be at the forefront of innovation and offer world-class services to our clients.”

Jean-Paul Mergeai, Managing Director Middle East & Africa at Temenos, stated: “We are proud to welcome Afriland First Bank on board as our latest signing in Cameroon. We are committed to working hand-in-hand as their strategic technology partner to help them achieve their goal of becoming a great innovative African bank. This partnership highlights our commitment to the entire Francophone Africa where we see the financial services landscape changing rapidly, with domestic players challenging traditional French banks and telcos entering the space. French-speaking Africa is a key growth region for Temenos, as banks are increasingly turning to core transformation to differentiate their offerings, develop new business models and reach new client segments with digital banking services. Our integrated, real-time and scalable banking software helps financial institutions address the evolving customer demands and regulatory requirements. We look forward to working with Afriland First Bank as it transforms the services it offers to its customers.”

Explore more articles in the Banking category