An integrated approach for cross-border stress testing compliance

Published by Gbaf News

Posted on January 9, 2019

6 min readLast updated: January 21, 2026

Published by Gbaf News

Posted on January 9, 2019

6 min readLast updated: January 21, 2026

The aftermath of the 2008 financial crisis saw regulators across the globe coming up with stress testing guidelines for their respective regions.In the US, the stress testing program which is managed by the US Federal reserve initially started in 2009 as SCAP (Supervisory Capital Assessment Program) and has matured into CCAR (Comprehensive Capital Analysis and Review) expanding coverage to 38 US Banks including 5 Foreign Banks with large US operations. In the European region the stress testing guidelines are managed by the EBA (European Banking Association) and impacts close to 100+ Banks, while in the UK the stress testing guidelines come under the purview of PRA (Prudential Regulatory Authority) impacting close to 7 large UK banks.

The complexity of the stress testing program varies across regions for different regulators in terms of data requirements, modeling methodologies, regulatory scenarios, and granularity of submissions. However, aspects like Application Architecture, Governance, Model Management, Reporting and Data Management provide a great opportunity for global banks to leverage on the commonalities, which can make stress-testing compliance more efficient and work in an integrated manner across the different regions.

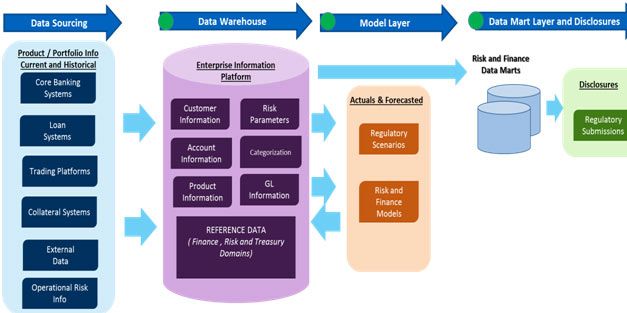

Furthermore, an integrated approach also helps global banks to reduce overall infrastructure costs and enable them to create a robust and a scalable stress-testing framework with better controls, quality and eventually enabling them to achieve better returns on their investments.Depicted in the chart below are the key components typical stress testing programs globally involve and components that can be potentially explored by global banks for achieving an Integrated Stress Testing approach.

Other components of Cross-Border Leverage

As the stress testing mandates across regions have more or less stabilized, Global Banks are looking at more and more opportunities to simplify, centralize and automate most of the processes involved in stress testing area to gain better efficiencies and controls. An integrated approach or framework could enable global banks to bring in greater efficiency in terms of cost and time to market but also bring in greater depth and consistency in their risk management and capital planning processes

About the Authors

Ajay Katara

Ajay Katara is a Domain Consultant with the Risk Management practice of the Banking and Financial Services (BFS) business unit at Tata Consultancy Services (TCS). He currently leads the BFS Risk Practice’s portfolio on Regulations and Robotics Process Automation. He has extensive experience of more than 13 years in Consulting & Solution design space cutting across CCAR Consulting, AML, Basel II implementation, and credit risk, and has worked with several financial enterprises across geographies. He has significantly contributed to the conceptualization of strategic offerings in the risk management space and has been instrumental in successfully driving various consulting engagements. He has also authored many editorials, details of which can be found in his linked in profile (https://www.linkedin.com/in/ajaykatara/)

Manoj Reddy

Manoj Reddy is the Head of BFS Risk & Compliance Practice for TCS North America with an experience of more than 15 years in the areas of financial services, IT, and business consulting. Reddy has lead several risk consulting and implementation engagements for financial firms globally. He has provided both Regulatory and Strategic Business solution to his customers over the last decade primarily in the area of CCAR, Basel, Liquidity Risk, and Enterprise Risk management and is currently leading TCS efforts in North America with respect to providing cognitive solutions for Risk & Regulatory problems.

Explore more articles in the Banking category