The Future of AI in Financial Services: Ankush Sharma explains Why Reliability Matters as Much as Innovation

Artificial intelligence has become the backbone of modern finance—powering everything from fraud detection to personalized banking experiences. But as financial institutions integrate AI deeper into mission-critical operations, one pressing question remains:

Artificial intelligence has become the backbone of modern finance—powering everything from fraud detection to personalized banking experiences. But as financial institutions integrate AI deeper into mission-critical operations, one pressing question remains: can these systems be trusted to perform reliably when the stakes are highest?

For Ankush Sharma, a global leader in AI reliability and infrastructure, that question defines the future of financial technology. With over two decades of expertise in AI, cloud infrastructure, and Site Reliability Engineering (SRE), Sharma has built a career not on chasing hype cycles, but on addressing the hidden fragility of large-scale AI in unpredictable, real-world conditions.

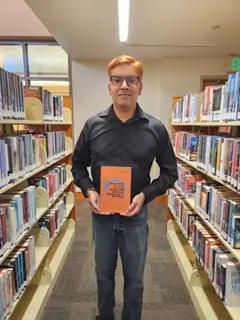

His latest work, Observability for Large Language Models: SRE and Chaos Engineering for AI at Scale, has quickly become a reference point across industries—including financial services. The book is endorsed by Vaibhav Shukla, AI Scientist at PayPal, who recognizes its value in guiding organizations to ensure that AI-powered systems in sensitive industries like finance remain dependable, transparent, and resilient.

Financial institutions face unique challenges in deploying AI. A silent model failure in fraud detection could let millions slip through the cracks. A system downtime in digital banking could interrupt services for tens of millions of customers worldwide. Unlike in consumer-facing tech, reliability failures in finance translate directly into reputational risk, regulatory scrutiny, and billions in potential losses.

Ankush Sharma, who holds a degree in Computer Engineering and a Master’s in IT degree with an alumni status from Stanford Graduate School of Business, Massachusetts Institute of Technology and Southern New Hampshire University with the book addresses these pain points head-on. By combining observability—the ability to measure, monitor, and understand AI system behavior—with chaos engineering—stress-testing systems under real-world failure conditions—he provides financial engineers with the tools to anticipate breakdowns before they escalate.

Bridging Research and Practice in Finance

Sharma’s impact also extends through his academic contributions, including his peer-reviewed article, “The Role of Artificial Intelligence in Revolutionizing Financial Services: From Fraud Detection to Personalized Banking” (Taaleem Journal, 2024). In it, he explores how AI is redefining the financial sector’s operational model—from risk assessment to customer engagement—while underscoring the importance of transparency and reliability.

His body of work draws more than 200,000 annual readers worldwide, including scholars, policymakers, and financial practitioners. For banks and regulators grappling with AI’s integration, this cross-pollination of research and practice provides a critical foundation for safe and effective deployment. His framework brings together proactive monitoring, SRE principles and chaos engineering into a comprehensive operational strategy for AI.

Reliability rarely makes headlines. There are no viral demos for “AI systems that didn’t fail today.” But in banking and finance, invisible stability is exactly what customers expect and regulators demand.

As governments, enterprises, and startups embed AI into the financial fabric of society, Sharma’s frameworks serve as the scaffolding that ensures these systems don’t just impress—they endure. The story of AI in finance will not be told solely by dazzling breakthroughs, but by the quiet, continuous trust that reliability enables.

And for leaders charting the future of financial services, that may prove to be the most consequential breakthrough of all.

Artificial intelligence (AI) refers to the simulation of human intelligence in machines programmed to think and learn. In finance, AI is used for tasks like fraud detection and personalized banking.

Risk management is the process of identifying, assessing, and controlling threats to an organization's capital and earnings. It is crucial in financial services to mitigate potential losses.

Fraud detection involves identifying and preventing fraudulent activities, often using advanced technologies like AI to analyze patterns and anomalies in transactions.

Explore more articles in the Top Stories category