Stocks recoup most of week’s sell-off as nerves steady

By Huw Jones

LONDON (Reuters) -Global shares extended gains on Friday to erase nearly all of their losses from a big sell-off earlier in the week, with investors betting on the U.S. economy avoiding a hard landing as Fed policymakers signalled rate cuts as soon as September.

Wall Street stock index futures were about 0.3% firmer, with no major U.S. data expected on Friday as nerves calmed following a volatile week that saw a mass unwinding of currency carry trades in response to the Bank of Japan’s surprise rate hike late last month.

Reassurance from Federal Reserve policymakers that they were more confident that inflation is cooling enough to cut rates, along with a bigger-than-expected fall in U.S. jobless claims data on Thursday, underpinned the recovery in stocks.

Oil prices headed for weekly gains of around 3% as fears of a widening Middle East conflict persisted, while the dollar hovered close to a one-week high.

The MSCI All Country stock index, was up 0.3% at 784.4 points, recovering much of the ground lost during the week.

The benchmark is 5.7% below its lifetime high of 832.35 reached on July 12, though still up 7.5% for the year.

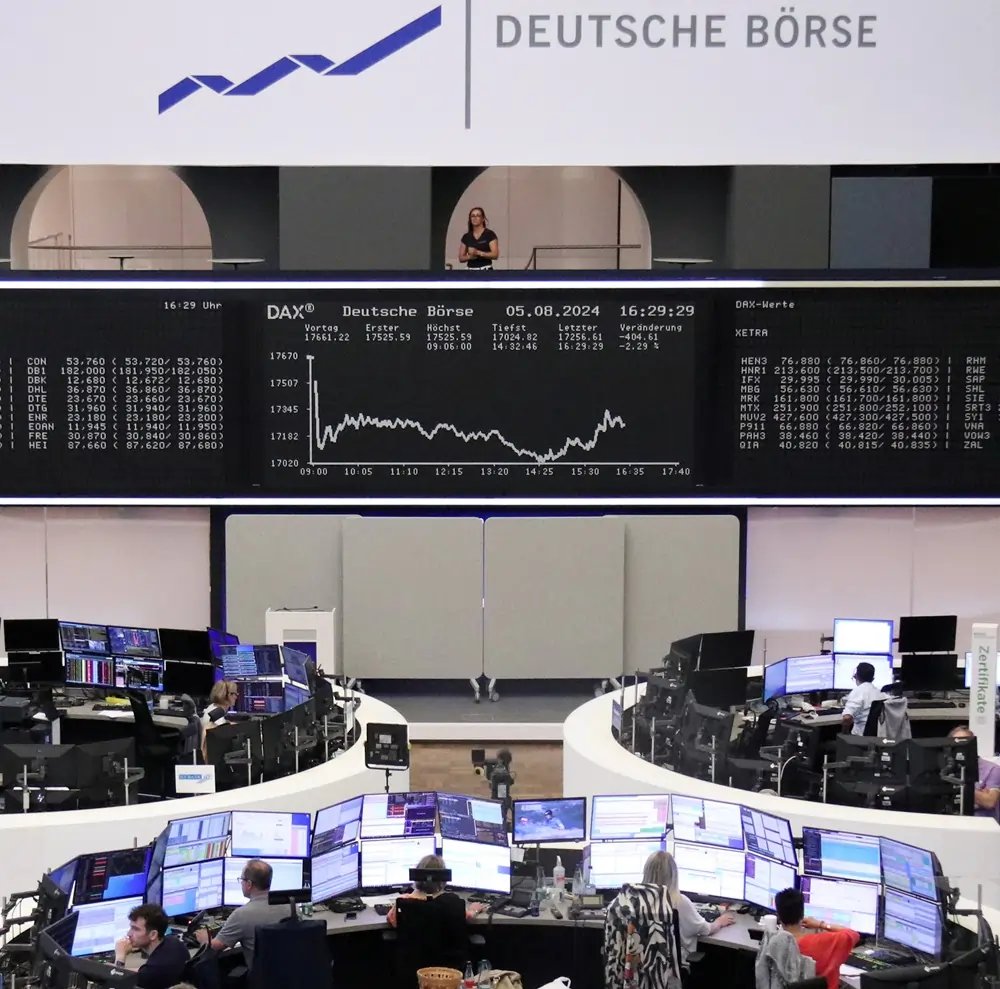

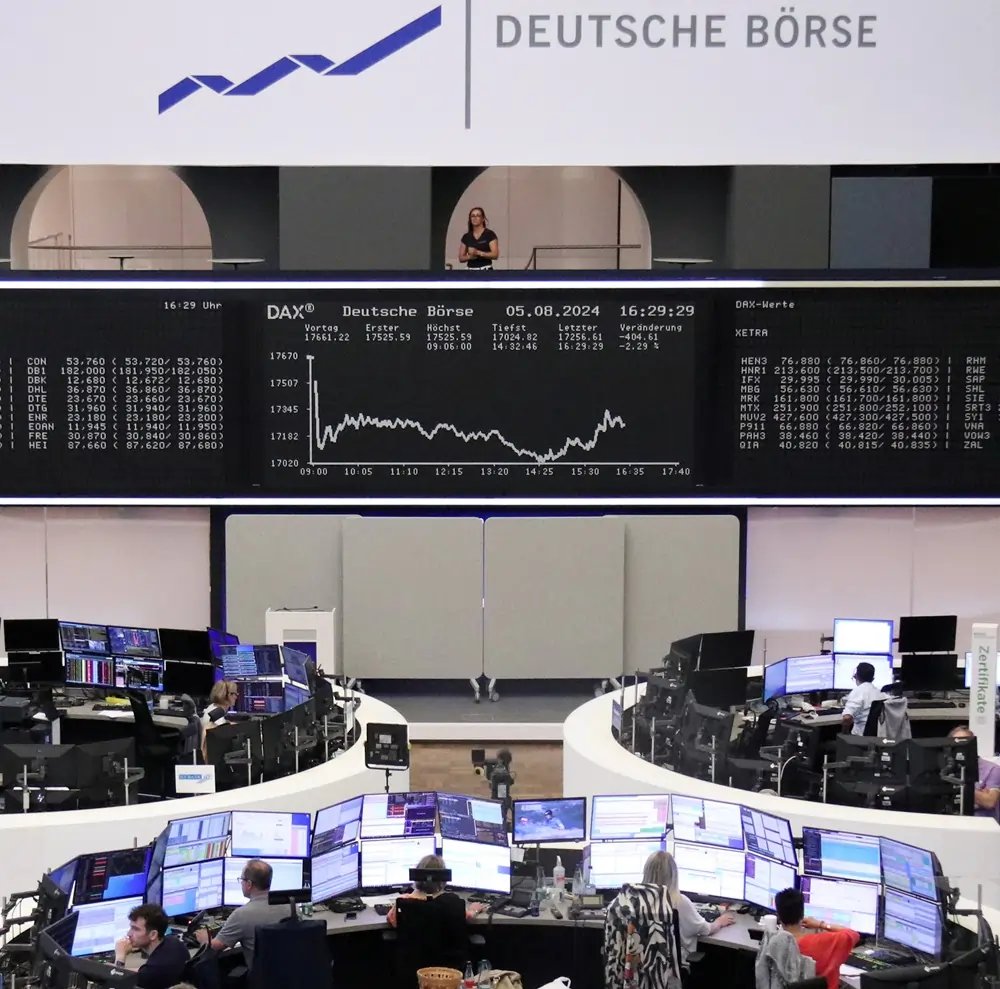

In Europe, the STOXX index of 600 companies was up 0.6%, with the loss for the week all but erased.

In a sign of calmer nerves, the VIX index, also known as Wall Street’s ‘fear gauge’, tumbled nearly 2%, a far cry from its record one-day spike on Monday.

Divergent central bank interest rate moves, a repricing of recession probability in the United States, thinner liquidity in August accentuating volatility, and Middle East tensions all combined to put the brakes on a months-long winning streak in stocks to record-highs, analysts said.

“We are still in the month of August, so we can still have some volatility,” said Marie de Leyssac, portfolio manager at Edmond de Rothschild Asset Management.

Investors will continue to study employment data, keep an eye on the Bank of Japan, and particularly on the annual meeting of global central bankers hosted by the Kansas City Fed in Jackson Hole later this month, she said.

“This year I think it is a really important meeting because we will have more insight into what (Federal Reserve Chair) Jerome Powell sees for the future, and maybe more insight on the path to lower rates,” de Leyssac said.

Before then, investors will scrutinise next week’s U.S. consumer prices and retail sales figures for fresh evidence on chances of the economy escaping a hard landing.

NIKKEI RECOVERS

Japan’s Nikkei stocks benchmark closed 0.6% higher, erasing most of the losses since a 12.4% crash on Monday.

The Nikkei has managed to claw back most of its losses after a brutal sell-off on Monday due to recession worries and the unwinding of investments funded by a soft yen, finishing the week with a comparatively tame 2.5% decline.

The yen also veered from negative to positive through the session, last trading at 147.060 per dollar.

MSCI’s broadest index of Asia-Pacific shares outside Japan climbed 1.65%, more than reversing the drop from Thursday. For the week, it has reversed earlier losses to be largely flat.

“The prospect of better-than-feared U.S. growth and a weaker yen constrain the fundamental and technical risks that inspired the extreme volatility experienced at the start of the week,” said Kyle Rodda, a senior financial market analyst at Capital.com.

Some Federal Reserve officials said they were increasingly confident that inflation is cooling enough to allow interest-rate cuts ahead, but not because of the recent market rout.

The U.S. dollar gained as markets gave up bets on an emergency rate cut from the Fed, and is set for a 0.4% gain on yen this week, despite Monday’s precipitous 1.5% plunge. [FRX/]

Bond yields have climbed this week with safe-havens in less demand, but began easing as confidence returned to markets. U.S. 10-year yields were at 3.957%. Two-year yields were trading at 4.0385%.

Brent crude futures were trading up 0.4% at $79.47 a barrel, and up more than 3% for the week, while U.S. West Texas Intermediate crude advanced 0.4% to $76.50, and also up over 3% for the week.

Gold prices were a touch firmer at $2,427 an ounce, and heading for a drop on the week.

(Reporting by Huw Jones; Editing by Stephen Coates and Ana Nicolaci da Costa)

Interest rates are the cost of borrowing money or the return on savings, expressed as a percentage. They are influenced by central bank policies and economic conditions.

Inflation is the rate at which the general level of prices for goods and services rises, eroding purchasing power. It is measured by the Consumer Price Index (CPI) and affects economic stability.

Explore more articles in the Top Stories category