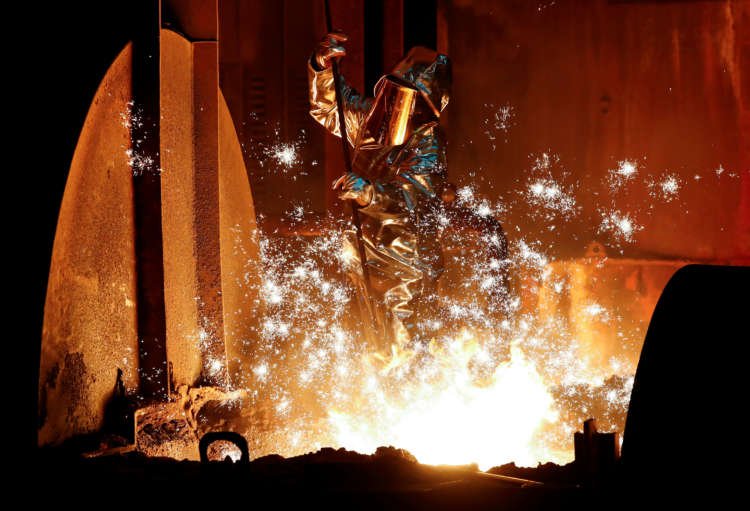

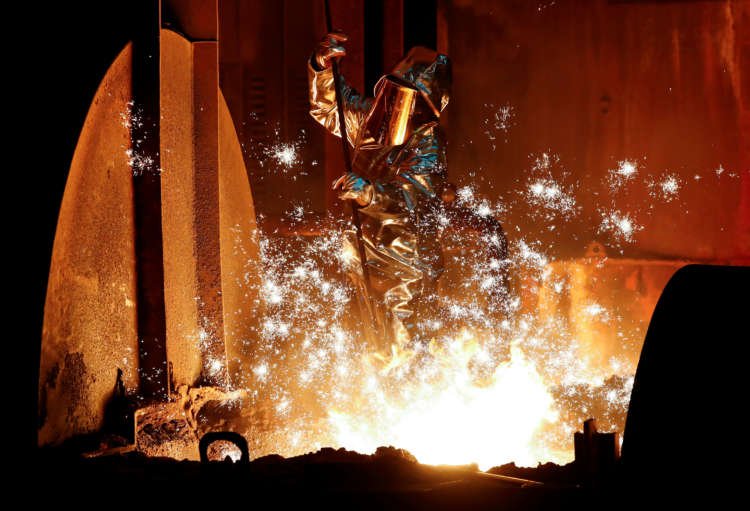

Steel demand in EU plus UK seen rebounding by 13.3% in 2021, says Eurofer

Published by linker 5

Posted on February 10, 2021

2 min readLast updated: January 21, 2026

Published by linker 5

Posted on February 10, 2021

2 min readLast updated: January 21, 2026

By Eric Onstad

LONDON (Reuters) – Demand for steel in the European Union and Britain fell by 11.6% year on year in the third quarter of 2020 as the COVID-19 pandemic hit industrial activity but it is expected to bounce back this year, industry group Eurofer said on Wednesday.

“2020 is likely to be one of the worst years on record, even if we will see positive figures in the fourth quarter,” said Eurofer Director General Axel Eggert.

The third quarter decline in apparent steel consumption for the 27 EU members plus Britain to 32.8 million tonnes was an improvement on the tumble of 25% in the second quarter, the European Steel Association said in a statement.

Apparent steel consumption measures output of steel producers plus net imports minus net exports.

Apparent consumption is forecast to fall 13% in 2020 before bouncing back this year by 13.3% to 152 million tonnes, but that would still be 2 million tonnes below the 2019 level.

To ensure consistency, the 2021 forecast includes Britain, which left the EU on Jan. 1 2020 but remained in the single market for the rest of last year during a transition period.

After reporting first quarter 2021 data, Eurofer will remove Britain from its calculations and revise the data series, Alessandro Sciamarelli, director of market analysis, told Reuters.

Eurofer’s Eggert urged the EU to boost the steel sector with funds aimed at the bloc’s target to become carbon neutral by 2050.

“The EU should use this crisis as an opportunity to use the recovery fund to support industry in meeting its decarbonisation ambitions – starting with sectors such as steel,” he said.

The European steel sector was already facing difficult conditions last year due to a downturn in the bloc’s manufacturing sector, trade tensions and uncertainty over Britain’s departure from the EU.

Imports of steel products from third countries into the EU dropped by 25.4% in the third quarter, the third consecutive quarterly decline of more than 10%, Eurofer added.

(Reporting by Eric Onstad; Editing by Edmund Blair)

Explore more articles in the Top Stories category