Santander, Best Bank for Digital Services Spain 2020 renews its app to make it more personal and useful.

Published by linker 5

Posted on September 11, 2020

7 min readLast updated: January 21, 2026

Published by linker 5

Posted on September 11, 2020

7 min readLast updated: January 21, 2026

Banco Santander has launched a renewed mobile app that addresses the needs of customers in the new Covid-19 era, in which more personal relationships are demanded through digital channels, in order to reduce as much as possible the need to go to the branch in person without dispensing with more personal treatment.

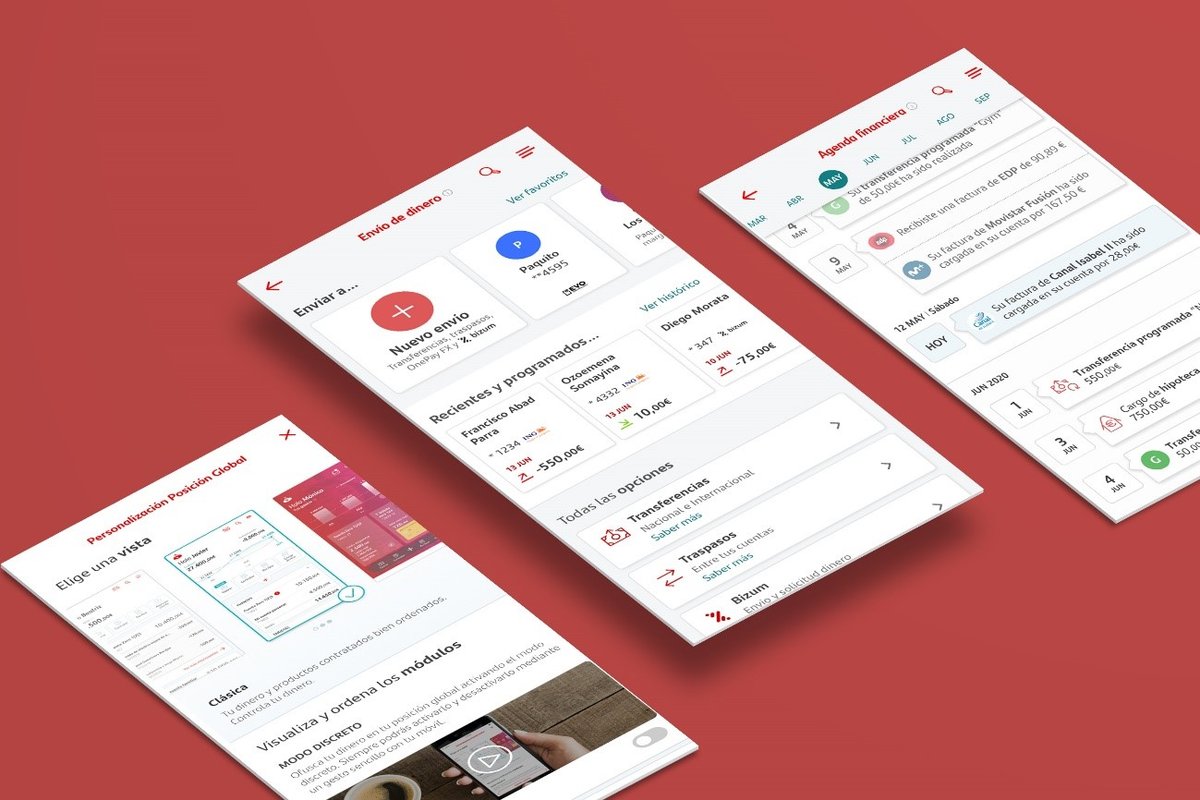

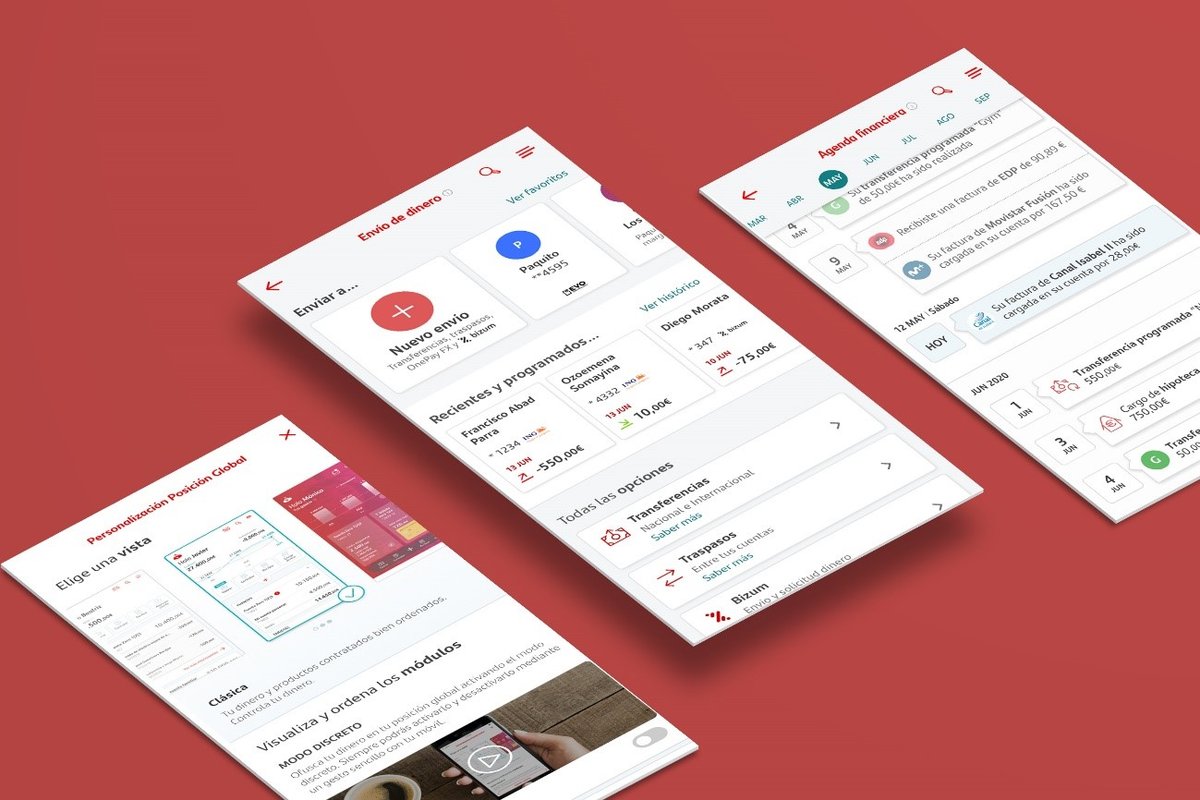

The new application improves the customer experience by simplifying the way they relate to the bank, and stands out for the relationship tools between banking managers and customers that make the personal relationship easier. It is the banking app that offers the most personalization, allowing the user to choose the visual aspects and, above all, the type of use he wants to give, so that both the most complex operations and a more basic consultation activity can be carried out, which simplifies product management by reducing the visual data load to a minimum.

One of the main new features of this application is the global search engine, which facilitates text searches for transactions and other relevant actions carried out in the past. It also offers analysis tools to control savings and expenses and to plan future payments using artificial intelligence. Through this advanced analysis of movements, the application will be able to make personalized recommendations for each client.

In addition, customers are going to be able to check their upcoming charges to take control of their finances and plan according to what will be arriving into their accounts thanks to the new Financial Timeline, conceived as a new way to financial planning. It is made for users not to lose track of upcoming bills and subscriptions, mortgage installments, card expiration dates, upcoming taxes and more.

The new app also incorporates improvements in the management of card payments, such as a search engine that allows you to locate on a map the last purchases executed and to verify accurately the movements made. In addition, customers can enroll their new card in Apple Pay or Samsung Pay, without leaving the Santander app and in one click, and withdraw money from ATMs with just one code.

Full and complete information on clients’ hands

With the aim of empowering clients to make wise financial decisions, Santander’s new app offers full and complete information to their customers to help them on every stage of their financial planning. They have introduced details on the amounts that are being retained to users and the movements subject to these charges, so users will have full details on why their balance is lower and will see explanations on how retentions work.

After a short trial period, the new app is now available to all mobile banking customers of Santander. Its design and features are the result of the customers’ own recommendations and suggestions. During the development phase, Santander has been collecting their opinions with the fintech methodology of feedback management Opinator, which has allowed to hear more than 387,000 opinions that have given a very detailed knowledge of the real needs of customers. Following the rationale that their customer’s opinion is important to improve its App a new friendly approach to gather feedback from users has been implemented, by letting users attach documents to have more information about their experience in the app. A “coming soon” area has been integrated so users can introduce ideas, rate upcoming features and get feedback from clients to prioritize new functionalities.

As a result of innovation and technological development that has eased the new digital banking model, Santander has more than 3.8 million customers who relate to the bank through their mobile devices and users have multiplied by 4 in the last three years. Furthermore, the recent situation of confinement and the new social behaviors have intensified the use of digital channels, where digital contracting has exceeded 50% of total sales on key days and customer support through remote channels has grown by 63%. This digitalization has crystallized in Santander’s new App where clients can fetch their contracts with the bank at any time directly from their app without any need to request it, having all their statements available by chronological order so that they can find them when they need to.

More payment possibilities

The new app simplifies sending money and incorporates customizable shortcuts to the most common transfers, such as Bizum and OnePay FX, Santander’s exclusive technology for sending money to multiple international destinations instantly and without commissions.

The growing use of digital payment systems and new functionalities are accompanied by a reinforcement of security for clients. Thus, the app incorporates the new operation confirmation codes by ‘inApp’ notifications, a more secure system than the codes by SMS and easier to load automatically, without the need to copy them.

Contextualized help when needed

Besides including a useful global search, the new app also offers contextual help in the right moments: customers may need help and more information about our products throughout their experience with the app, so the new app includes specific help FAQ sections and contextual help (with interactive content) to ensure that all their questions can be solved. Users can also reach Santander to solve all their problems whenever their need to thanks to the new Help Center included in the app, which allows users to and find tailor-made assistance with the aim of offering better service.

In addition to these help tools, Santander also has a model of personal help: My Advisor. The personal advisor area has been enhanced with a more personal display of their advisors information, including their photos. The advisors can now add information on their hobbies and experience so that users can get to know them better.

New budgeting tools

Users can now set up a budget for their monthly expenses. As financial tools are only useful if users can easily monitor how they are doing, the user’s budget is available in the Global Position and there is a comparative analysis between current and previous month expenses.

The new app also offers contextualized financial data at their client’s reach: the app helps clients understand the importance of planning and controlling their finances with simple indicators provide to users information on how they are doing financially and also recommending budgets to improve every month.

With this purpose, the app also offers new tips to extend financial Education and personal insights to manage better user’s finances: offering financial metrics is important to help the users, but fostering Financial education is key to help clients understand how they do financially. Users can see an advanced analysis of their finances and it proposes some tips on how to save every month, from advice when going to the supermarket to tips on how to save during a trip, etc.

Digital leaders, according to Aqmetrix

Aqmetrix, specialized in rating the quality of service offered by online banking, has recognized the improvement in functionality, availability and response time of Banco Santander’s digital channels over its competitors, placing Santander as the leader in the second quarter of 2020 in the industry ranking that assesses functionality and performance. Specifically, the bank in Spain holds first place in the business channels, both web and app.

What’s next?

Apart from the renewed most common mobile banking services offered and new differentiators, there are some features coming up soon that aim to drive Santander’s app up to excellence in mobile banking services: saving tools, areas to manage from the app the rest of banking channels such as ATMs, better capabilities for analyzing information for the customer…and much more.

All this has resulted in the new Santander App being awarded and recognized as the best banking services App in Spain (Best Bank for Digital Services Spain 2020) by Global Banking & Finance.

Explore more articles in the Banking category