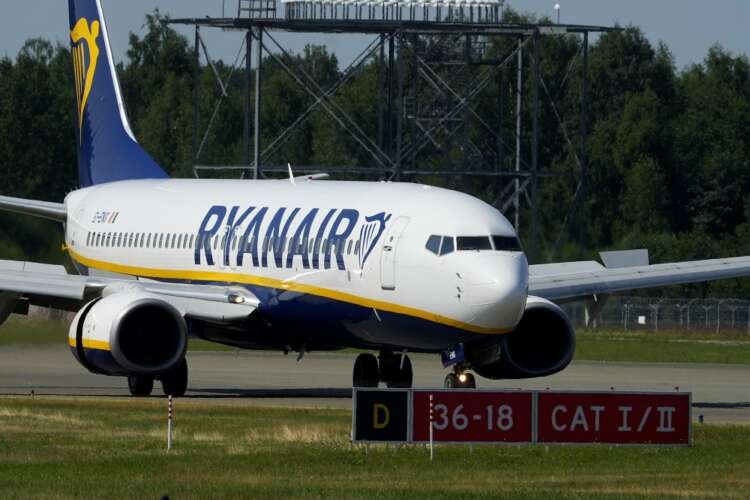

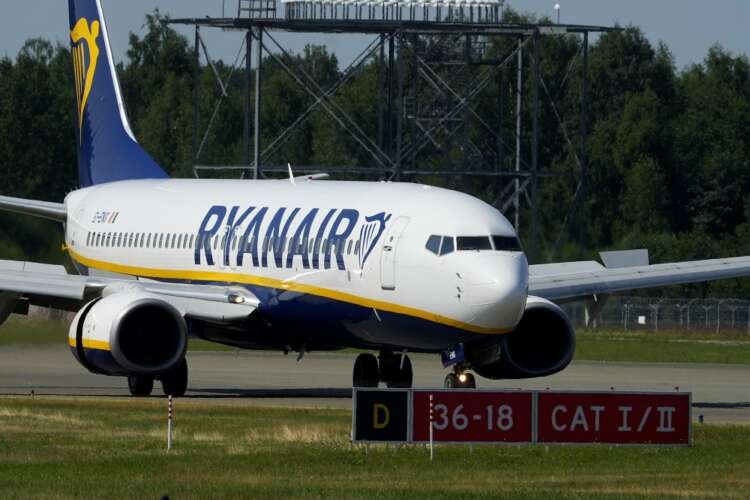

Ryanair unsure of return to pre-COVID profit this year, tops Q1 estimates

By Conor Humphries

DUBLIN (Reuters) -Ryanair on Monday said a return to pre-COVID levels of profitability this year was not certain even as it topped first-quarter estimates in what Chief Executive Michael O’Leary described as “a very strong but still fragile recovery”.

The after-tax profit of 170 million euros ($174 million) for the quarter ended June was ahead of estimates of 157 million euros in a company poll of analysts, but well short of the 243-million-euro profit in the same quarter of 2019.

Ryanair shares were down 1% at 0706 GMT.

Ticket pricing for bookings for the July-September quarter, typically Ryanair’s most profitable period of the year, are tracking higher than 2019 levels by a low double-digit percentage, O’Leary said.

But unpredictability around fuel prices, COVID-19 and geopolitical risks made it impossible to forecast profit for the full 2023 financial year (FY23) which ends on March 31, he said.

Ryanair is confident of a “full restoration” of the profitability and margins it enjoyed before COVID, O’Leary said in a video presentation. “It’s just we’re not sure yet whether that will be in FY23 or FY24.”

Ryanair posted a profit of 1 billion euros in its pre-COVID financial year ending March 2020, with 148 million passengers compared to the 165 million people it plans to fly this year.

Fares in the first quarter we down 4% on pre-COVID levels, Ryanair said.

Stockbrokers Goodbody described the release as “a very strong set of numbers”. Citi said a Q1 cost outperformance and Q2 pricing comments were “likely to drive FY consensus upgrade.”

Ryanair has not seen any impact on bookings from fears of high inflation and low economic growth in Europe and expects to build market share as passengers move from higher-cost rivals, Chief Financial Officer Neil Sorahan told Reuters.

Ryanair is, however, unlikely to return cash to shareholders in the its current or next financial year as it will be focused on paying down capital expenditure, Sorahan said.

“Our objective over the next two years is to manage our peak capex” and repay bonds. “That is where we will be focused,” he said.

Ryanair is in regular contact with Boeing but the U.S. plane manufacturer is “not anywhere close” to the pricing levels that would be required to move forward with a large order for the upcoming 737 MAX 10, Sorahan said.

($1 = 0.9795 euros)

(Writing by Conor Humphries; editing by Uttaresh.V, Vinay Dwivedi, Kirsten Donovan)

After-tax profit is the amount of money a company earns after all expenses, including taxes, have been deducted from total revenue.

Fuel prices refer to the cost of gasoline or diesel, which can significantly impact transportation companies like airlines.

Market share is the percentage of an industry's sales that a particular company controls, indicating its competitiveness in the market.

Corporate profit is the total revenue of a company minus its expenses, taxes, and costs, representing the financial gain of the business.

Explore more articles in the Top Stories category