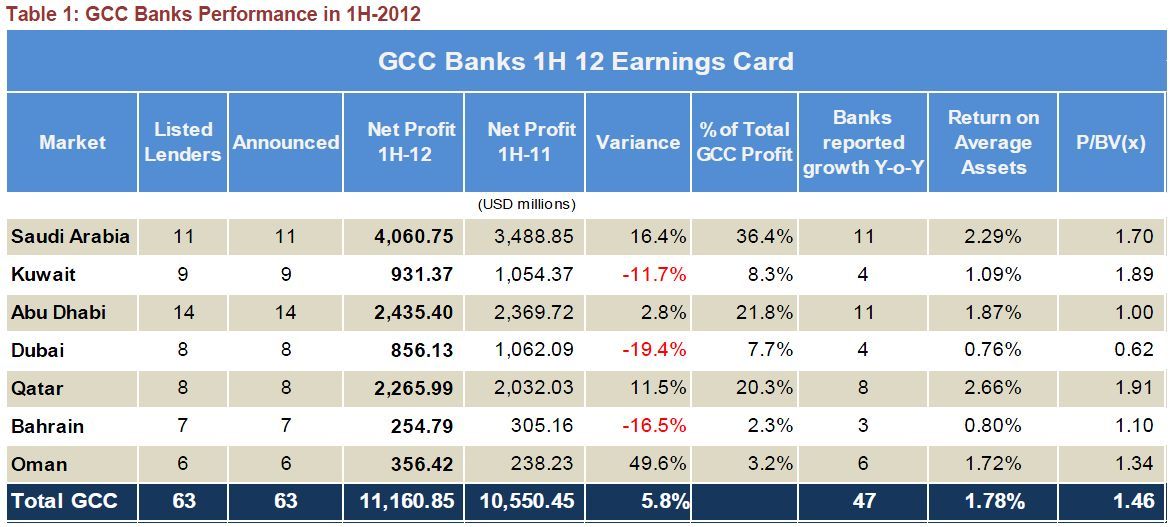

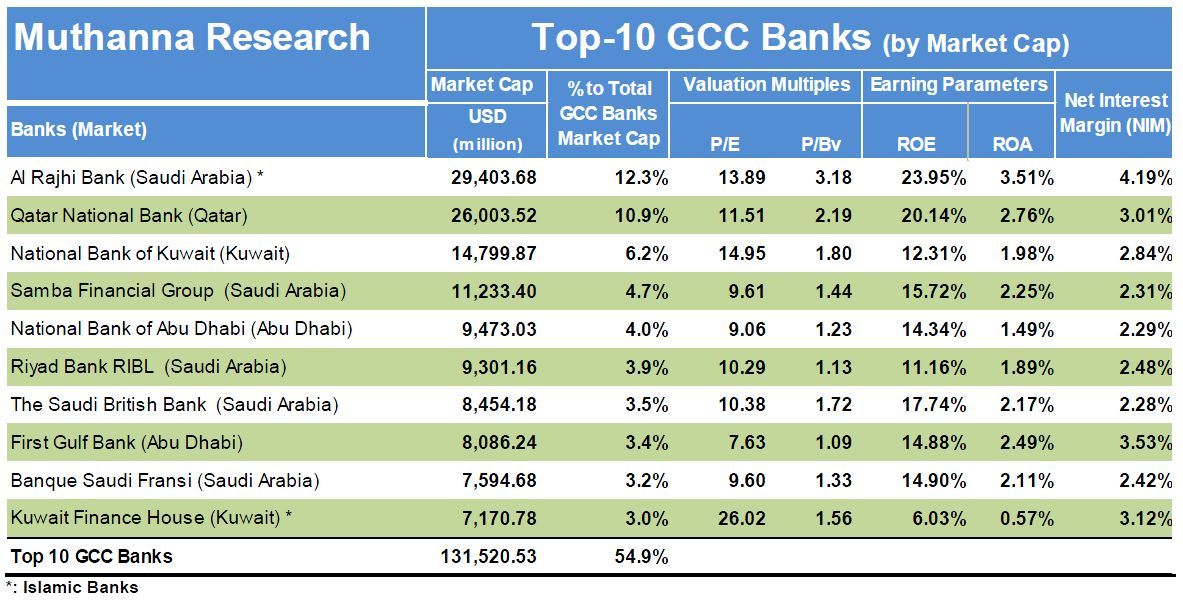

Return on Equity (RoE) is one of the most crucial ratios that should be understood by investors as it is used to measure the efficiency with which a company utilizes the equity capital. But why Muthanna chose RoE in current circumstances? In a plain vanilla essence, RoE tells you the rate of return the company is earning on the total funds that shareholders of the company have put in. The average ROE that a business earns over many years can tell you a lot about the profitability of the business. The maintenance of a strong ROE during good and bad times indicates a superior business model employed by the company, and can be a fabulous thing for the investors of the company provided that an exceptionally high price is not paid for buying a piece of that company. In this article, we shall discuss what RoE across the GCC, its 5-Years trend and 5 best performing stocks across the GCC counters. In our scanning, we considered only those companies which declared their 5 year financials (from 2007 to 2011), means that any company having an operational history of less than 5 year is automatically omitted from the process. Doing so, we formed a matrix of 564 companies across the 7 GCC counters. And indeed, in line to general perception; Qatar, Oman and Saudi Arabia looked quite promising and competing markets on the board. By the end of 2007, all markets shared a common platform by earning RoE varying between 17% to 21%, however the differentiating performance appeared only after the crisis era of 2008. (As shown in Table below)

UAE, Bahrain and Kuwait witnessed a sharp drop in their profitability, and factually Kuwait produced negative return for investors in 2008 and Bahrain in 2009. Saudi Arabia too reported a lower profitability in 2008, however it recovered later with pronounced performance from 2009. In 5-years spell, Qatar and Oman remained the best performing markets, as they have never lost even a single time; their double digit profitability performance. Qatar remained the best market, in 4 years of 5 years era while Oman shared the best performer tag once in 2010. On an average, Qatar has rewarded 18.2% to its investors in past 5 years while Bahrain returned the lowest of 6.8% to its investors.

Should an investor start to build up portfolio with high RoE?

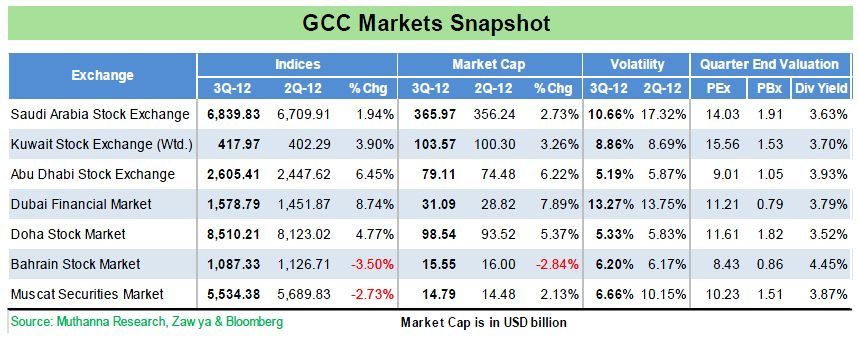

Talking straight, RoE is just a fundamental viewpoint which highlights stocks that are best in their businesses, but selecting a stock at right time and opportunity, depends upon various other aspects like valuation multiples like P/Ex, P/BVx with respect to market valuations, then Cash Generation capabilities, Debt levels, ongoing economic scenarios and many others. Our aim is to look out actively at the really good companies – those that generate lots of capital and allocate the capital for the benefit of their shareholders. One can surely argue that amid talks and implementation of quantitative easing(s) by many nations, is sure to move up equity price levels, but at Muthanna; we are of the opinion that it makes more sense to focus on fundamentals rather than get carried away with liquidity pushed euphoria across the counters.

Muthanna Research

For further enquiries, kindly contact us at:

Muthanna Investment Research

Safat Square, Baitak Tower, 32nd Floor, Kuwait

Tel: +965 2298 7000

mail: irdept@mic.com.kw

Appendix – Consistent Performers from GCC Markets

(Companies Highlighted in green)

Appendix:

Saudi Arabia (Tadawul All Share Index – TASI):

Disclaimer

The information contained in this document has been derived from sources believed to be accurate and reliable. Muthanna Investment Company (MIC) has not independently verified any information contained in this document. Therefore, neither MIC nor any of its employees, representatives or officials gives any representation or warranty of reliability, completeness or accuracy of such information. This information should not be construed as an offer, invitation, promotion or solicitation to subscribe, purchase, maintain or sell any of the financial products mentioned here, nor does it constitute investment advice or a recommendation toenter into any transaction that would form whatsoever the basis of any contract or commitment. The opinions in this report were prepared by MIC for its clients based on the information obtained from public sources that are believed to be reliable, but that belief is not a warranty on the reliability of the information based upon for preparing the report. The published research report may be considered by MIC when it decides to buy or sell proprietary positions in the securities mentioned in this report. For selected companies, MIC’s equity research analysts may identify shorter term opportunities that are consistent or inconsistent with MIC’s existing, longer term Buy or Sell strategy. In addition, MIC may trade for its own account as a result of the short term trading suggestions of analysts and may also engage in securities transactions in a manner inconsistent with this research report and with respect to securities covered by this report. Moreover, MIC will sell to or buy from customers based on its principal criteria. Opinions, estimates or projections in this report constitute the current conclusion of the author as of the date of this report. They do not necessarily reflect the opinions of MIC and are subject to change without notice. Moreover, MIC has no obligation to update, modify or amend this report or to otherwise notify a reader thereof in the event that any matter stated herein, or any opinion, projection, forecast or estimate set forth herein, changes or subsequently becomes inaccurate. The financial discussion and conclusion discussed in this report may not be suitable for all investors and investors must make their own investment decisions using their own independent advisors as they believe necessary and based upon their specific financial situations and investment objectives. Past performance is not necessarily indicative of future results and historical information in this report about companies, markets and securities does not guarantee future performance and investors are advised to take expert legal and financial advice before entering into any transaction similar to or inspired by the contents of this publication. The use of any information contained in this report and taking any of investment decisions is the responsibility of the reader and included as part of his risks.

Accordingly, neither MIC nor any of its employees, representatives or officials shall be responsible for any investment decisions, damages, opportunity losses, direct or indirect losses related to using of information, data, analysis or opinions contained in this report. This report may not be reproduced, distributed or published by any person for any purpose without MIC’s prior written consent. Please cite source when quoting. MIC shall retain ownership of the copyright and all other intellectual property rights. You shall not quote our name or reproduce our logo in any form or medium without MIC’s prior written consent. This information is made available on the company’s website (http:/www.mic.com.kw) under Investment Research. This disclaimer is subject to laws of the State of Kuwait. All disputes arising out of or relating to this disclaimer, contents of the opinions or information contained in this website shall be submitted to courts of the State of Kuwait and in line with provisions of Islamic Shariaa principals. MIC shall not be held responsible for any liability in case of using the contents of this website in other countries and any use of the contents of this website shall be subject to the relevant laws of those countries.