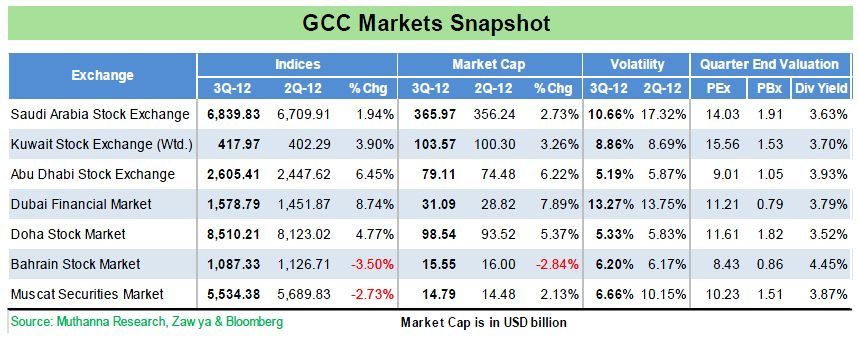

The market remained under the firm grip of volatility compared to last quarter, specifically by the end of the quarter. The market which began its 3Q journey on a strong foot, and rallied for consecutive 2 months (starting from July 18 till mid-September) witnessed heavy profit booking during the last sessions of September. Earnings estimations of either side together with uncertain economic aspects of Euro zone and oil prices fluctuations continued to add volatility to the market. TASI’s initial 3Q bull-run remained quite ephemeral as better expectations of 2Q earnings initially lifted market but soon profit booking actions spoiled the party. However, from this low level, the market got a flood of bulls and started-off one of its best journey from July 18. The benchmark gained 609.95 points within a span of two months, in lieu of all positive news inflow from corporate side as well as from economic circle. Investors remained upbeat during September, ahead of the FOMC’s monetary policy decision with expectations of more monetary easing growing. Sentiment also boosted by hopes that a ruling by a German Constitutional Court on the legality of the ESM will act as catalyst for positive developments. By September 15, 2012, the market board was showing a gain of around 9% over June 30 closing. As the party was cheering all these gains, the benchmark came under the firm grip of bears, mainly due to earning concerns and

uncertainty in oil markets, which in turn affected sentiment; particularly in the banking and petrochemical sector. The falling spree-post September 15, gained a further pace by the month end and the market lost 326 points (4.56%) within last two weeks of the month. Saying so, by 3Q end, TASI managed to save some of its earlier gains and ended the period with a 1.94% (129.92 points) gain only. In totality, Year 2012 is witnessing a sort of alternate session of peak and trough as in 1Q, it added 22.09% but lost 14.36% in 2Q. The index touched its quarter-peak on September 01, to reach 7,179.49 and touched its low on July 18, at 6,555.91, reflecting a range bound of 623 in the quarter, which is clearly reflected in its double digit volatility. On the country news side, government has drawn mega plans across the board for the public welfare. The Kingdom has approved USD 72 billion worth of infrastructure projects in Year 2012 and see no full stop. In the Healthcare, Saudi Arabia plans to open 132 new hospitals – adding 26,700 beds to its current healthcare landscape, in next two years. On the construction side, the list is too long in terms of water, residential, solar and roads construction projects, especially for 3 big cities of Mecca, Riyadh and Jeddah. In a nutshell, despite of IMF projecting a small deficit by 2017 and growing affiliation of the Saudi market to Global downfall and slowdown, we believe the long term story for the country remains intact given the emerging role of private industry as well as improving job scenarios, living standard and controlled inflation.

Across the Market

Despite 1Q-12 strong earnings, the market embraced a downswing mainly due to Eurozone crisis as well as by sliding oil prices.

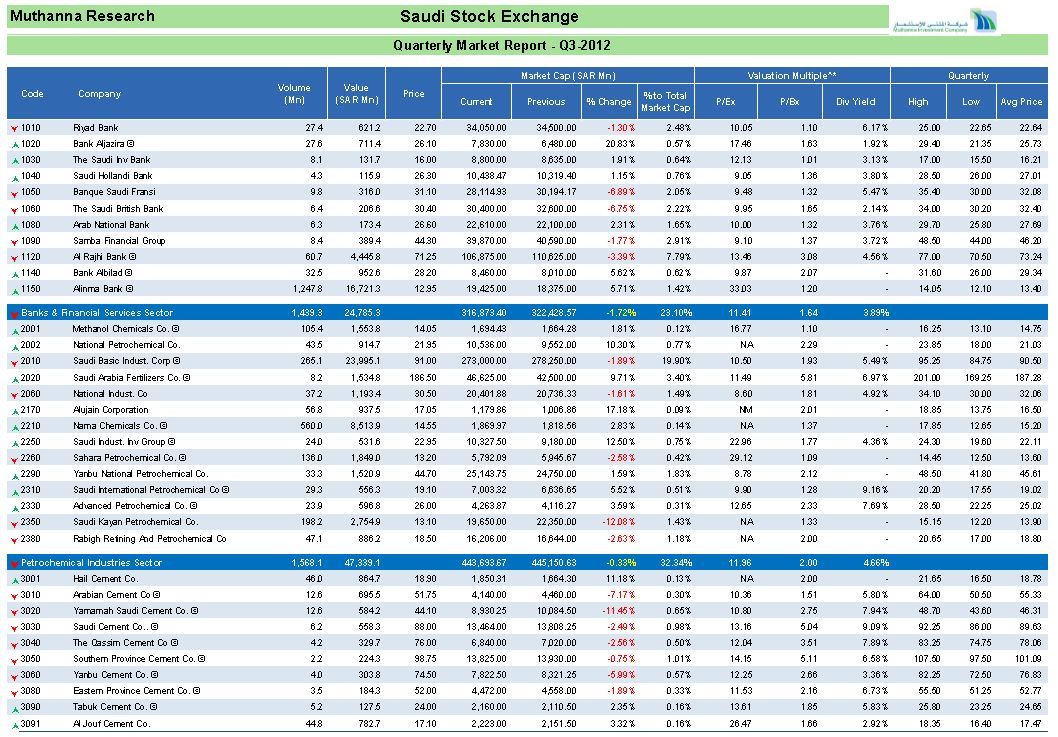

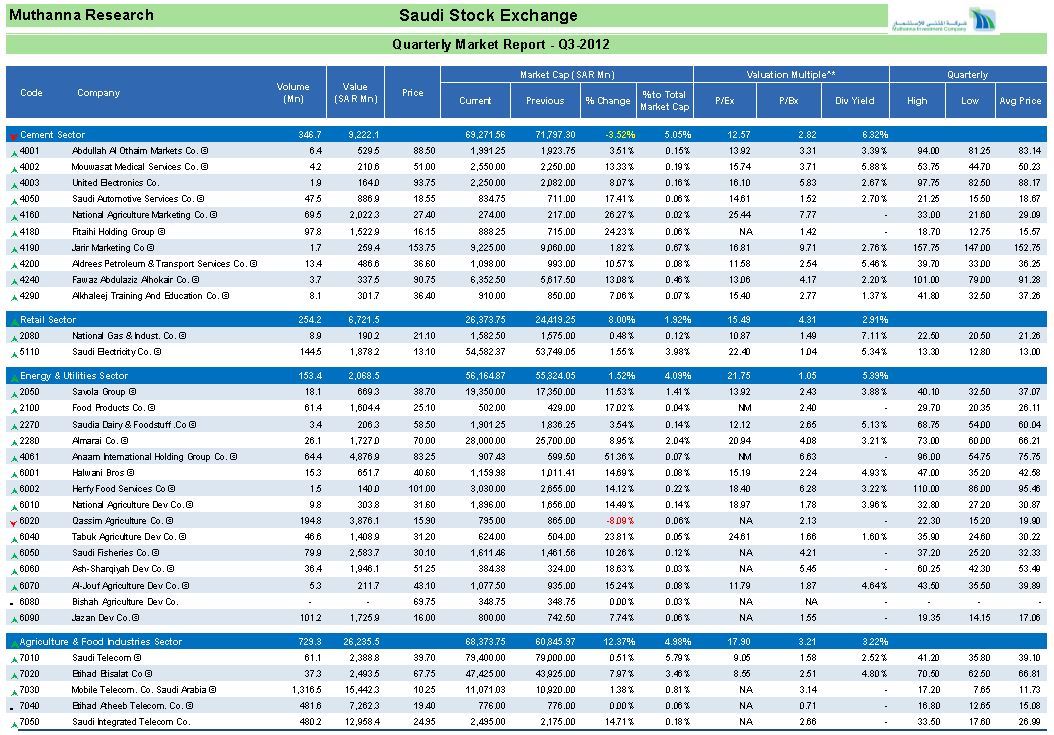

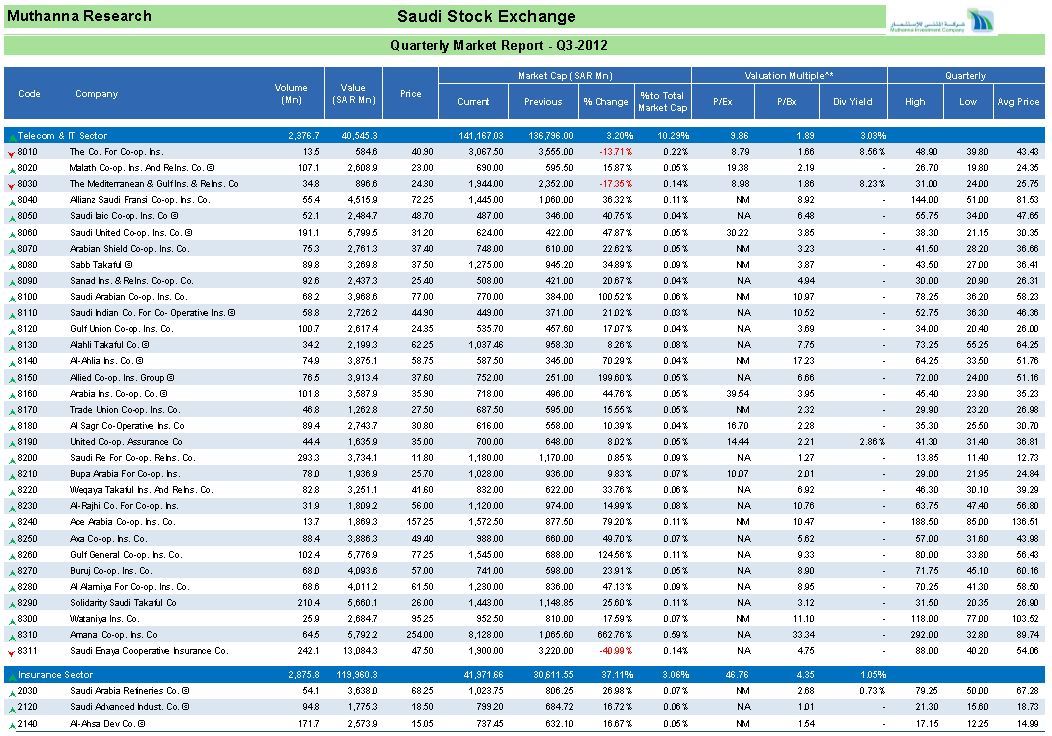

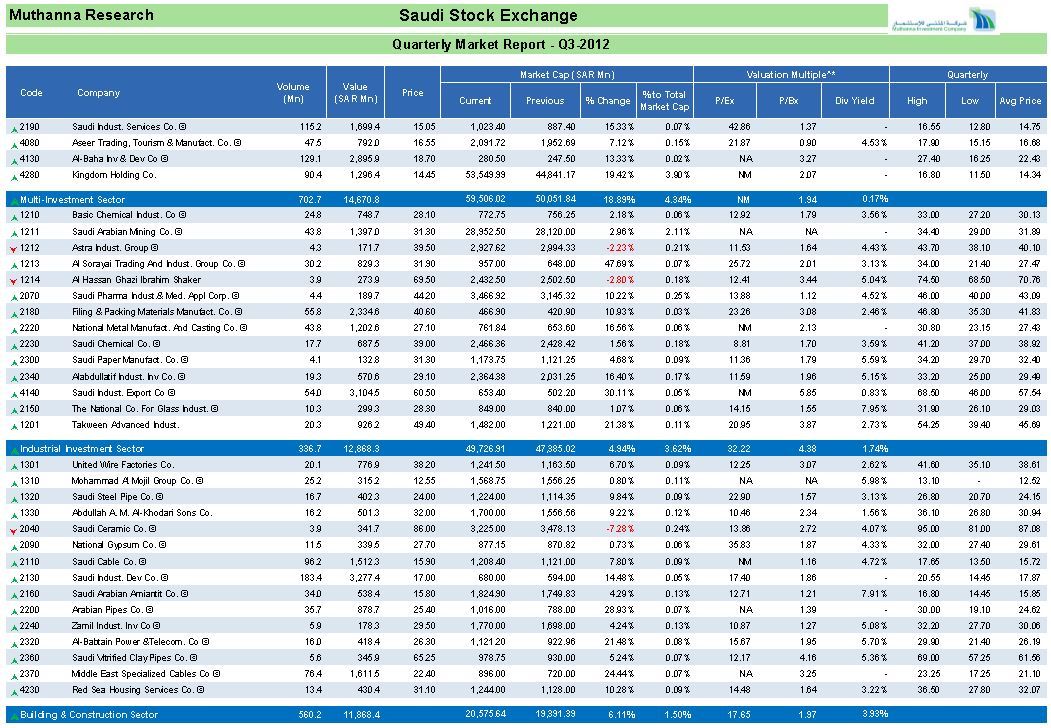

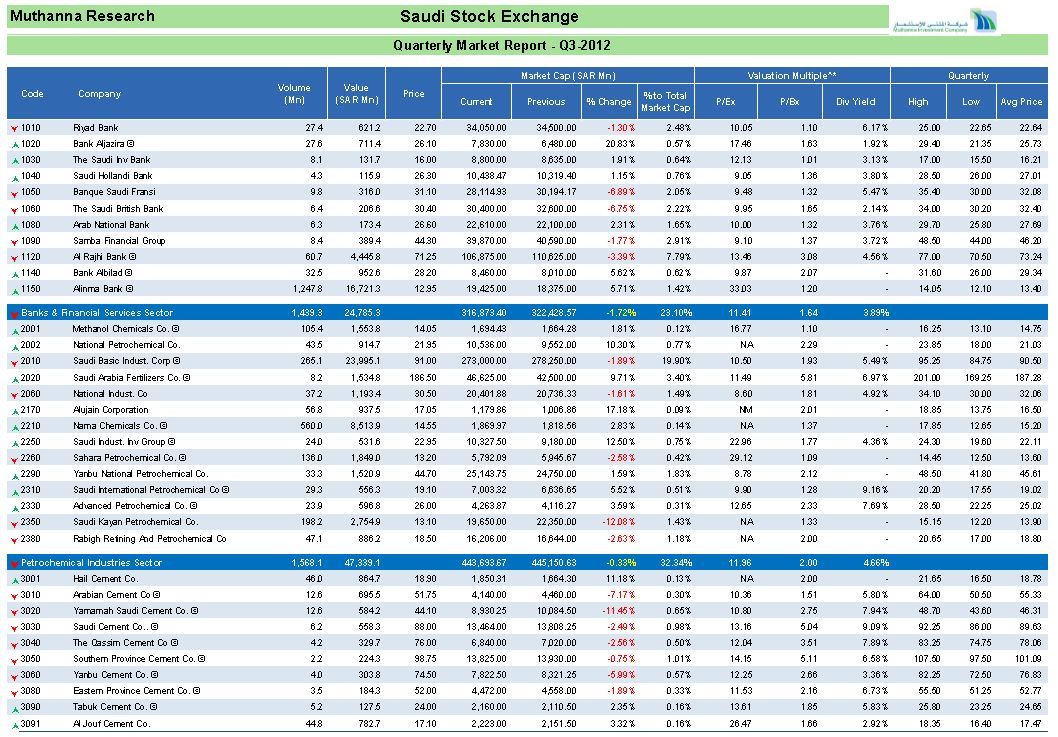

a. Of tabulated 15 sectors, with an exception of the Banks & Financial Services plus Cement sector, all 13 sectors witnessed black signs on their boards, mainly buoyed by strong oil prices and active interest of Saudi government on infrastructure plans.

b. The benchmark witnessed one new listing; Catering in the Agriculture & Food Industries on July 09, 2012, thus taking total tally to 156.

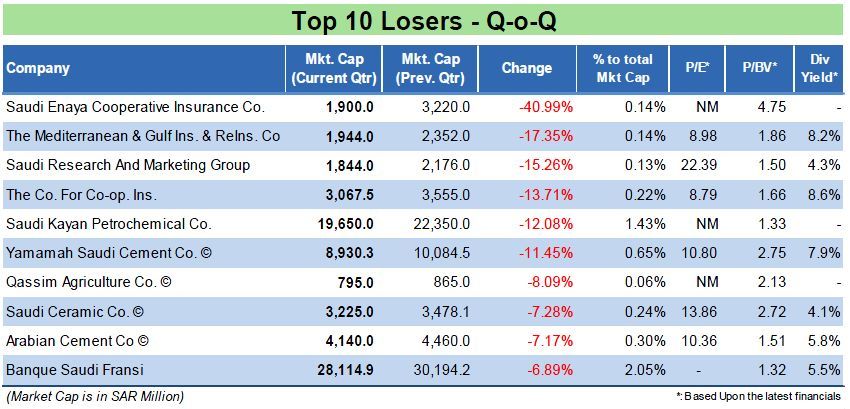

c. On the Sector Indices front, the Cement was the worst performer, as it lost 4% on the Index front as well as 0.8% on the market capitalization front. Out of 10 listed stocks, 7 witnessed a quick erosion in their market cap, especially sector’s bellwethers like Southern Province (sharing 21% of sector market cap), Saudi Cement (sharing 20.5% of sector market cap) and Yamamah Cement (sharing 13.6% of sector market cap) lost 0.75%, 2.49% and 11.45% respectively. Hail cement was the only double digit gainers for the month as it added 11.18% in the market cap. During the quarter, Southern Province announced about the delay of the operation of the third mill in Jazan Plant, which dragged down the price level.

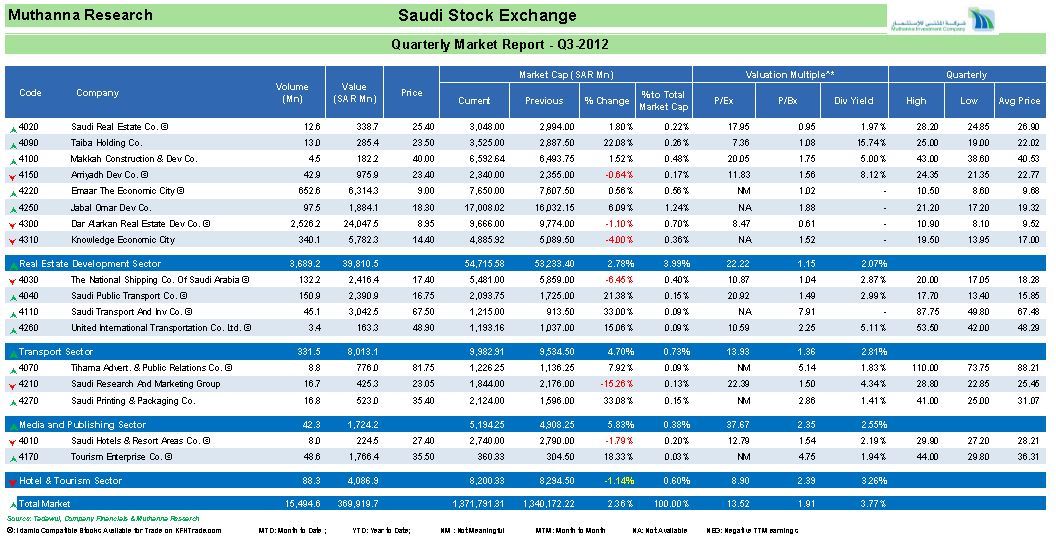

d. On the market capitalization side, the market cap mirrored the overall index performance; as out of 15, baring 3 namely – the Cement, Petrochemical and Banks 12 sectors added value in their market cap in a range of 1.5% to 43.9%. The Petrochemical sector remained an exception as it grew by 0.2% on Index level but contracted by 0.3% on the market cap side. Such odd behavior is mainly due to fall in SABIC and Saudi Kayan which reported a dip of 1.89% and 12.08% q-o-q basis. Overall market capitalization soared to SAR 1.371 trillion, from SAR 1.337 trillion a quarter ago. 3 major sectors namely, Banks & Financial Services, Petrochemical and Telecommunication continued to account for 66% of total market capitalization. Lower than 68% a quarter ago.

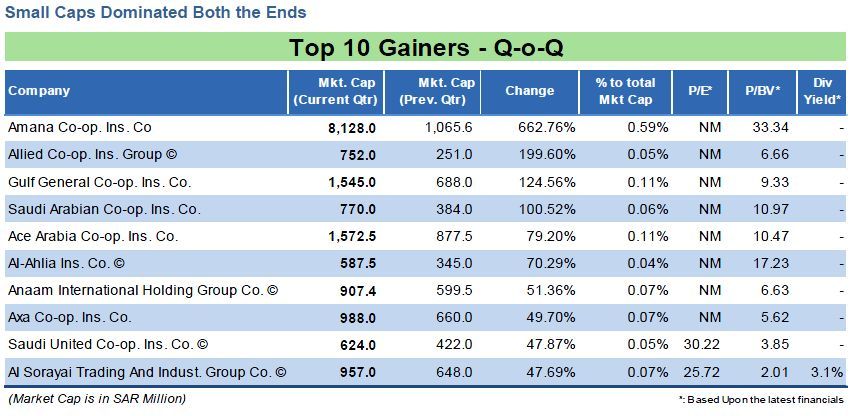

e. The Insurance sector remained the best performer on both the fronts; as it surged 35% on Index level while added 44% on the market cap corner. Amana Co-Operative reported a whopping gain of 662.76% in the quarter while Allied Co-Operative Insurance almost tripled its market cap in the period. In addition, Gulf General and Saudi Arabian Co-Ops Insurance inflated by 124% and 100% respectively, thus provided a booming impetus to Insurance.

f. Following the Insurance, Multi-Investment sector remained another outperformer in the period, gaining 19% in its market cap, mainly due to robust performance of its bellwether Kingdom Holding Co. which added SAR 8.71 trillion alone (19.42%) in the total sector addition of SAR 9.46 trillion.

g. Out of 156 stocks, as of October 11, 39 stocks announced their 3Q earnings. As per Gulfbase, total market earnings (announced so far) reached SAR 25.28 billion, up by 2.55 from a year ago. The improvement in earnings is a clear proof that market remained a lead indicator of better sentiments in the course.

Latest 9M-FY2012 Earnings Snapshot

Earnings Remain Flat Till Report Writing

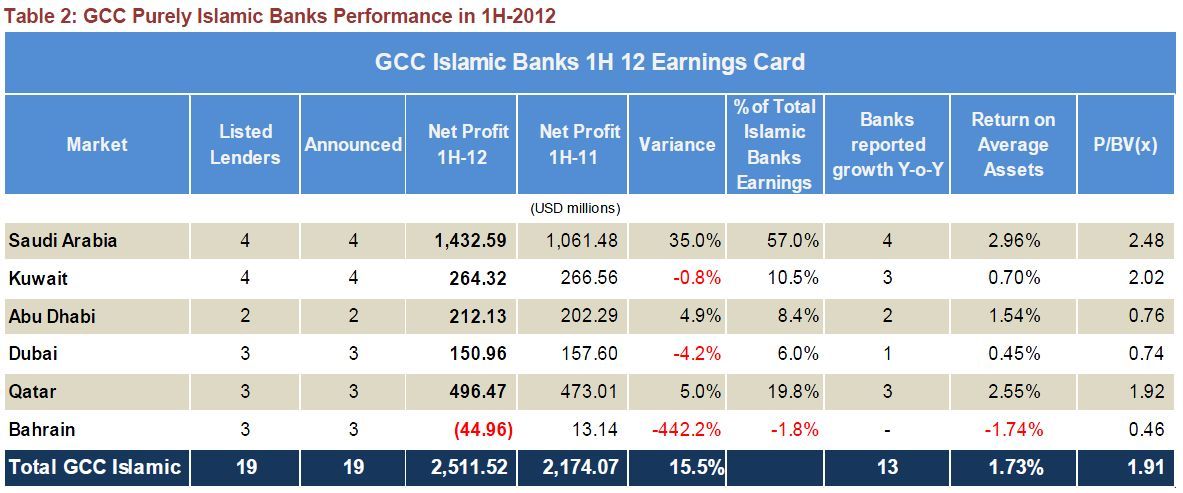

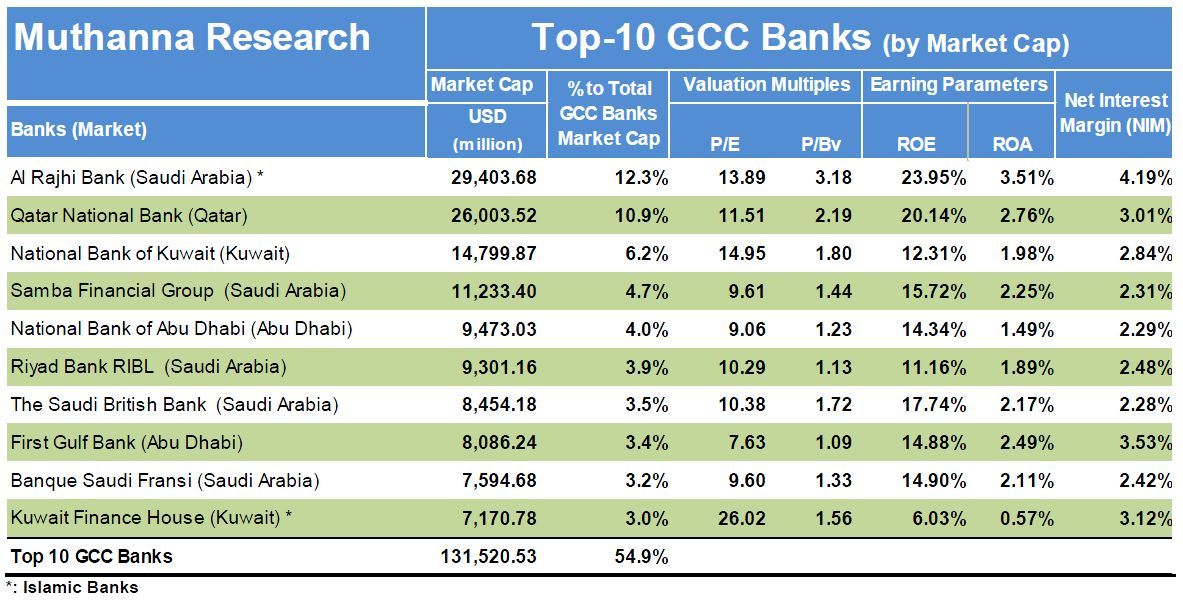

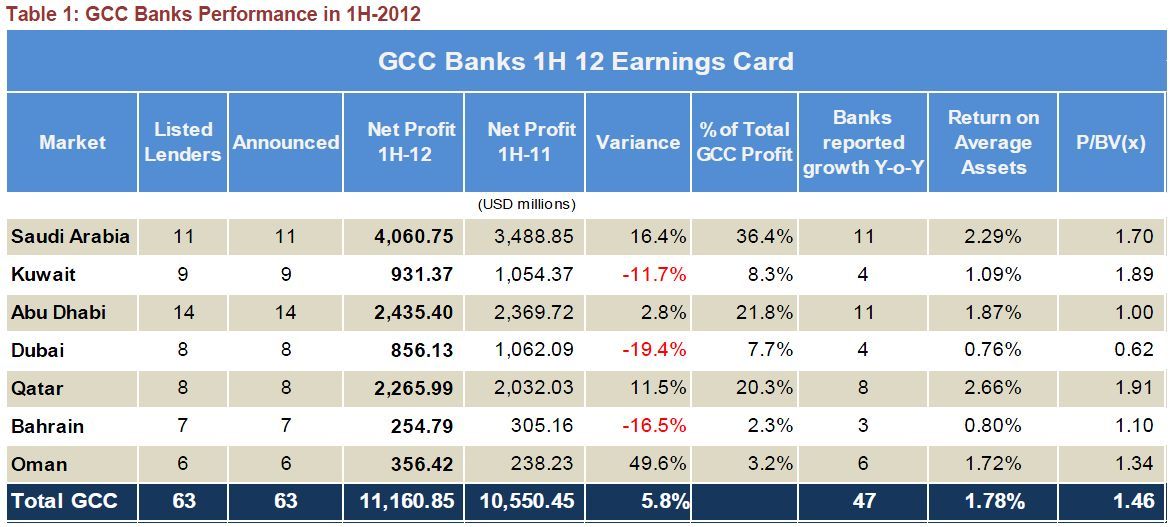

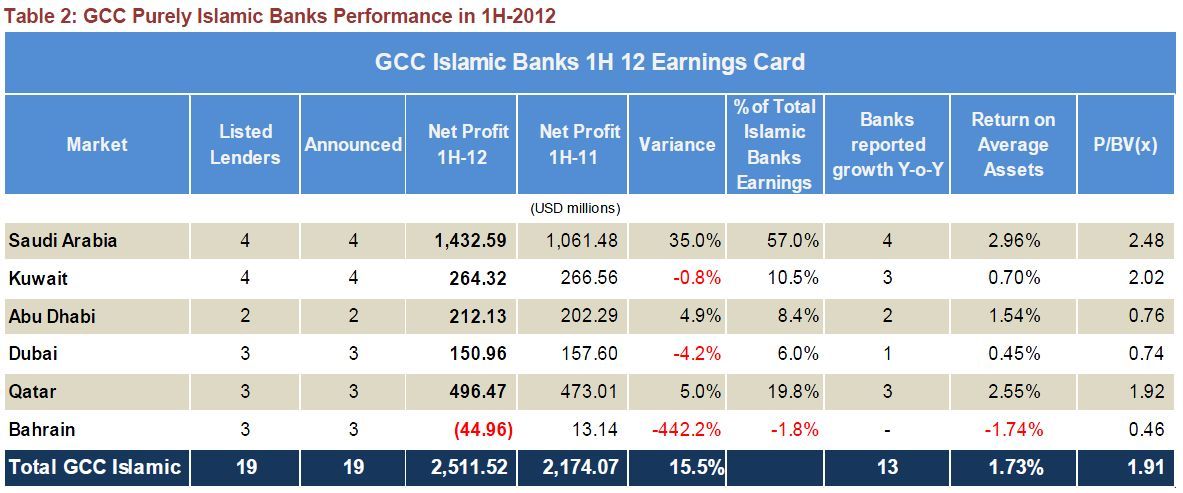

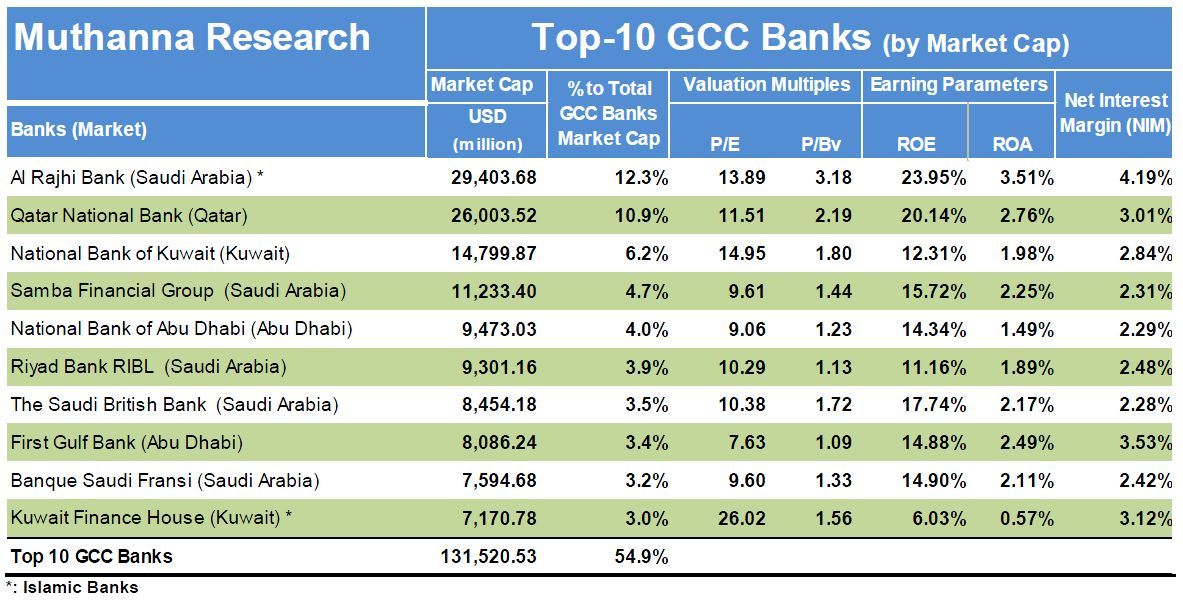

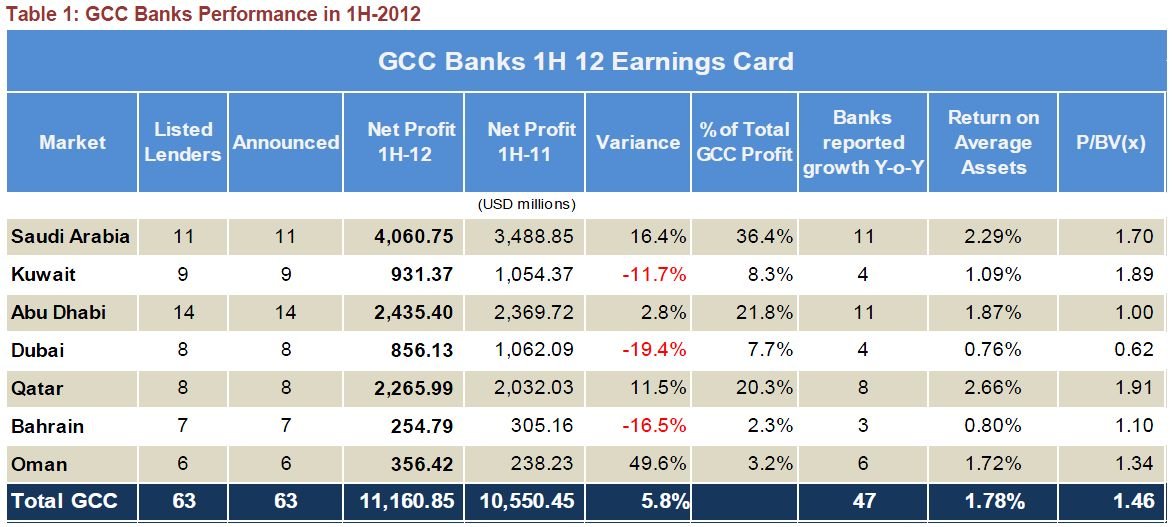

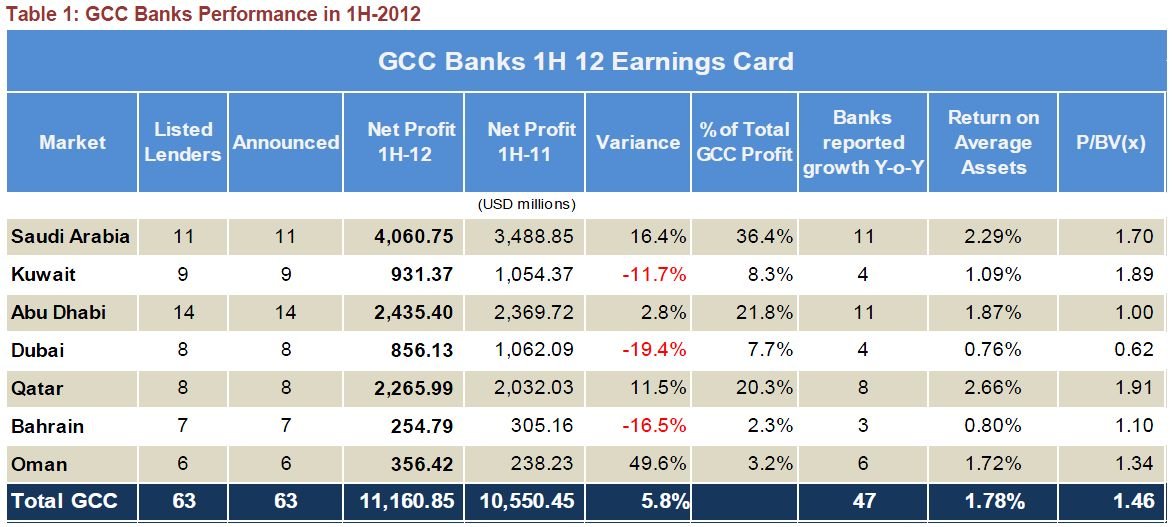

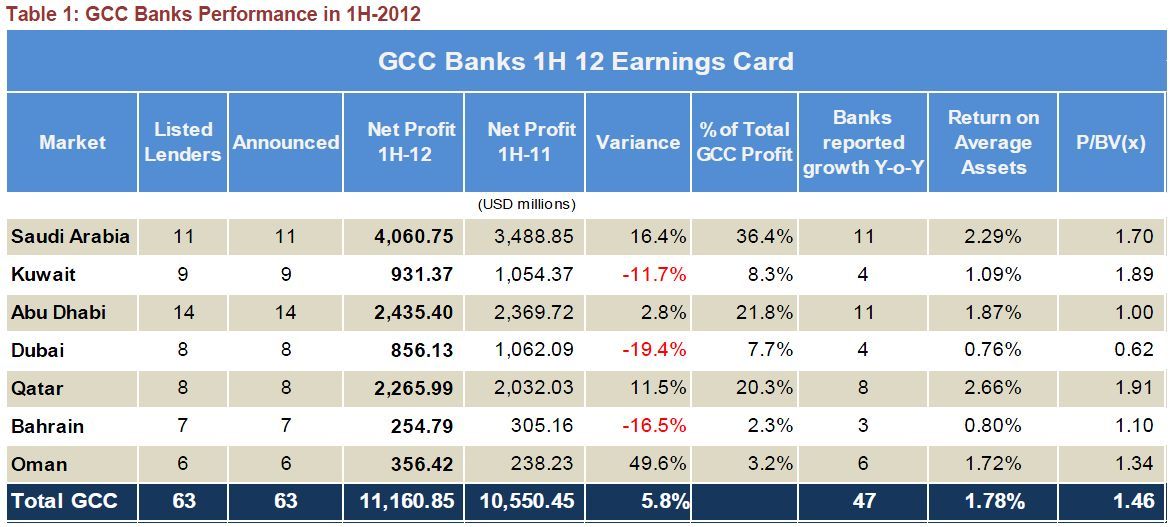

Banking, the market heavyweight, remained the biggest booster for total market earnings by sharing 58.74% of total announced earnings till the report writing date. As per the latest earning status (source: Gulfbase), in the banking space, Bank Al Jazeera was the best outperformer as it reported a growth of 10.9.35% in its bottom line on y-o-y basis. On contrary, Banque Saudi Fransi was the lone lender to witness a drop in its net profit by 1.87% on annual basis. Islamic lender, Alinma bank, reported a robust growth of 78.3% in its bottom-line for the 9M-2012. In the Petrochemical space, Methanol Chemical Co. remained an exception to the matrix by reporting a surge of 63% in its net profit whereas all other reported a dip, led by Saudi Kayan and Sahra Petrochemical. Saudi Kayan reported a net loss of SAR 577.82 million as against a net loss of SAR 59.5 a year ago whereas Sahara reported a net profit of SAR 139 million, way down from a net profit of SAR 407 million a year ago. In totality, these two sectors jointly shared 77% of total market earnings so far. The Cement sector also performed quite well as 6 out of 10 listed entities announced their earnings for 9M and reported a surge of 17.45%, in which Yanbu outshined all others in terms of profit growth during the period. In the Agricultural side, Almarai continued to dominate the sector with its robust earnings, as the dairy products producer reported a total net profit of SAR 1.07 billion, up by 5.67% from a year ago.

* *

Market Movers

Small Caps Dominated Both the Ends

Market Momentum

a. The top gainers remained a diversified group; with a combination of companies from the Real Estate; Telecommunication; Banking and Petrochemical sector. However; activities across the above counters were largely driven by news flows (either Q2FY12 earnings or specific company announcements)

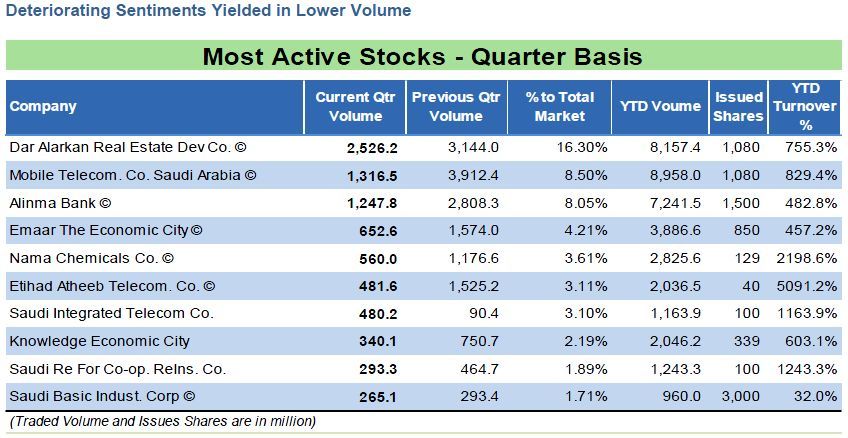

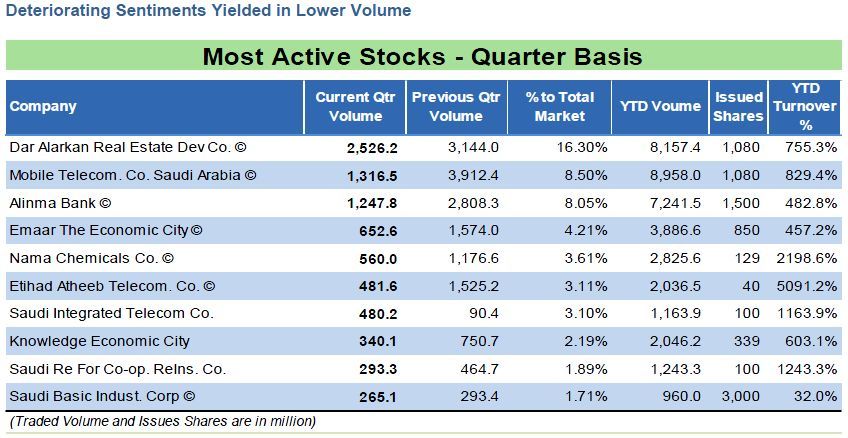

b. Dar Alarkan Real Estate Dev Co was the most active stock as it reported a jump of 9.2% in its 6M-2012 net income, which was welcomed by investors. In other development, the company disclosed that it had fully repaid USD 1 billion Sukuk- due in July. These two news acted as catalyst for the company’s market cap, which saw a run of 23.5% during the quarter.

c. Mobile Telecommunications Co – Zain KSA followed Dar Al Arkan post the capital restructuring during the quarter. The mobile operator increased its capital through a rights issue to dilute its accumulated losses as well as to ease the “debt to equity” stretching ratio.

****

What Lies Ahead

The Saudi economy is bursting by surplus despite few economic issues surfacing to hinder economic pace. Let’s look-upon some promising key economic developments of this economy:

? As per SAMA (Saudi Arabian Monetary Agency), the current account surplus has widened to USD 158bn in 2011, equivalent to 27.5% of GDP; up by 137.4% on y-o-y basis.? The Construction sector is booming, primarily driven by new contracts awarded totaled USD 72bn, up by 140.0% y-o-y.

? The country’s external position remains safe, by two P’s – Price and Production pertaining to Oil. Firstly, oil prices is about to remain strong in near term and even if it drops, the fall will limit oil price near USD 100/barrel. Secondly, the country increased its production by around 11% in 2011 and continue to enhance it further by 5% approximately in 2012, in a bid to ease out pressure on oil prices. Jointly, these two factors are poised to strengthen the economic position of Saudi Arabia.

? Total foreign reserves reached USD 605bn by July 2012, up by 19.7% y-o-y basis, meaning that SAMA is continued to divert majority of its surpluses towards reserve assets.

? Overall PMI continue to hang above 50, which separates expansion from contraction. Definitely, this PMI number is in sharp contrast to recently figures appeared on the board from China and Euro Zone, which are firmly below 50.

? Concern: Economic growth with this pace is certain to slow down based upon certain assumptions like declining oil prices post a stability in the ME region, stabilizing oil production after 2 years of spurt to meet demand and continuity of rising import bill to quench the thirst of infrastructure needs. In totality, Saudi Arabia is doing her best to diversify its economy away from oil. Keenness to approve and quick implementation of major infrastructure projects in three big cities; namely Riyadh, Jeddah and Mecca in addition to kick-off several housing projects to eliminate housing issues are live examples of government determination. Not only this, the country is also searching new avenues to generate electricity through solar channel so as to reduce oil consumption for electricity generation. As per a recent report from Business Monitor Index, clearly states that BMI’s infrastructure team expects this growth to average 9.2% in real terms in 2012 and further estimate this sector to grow by average 5.6% from 2012 to 2016. Need not to say that activation of new Mortgage Law from October 2012, will further boost the lending sentiments.

We reiterate our last report wordings the Saudi economy is certainly showing a lot of improvement and discipline as reflected in a smart growth of non-oil related sectors. The economy has marked a real GDP of 4.1% and 7.1% in 2010 and 2011 respectively, and we believe it will continue to grow with all corners contribution.

However, as a concern, this growth may slow down- backed by certain issues as highlighted in our foresaid paragraph and the economy may grow within a range of 5 to 5.5% in 2012 and may decelerate“below 5%” in 2014.

Finally

Report Contributor

Muthanna ResearchFor further enquiries, kindly contact us at:

Muthanna Investment Research

Safat Square, Baitak Tower, 32nd Floor, Kuwait

Tel : +965 2298 7000

mail:

irdept@mic.com.kw

uncertainty in oil markets, which in turn affected sentiment; particularly in the banking and petrochemical sector. The falling spree-post September 15, gained a further pace by the month end and the market lost 326 points (4.56%) within last two weeks of the month. Saying so, by 3Q end, TASI managed to save some of its earlier gains and ended the period with a 1.94% (129.92 points) gain only. In totality, Year 2012 is witnessing a sort of alternate session of peak and trough as in 1Q, it added 22.09% but lost 14.36% in 2Q. The index touched its quarter-peak on September 01, to reach 7,179.49 and touched its low on July 18, at 6,555.91, reflecting a range bound of 623 in the quarter, which is clearly reflected in its double digit volatility. On the country news side, government has drawn mega plans across the board for the public welfare. The Kingdom has approved USD 72 billion worth of infrastructure projects in Year 2012 and see no full stop. In the Healthcare, Saudi Arabia plans to open 132 new hospitals – adding 26,700 beds to its current healthcare landscape, in next two years. On the construction side, the list is too long in terms of water, residential, solar and roads construction projects, especially for 3 big cities of Mecca, Riyadh and Jeddah. In a nutshell, despite of IMF projecting a small deficit by 2017 and growing affiliation of the Saudi market to Global downfall and slowdown, we believe the long term story for the country remains intact given the emerging role of private industry as well as improving job scenarios, living standard and controlled inflation.

uncertainty in oil markets, which in turn affected sentiment; particularly in the banking and petrochemical sector. The falling spree-post September 15, gained a further pace by the month end and the market lost 326 points (4.56%) within last two weeks of the month. Saying so, by 3Q end, TASI managed to save some of its earlier gains and ended the period with a 1.94% (129.92 points) gain only. In totality, Year 2012 is witnessing a sort of alternate session of peak and trough as in 1Q, it added 22.09% but lost 14.36% in 2Q. The index touched its quarter-peak on September 01, to reach 7,179.49 and touched its low on July 18, at 6,555.91, reflecting a range bound of 623 in the quarter, which is clearly reflected in its double digit volatility. On the country news side, government has drawn mega plans across the board for the public welfare. The Kingdom has approved USD 72 billion worth of infrastructure projects in Year 2012 and see no full stop. In the Healthcare, Saudi Arabia plans to open 132 new hospitals – adding 26,700 beds to its current healthcare landscape, in next two years. On the construction side, the list is too long in terms of water, residential, solar and roads construction projects, especially for 3 big cities of Mecca, Riyadh and Jeddah. In a nutshell, despite of IMF projecting a small deficit by 2017 and growing affiliation of the Saudi market to Global downfall and slowdown, we believe the long term story for the country remains intact given the emerging role of private industry as well as improving job scenarios, living standard and controlled inflation.