PERSONAL BANKING IN A DIGITAL WORLD

Published by Gbaf News

Posted on June 21, 2014

4 min readLast updated: January 22, 2026

Published by Gbaf News

Posted on June 21, 2014

4 min readLast updated: January 22, 2026

Bill Sarris, CEO and Co-Founder of Linqto, Inc.

Apple recently announced making its fingerprint sensor available to third-party app developers. This is a big step ahead, and has some some experts expecting that it will double the number of mobile banking adopters. We’re optimistic too, but other factors are preventing moble banking apotion.

We Still Need a Banker’s Advice

Financial institutions will always need a human face in their interaction with the customer. Linqto’s focus group research with banking customers reveals the primary reason for visiting the bank is trust in their bankers. Trust to process their transactions correctly. Trust to give them sound financial advice. Just as the Internet has not removed Realtors from home-buying transactions, computer programs simply cannot replace Bankers.

Biometrics can’t cure digital banking skepticism overnight because it won’t induce financial literacy. People feel comfortable when talking to their banker directly. They need a banker’s opinion when making important financial decisions.

Although recent articles like “Mobile Banking Adoption to double by the end of 2015. Now Third Party Apps Can Use IPhone 5s Fingerprint Scanner”, claim that new security in authentication technology will answer the mobile banking adpotion problem, they are discounting the stated reason that tech-savvy users still go to the bank.

The “Personal Touch” Factor

Customers who haven’t adopted mobile banking will most certainly not get convinced by the iPhone 5s Fingerprint Scanner and turn to digital banking overnight. Their financial expectations are more complicated than that. Banking is a relationship business, not a data business. Digital and mobile banking apps only solve for the transaction side and do not address relationhips.

In the 90’s, amazon.com began displaying books and realtor.com began displaying real estate listings. Today, Borders is gone and bookstores are obsolete. But even though we hunt for houses on the web, we still retain a Realtor for buying and selling. Where our money is concerned it is not only about the data. We want solid advice from professionals.

Relationship Banking in a Digital World

Relationship Banking in a Digital World

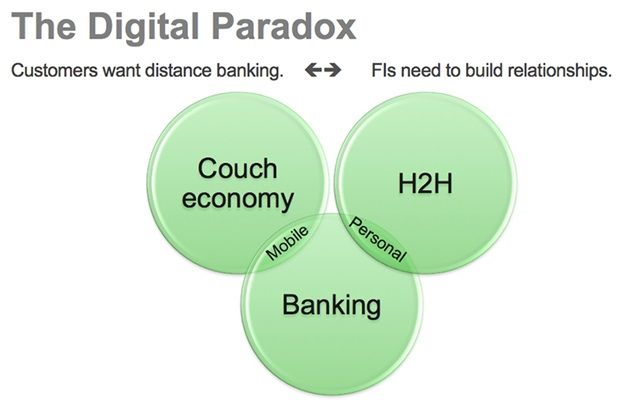

Consumers demand a “couch economy”. Digital banking will solve for this when technolgy matches needs by allowing remote access to real bankers. NCR’s new Interactive Teller Machines is one new solution. Interacting with the bank from any device will ultimately bring the omni-channel revolution into the digital banking realm. We can coduct data-centric transactional business unilaterally, but relationship banking requires contact-centric applications.

Branches are still a strategic asset for the American retail bank and will likely continue to be so. According to Accenture’s US Retail Banking in the Digital Era study, “78% of respondents say they expect to be visiting their local bank branch just as frequently—or even more frequently—five years from now; in large part because 66% of them still prefer to “talk to a person” rather than purchase a banking product online. Two-thirds see in branch closures more than a minor inconvenience, and nearly 50% would switch banks as a result.”

Branches are still a strategic asset for the American retail bank and will likely continue to be so. According to Accenture’s US Retail Banking in the Digital Era study, “78% of respondents say they expect to be visiting their local bank branch just as frequently—or even more frequently—five years from now; in large part because 66% of them still prefer to “talk to a person” rather than purchase a banking product online. Two-thirds see in branch closures more than a minor inconvenience, and nearly 50% would switch banks as a result.”

Trust is About People

Bill Sarris

Financial institutions shouldn’t reduce their customer’s needs down to a range of statistics, demographics or biometrics. Any means of automation is good, but they still have to consider that loyalty and important decisions such as “should I adopt mobile banking” are not taken on an “A vs. B”, “password vs. fingerprint” basis. If only banking were that simple! The good news for banks is that the digital world will soon provide solutions for maintaining valuable customer relationships while allowing remote access.

Author’s Bio:

Bill Sarris, CEO and Co-Founder of Linqto, Inc.

Bill Sarris is a recognized expert in the field of streaming and collaborative technology and the inventor of Linqto technology. Bill has delivered major enterprise software applications for Microsoft, Intuit, Digital Insight, NCR, Google, Stanford and other clients. With over a decade of experience in financial services applications, digital and mobile banking, Bill’s work has received the Forrester Groundswell Award and he holds numerous software certifications.

Explore more articles in the Banking category