Oil up 2% as dollar weakens on small US Fed rate hike

By Scott DiSavino

NEW YORK (Reuters) -Oil prices rose about 2% to a one-week high on Wednesday as the dollar slid to a six-week low after the U.S. Federal Reserve delivered an expected small rate hike while hinting that it was on the verge of pausing future increases.

Brent crude futures rose $1.37, or 1.8%, to settle at $76.69 a barrel, while U.S. West Texas Intermediate crude (WTI) ended $1.23, or 1.8%, higher at $70.90.

That was the highest closes for both crude benchmarks since March 14.

The Fed raised interest rates by a quarter of a percentage point, but indicated it was on the verge of pausing further increases in borrowing costs amid recent turmoil in financial markets spurred by the collapse of two U.S. banks.

“Today’s 25-point rate hike by the Fed provided no surprises but the accompanying language prompted some increase in risk appetite that easily spilled into the oil space,” analysts at energy consulting firm Ritterbusch and Associates told customers in a note.

The U.S. dollar fell to its lowest level since Feb. 2 against a basket of other currencies, supporting oil demand by making crude cheaper for buyers using other currencies.

The oil markets shrugged off the U.S. Energy Information Administration’s (EIA) weekly data that showed crude stockpiles rose 1.1 million barrels last week to a 22-month high. [EIA/S] [API/S]

Analysts in a Reuters poll had forecast a 1.6-million barrel withdrawal. But the official EIA data showed a smaller build than the 3.3-million barrel increase reported on Tuesday by the American Petroleum Institute (API), an industry group.

“We just have a lot of crude oil in storage and it’s not going to go away anytime soon,” said Bob Yawger at Mizuho.

U.S. crude stockpiles have grown since December, boosting inventories to their highest since May 2021. Gasoline and distillate inventories, meanwhile, fell last week by more than analysts expected.

WTI and Brent prices last week fell to their lowest since 2021 on concern that banking sector turmoil could trigger a global recession and cut oil demand. An emergency rescue of Credit Suisse Group AG over the weekend helped revive oil prices.

The Organization of the Petroleum Exporting Countries and its allies like Russia, a group known as OPEC+, is likely to stick to its deal on output cuts of 2 million barrels per day (bpd) until the end of the year, despite the plunge in crude prices, three delegates from the producer group told Reuters.

(Additional reporting by Rowena Edwards in London, Shariq Khan in Bengaluru, Sudarshan Varadhan in Singapore and Andrew Hayley in Beijing; Editing by Marguerita Choy and David Gregorio)

Monetary policy refers to the actions taken by a country's central bank to control the money supply and interest rates to achieve macroeconomic goals such as controlling inflation, consumption, growth, and liquidity.

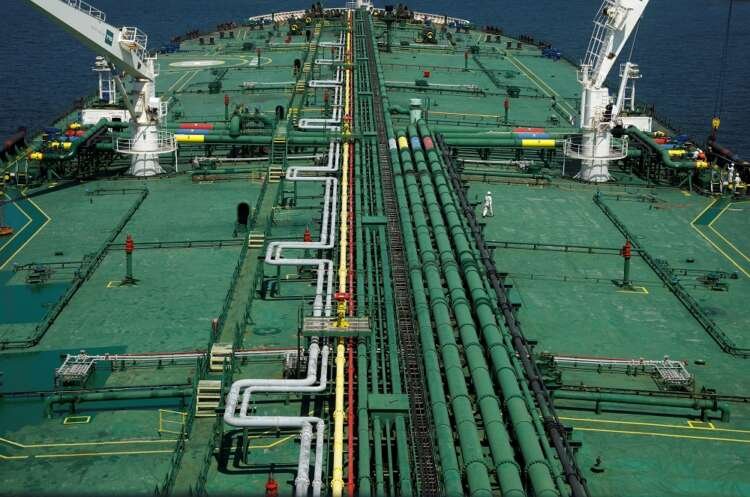

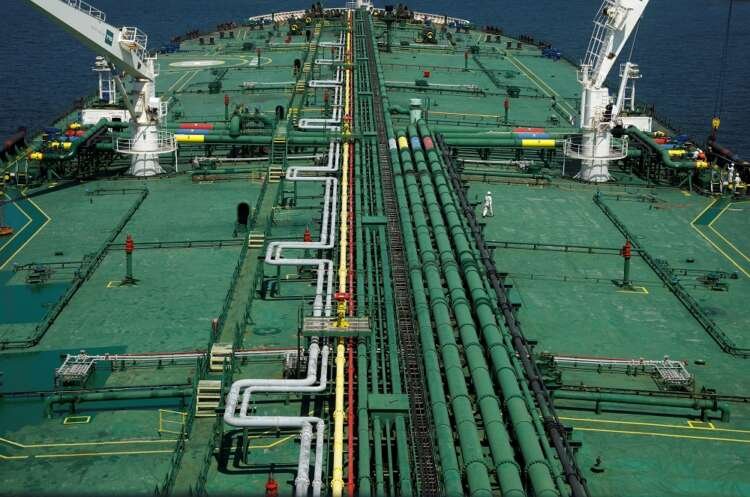

Crude oil is a naturally occurring, unrefined petroleum product composed of hydrocarbon deposits and other organic materials. It is used to produce fuels and other products through refining processes.

Interest rates are the amount charged by lenders to borrowers for the use of money, expressed as a percentage of the principal. They play a crucial role in economic activity and monetary policy.

The Federal Reserve, often referred to as the Fed, is the central banking system of the United States. It regulates the U.S. monetary and financial system, aiming to promote maximum employment and stable prices.

A crude oil benchmark is a standard reference price for crude oil, used to price other types of oil. Examples include West Texas Intermediate (WTI) and Brent Crude.

Explore more articles in the Top Stories category