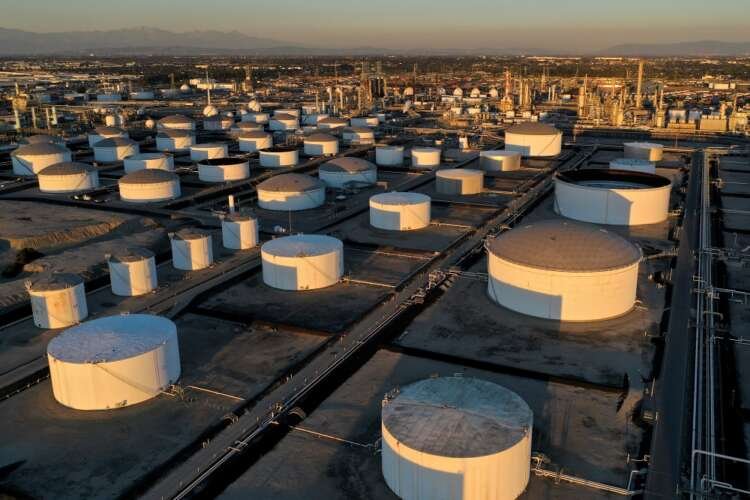

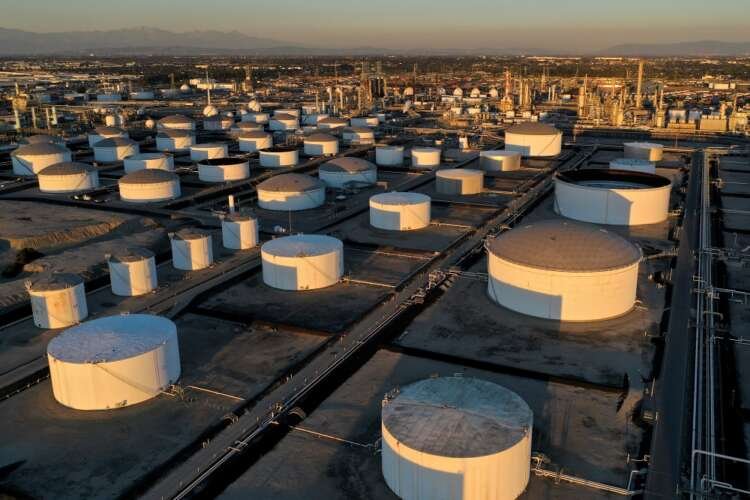

Oil hits 3-week high as China eases COVID curbs

By Alex Lawler

LONDON (Reuters) -Oil hit a three-week high on Tuesday as China’s latest easing of COVID-19 restrictions spurred hopes of a demand recovery, although prices pared gains after some U.S. energy facilities shut by winter storms began to restart.

China will stop requiring inbound travellers to go into quarantine, starting from Jan. 8, the National Health Commission said on Monday in a major step towards easing curbs on borders that have been largely shut since 2020.

Brent crude was up 19 cents, or 0.2%, at $84.11 a barrel by 1450 GMT and U.S. West Texas Intermediate crude gained 39 cents, or 0.5%, to $79.95. Both benchmarks hit their highest since Dec. 5 earlier in the session.

“This is certainly something that traders and investors have been hoping for,” Avatrade analyst Naeem Aslam said of China’s plan over the quarantine rule.

UK and U.S. markets had been closed on Monday for Christmas holidays.

Equities gained while the U.S. dollar softened on Tuesday in response to the Chinese move. A weaker dollar makes oil cheaper for holders of other currencies and tends to support risk assets.

Oil also drew support from worries over supply disruption because of winter storms in the United States, said Kazuhiko Saito, chief analyst at Fujitomi Securities.

“But the U.S. weather is forecast to improve this week, which means the rally may not last too long,” he said.

Some facilites were already being brought back online. TotalEnergies continued restarting its 238,000 barrel-per-day (bpd) Port Arthur, Texas refinery on Tuesday, said people familiar with plant operations.

As of Friday, some 1.5 million barrels of daily refining capacity along the U.S. Gulf Coast was shut, while oil and gas output from North Dakota to Texas suffered freeze-ins, cutting supply.

Concern over a possible production cut by Russia also provided price support.

Russia might cut oil output by 5% to 7% in early 2023 as it responds to price caps, the RIA news agency cited Deputy Prime Minister Alexander Novak as saying on Friday.

(Reporting by Alex LawlerAdditional reporting by Yuka Obayashi in Tokyo and Isabel Kua in SingaporeEditing by David Goodman and Louise Heavens)

Brent crude is a major trading classification of crude oil originating from the North Sea. It serves as a global benchmark for oil prices, influencing the pricing of oil worldwide.

West Texas Intermediate (WTI) is a grade of crude oil used as a benchmark in oil pricing. It is sourced from the United States and is known for its light and sweet characteristics.

Demand recovery refers to the process of returning to previous levels of demand for goods and services after a decline, often following economic disruptions or crises.

A production cut is a reduction in the amount of a product produced, often implemented by oil-producing countries to stabilize or increase prices in response to market conditions.

Explore more articles in the Top Stories category