Oil drops on Druzhba pipeline restart, demand fears

By Rowena Edwards

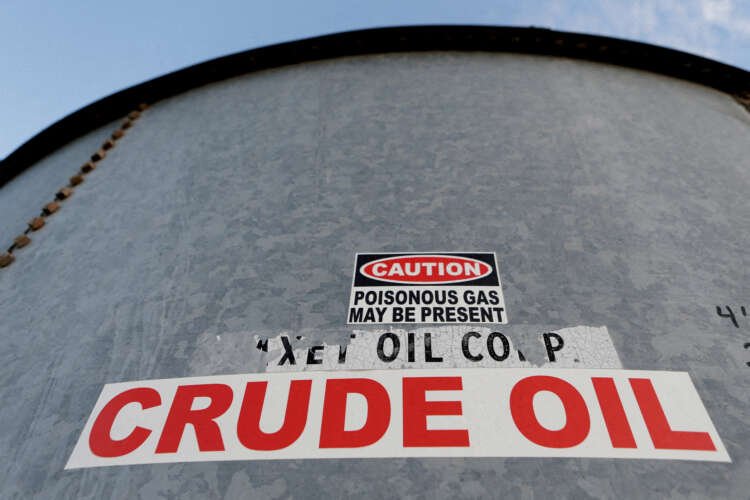

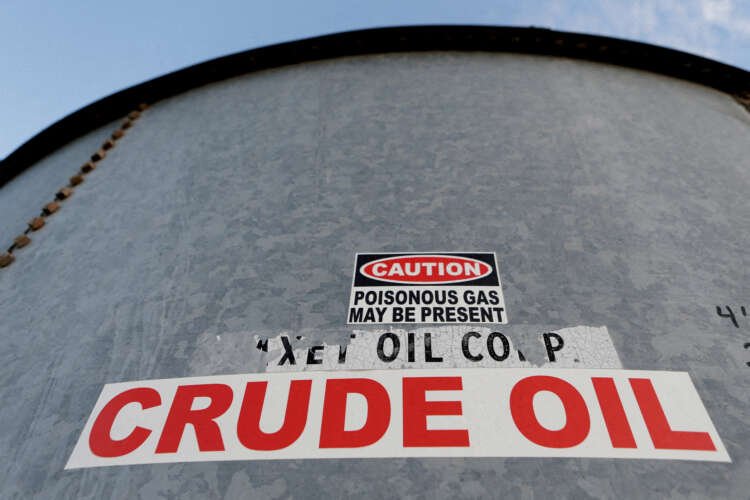

LONDON (Reuters) – Oil prices fell on Wednesday as Druzhba pipeline flows resumed and as an expected rise in U.S. crude stocks intensified demand concerns.

Brent crude futures were down $1.71, or 1.78%, to $94.60 a barrel at 1407 GMT.

U.S. West Texas Intermediate crude futures were down $1.69 cents, or 1.87%, at $88.81.

Russian state oil pipeline monopoly Transneft has restarted oil flows via the southern leg of the Druzhba oil pipeline, RIA news agency said, citing Igor Dyomin, an aide to Transneft’s president, on Wednesday.

Ukraine had suspended Russian oil pipeline flows to parts of central Europe since early this month because Western sanctions prevented it from receiving transit fees from Moscow, Transneft said on Tuesday.

Demand fears also weighed on prices, analysts said.

“Fears of recession-induced demand destruction are the single-biggest price driver currently and the principal reason why Brent is trading sub-$100 a barrel,” said PVM analyst Stephen Brennock.

Contrary to expectations, U.S. consumer prices did not rise in July due to a sharp drop in the cost of gasoline, delivering the first notable sign of relief for Americans who have watched inflation climb over the past two years.

Economists polled by Reuters had forecast a 0.2% rise in the monthly CPI in July.

But the Fed has indicated that several monthly declines in CPI growth will be needed before it lets up on the increasingly aggressive monetary policy tightening it has delivered to tame inflation currently running at four-decade highs.

“Inflation remains far from target … add to all that a positive contribution from net trade and a less negative drag from inventories then the case for a third consecutive 75 bp Federal Reserve rate hike in September remains strong,” said James Knightly, chief international economist at ING.

A hike could curb economic activity and, consequently, fuel demand.

U.S. crude oil stocks, meanwhile, rose by about 2.2 million barrels for the week ended Aug. 5, according to market sources citing American Petroleum Institute (API) figures. Analysts polled by Reuters had forecast crude inventories would rise by about 100,000 barrels. [API/S] [EIA/S]

Official government data is due later on Wednesday.

Though concerns over a potential global recession have weighed on oil futures recently, U.S. oil refiners and pipeline operators expect energy consumption to be strong for the second half of 2022, according to a Reuters review of company earnings calls.

(Reporting by Rowena Edwards; Additional reporting by Emily Chow in Kuala Lumpur; Editing by Mark Potter, Kirsten Donovan)

The Druzhba pipeline is a major oil pipeline that transports crude oil from Russia to various countries in Europe, playing a crucial role in the European energy supply.

Crude oil futures are contracts to buy or sell oil at a predetermined price at a specified time in the future, allowing traders to hedge against price fluctuations.

Inflation is the rate at which the general level of prices for goods and services rises, eroding purchasing power and often measured by the Consumer Price Index (CPI).

U.S. crude stocks refer to the inventory of crude oil held in storage facilities across the United States, which can influence oil prices based on supply and demand.

Demand destruction occurs when consumers reduce their demand for a product, often due to high prices or economic downturns, leading to lower sales and prices.

Explore more articles in the Top Stories category