Nissan unveils $18 billion electrification push in bid to draw level with rivals

Published by Jessica Weisman-Pitts

Posted on November 29, 2021

4 min readLast updated: January 28, 2026

Published by Jessica Weisman-Pitts

Posted on November 29, 2021

4 min readLast updated: January 28, 2026

Nissan plans a $18 billion investment in electrification, launching 23 electrified vehicles by 2030 and reducing battery costs by 65%.

By Tim Kelly

YOKOHAMA (Reuters) – Nissan Motor Co announced it will spend 2 trillion yen ($17.59 billion) over five years to accelerate vehicle electrification to catch up with competitors in one of the fastest growth areas for car makers.

This is the first time Japan’s No.3 automaker, one of the world’s first mass-market electric vehicle (EV) makers with its Leaf model more than a decade ago, is unveiling a comprehensive electrification plan.

Nissan will be spending twice as much as it did in the previous decade for a share of the EV market as rivals, including Toyota Motor Corp and newer entrants such as Tesla Inc, move ahead with their electric-car plans.

Nissan said on Monday it will launch 23 electrified vehicles by 2030, including 15 electric vehicles (EVs), and wants to reduce lithium-ion battery costs by 65% within eight years. It also plans to introduce potentially game-changing all solid-state batteries by March 2029.

Those commitments, Chief Executive Makoto Uchida said, would make EVs affordable to more drivers.

“We will advance our effort to democratise electrification,” he said in an online presentation.

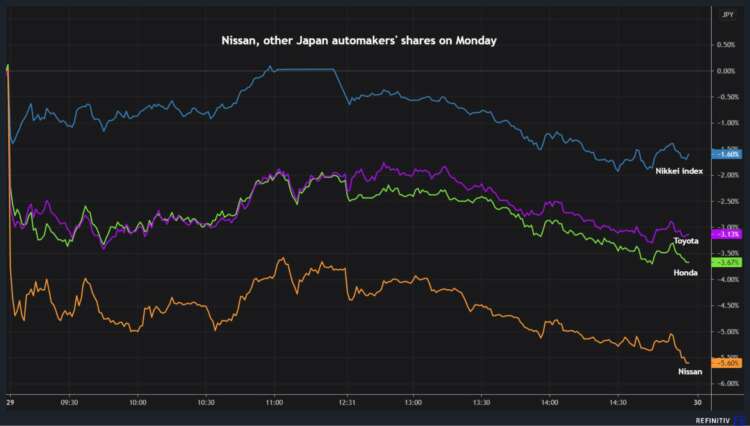

Shares of Nissan slid 5.6% on Monday, underperforming its major rivals and compared to the benchmark Japan index’s 1.6% drop.

Some analysts were unimpressed with Nissan’s plan, noting it was already behind its rivals in electrification.

Masayuki Otani, senior analyst at Securities Japan Ltd, also said auto shares were falling on Monday because of concerns the new coronavirus variant would squeeze production.

“Nissan’s long term vision comes at a time when the market is perhaps not receptive to it. It can be said that it represents a huge increase in investment, it feels cautious,” he said.

Nissan’s electrification plan comes as it pulls back from a pursuit of sales volume pushed by former chairman Carlos Ghosn, slashing production capacity and model types by a fifth to improve profitability.

“It’s very important for Nissan to show where we are going next, and today’s plan is a vision and direction which is talking about the future,” Chief Operating Officer (COO) Ashwani Gupta said when asked about the share price at the gallery at its headquarters in Yokohama where it is displaying only electrified vehicles.

Graphic: Nissan shares https://fingfx.thomsonreuters.com/gfx/mkt/klpykdxeepg/image-1638174919146.png

Although still only a small portion of vehicles on the road, global electric car registrations in 2020 grew 41% even as the overall car market contracted by almost a sixth, according to the International Energy Agency (IEA).

At the U.N. climate summit in Glasgow this month, major car makers, including General Motors and Ford Motor Co, signed a declaration that committed them to phase out fossil fuel vehicles by 2040.

Nissan, however, has not committed to abandoning gasoline vehicles. It said on Monday half of its vehicles mix will be electrified by 2030, including EVs and its e-Power hybrids. COO Gupta said the goal was a reference point that may change.

As it readies to compete for the growing demand for EVs, Nissan in July pledged $1.4 billion with its Chinese partner Envision AESC to build a giant battery plant in Britain that will power 100,000 vehicles a year including a new crossover model.

Rivals, including Toyota, which also declined to sign the Glasgow pledge, are also ramping up their battery production.

The world’s biggest automaker by production volume plans to have 15 battery electric vehicle (BEV) models globally by 2025 and will spend $13.5 billion by 2030 to develop cheaper, more powerful EV batteries and their supply system.

Toyota has said it is aiming to introduce solid-state batteries by the mid-2020s.

($1 = 113.7000 yen)

(Reporting by Tim Kelly; Additional reporting by Maki Shiraki; Editing by Muralikumar Anantharaman)

The article discusses Nissan's $18 billion investment plan to accelerate vehicle electrification and catch up with competitors.

Nissan aims to launch 23 electrified vehicles by 2030 and reduce lithium-ion battery costs by 65%.

Nissan's investment is a response to competitors like Toyota and Tesla, who are advancing in the EV market.

Explore more articles in the Technology category