New Accountancy Services Exchange Set To Revolutionise Accountancy Industry

Published by Gbaf News

Posted on June 13, 2012

6 min readLast updated: January 22, 2026

Published by Gbaf News

Posted on June 13, 2012

6 min readLast updated: January 22, 2026

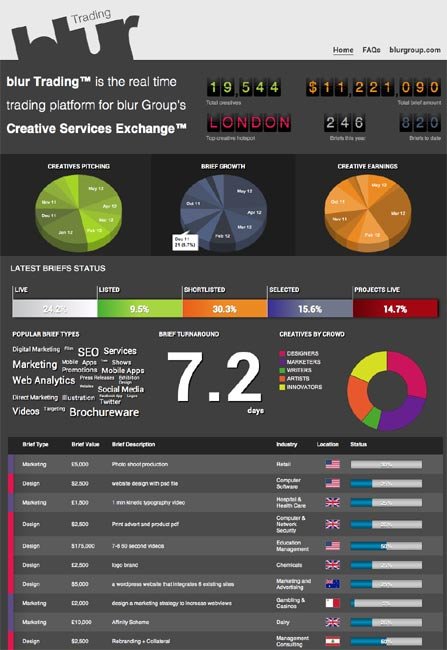

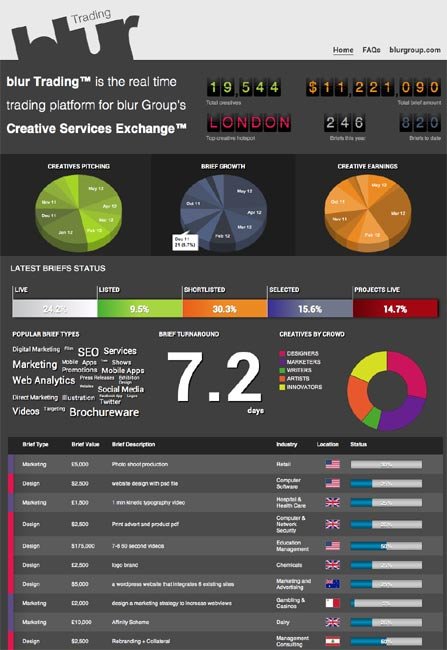

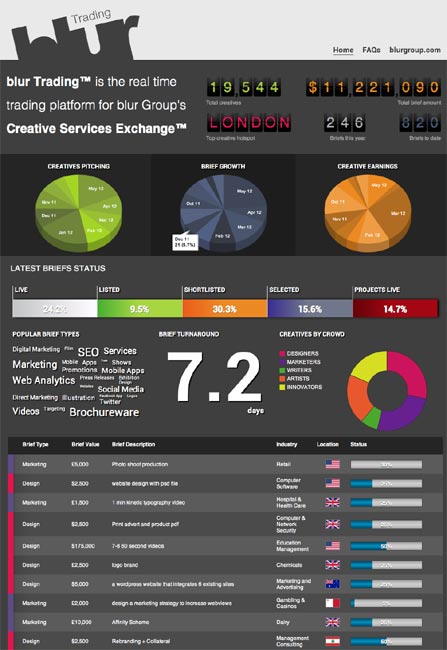

Later this year will see the launch of three new online exchanges, which aim to revolutionise the purchasing of many professional services, including accountancy. The exchanges will enable purchasers of accountancy, legal and IT services to connect in to a global community of service providers, finding the one that best fits their requirements – anywhere in the world.All three exchangesare open now for professionals to sign up to, with the Technology Exchange opening for trading later this month and Accounting and Legal by the end of 2012.

At the dawn of the internet many thought that it had the potential to revolutionise the means in which business was conducted, opening up international trade, bringing together people and the exchange of ideas. While this has most certainly taken place on a global basis in the consumer world, with Facebook, Twitter and eBay being clear examples, the corporate world, with the exception of retail, is still lagging behind in terms of embracing the internet as a means to do business. Many companies do of course have their own website, on which they carry their credentials, but very few actually secure leads and deliver services over the web.

blur Group, the company which owns and manages these exchanges, was founded to do just that. Philip Letts, founder of the business, tells us, “my background was in a combination of the creative and business industries. I’m a photographer but also an entrepreneur and back in 2007 I spotted the opportunity to utilise the power of the social network to enable creatives to do business on a global basis. On a September weekend I designed a Social website in my garage as an ‘experiment’: what would happen if all the b2b experts in the world had equal access to a single market where they could pitch for business – one global exchange?”

Philip tested his new website by posting his personal profile as an artist and uploading his artwork, which was abstract photography. To his surprise, other artists and graphic designers started coming and collaborating. The Global b2b Exchange had been born. Social sharing of personal profiles and artwork was the beginning of a radical transformation in b2b ecommerce. By the end of 2009 blur Group had connected nearly 2,500 creative professionals and studios via four dedicated b2b exchanges; for design, marketing, media and artwork. In January 2010 these exchanges opened their doors fully and allowed business buyers to submit briefs for projects. The sellers responded with pitches and the most suitable were bought.

Philip adds, “the great thing about the Exchanges is that not only does it bring purchasers and suppliers together on a global basis, but it also takes all the administrative burden off the suppliers, which was particularly important in the creative industry. The Exchange manages all the interaction, including the administration of payment, leaving the purchaser and supplier to focus on what is really important – the creative output.”

Between January 2010 and May 2012, businesses submitted over 800 creative, marketing and media projects worth just over $11 million. Buyers were impressed with the speed and quality of pitches and projects delivered by experts and businesses on the exchanges – and by the customer-centric focus of the team.

blur Group’s systems, expertise in expert sourcing and exchange support resources make it ideally suited to move from creative services to other professional services and blur Group is now aiming to replicate this success through the launch of three new exchanges: Technology Services Exchange, Legal Services Exchange and Accounting Services Exchange.

Philip believes these industries are ones that could most benefit from this new means of doing business and tells us why in particular he believes accountancy can benefit: “We have chosen the accounting industry as it is a large, global industry that suffers from the same challenges as we saw in the creative and marketing services spaces. Buyers of accounting services need to be able to more easily discover accountants and tax specialists. They want to outsource the discovery, selection, billing and collaboration of accounting services yet maintain choice and quality. Procurement today for SMB’s in particular is based more on who you might know rather than who is best. Yet, tax and accounting needs are becoming more sophisticated and demanding – a new, more rigorous and open process is required.”

The accountancy industry has faced challenges over the last few years which Philip believes also makes it a fertile ground: “The accountancy industry has suffered from continued consolidation at the top of the market and at the same time fragmentation at the bottom and middle of the market. Given the importance of accounting and increasing globalisation of SMB’s, a platform such as blur Group’s is needed to open the market up and enable accountants to discover and bid for projects more efficiently, while helping businesses to purchase better.”

blur anticipates that the types of briefs that will initially be placed on the exchange will be around accounting and tax projects from SMBs which could include better reporting, selection of finance systems, specific tax advice, outsourced payroll management, data entry, collections, etc. At the start of any new exchange briefs typically range from $5,000 to $15,000 in value. Users of the service are expected to be small businesses and stretched finance professionals in medium sized businesses looking for extra resource.

Accountancy and tax firms who wish to use the Exchange to drive new business can now sign up as members of the exchange at blurgroup.com and become part of the community. The doors of the Exchange are scheduled to open for trading later in the year once sufficient service providers have been secured to ensure briefs will receive a good selection of responses.

It is evident that blur Group’s exchanges provide a remarkably efficient market by connecting professionals and businesses who wouldn’t otherwise be connected. One of the first pure play businesses to adopt Cloud computing architectures in all that it did and an early pioneer in Crowdsourcing – they are the world’s first example of a Social b2b exchange. May the revolution begin!

Building on Philip’s entrepreneurial legacy, blur Group continues to passionately believe in the potential of exchange technologies to better connect businesses around the world and improve the way in which they transact with each other.

Explore more articles in the Finance category