Financial Records Retention: what do you need to know?

Published by Gbaf News

Posted on September 23, 2019

5 min readLast updated: January 21, 2026

Published by Gbaf News

Posted on September 23, 2019

5 min readLast updated: January 21, 2026

By Paul Ravey, Manager at Access Records Management

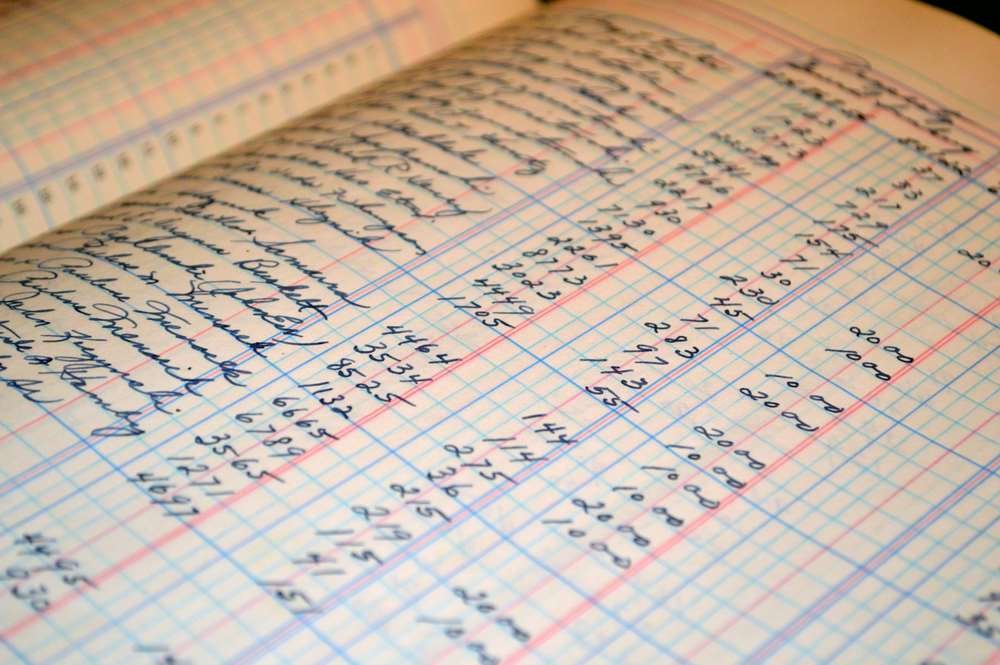

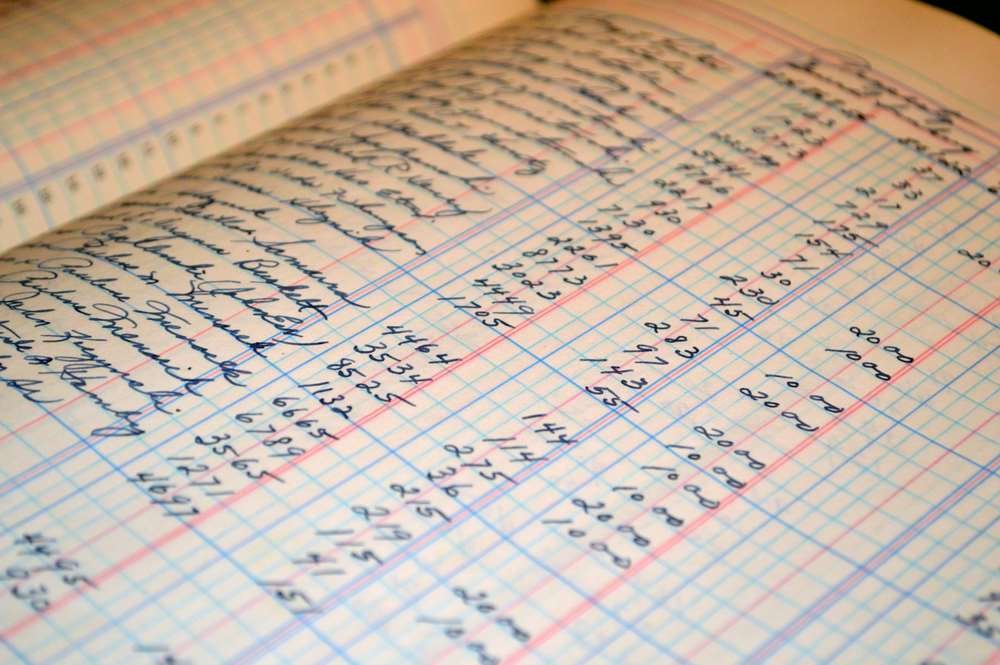

Financial records often make up the majority of an organisations’ files and documents. These records need to be carefully managed and stored, as senior management often need to refer back to them to make decisions.

Correct financial record retention strategies should be made in line with the relevant regulations, as there are some serious financial penalties for non-compliance. The retention strategy needs to balance compliance, security and accessibility, so that all relevant laws are abided by and so that people can access the information that they need as and when.

Financial records come in various categories, each with their own rules on how long you can store them for and reasons for keeping them. Here are the most important rules to remember.

Accounting documents

Accounting records include receipts, purchases, expenses, payroll, invoices, VAT records and tax returns, as well as any supporting documents. It doesn’t matter whether these records are digital or physical – either way, they’ll be subject to the Companies Act 2006 and the VAT Act 1994.

According to these regulations, private companies must keep these accounting records for a minimum of three years, and public companies have to keep them for at least six years. To play it safe, it’s best for all organisations to keep them six years.

These records need to be kept at a registered office (or another location as dictated by the business directors, like an accountancy firm, a satellite office, or a records management facility). Certain individuals (normally senior management) will also need to be given access to inspect these records. If you need to convert physical records to a digital format, all information will need to be accurately transferred.

Health and Safety documents

Although not a financial record in the true sense of the word, an individual health record, or copy, must be kept for all employees under health surveillance. Such records are important because they can indicate connections between exposure and any health effects. They should be preserved for at least 40 years from the date of last entry because the onset of ill health due to exposure can often take several years to manifest.

The recorded details of individual health surveillance checks should include:

Tax documents

The Taxes Management Act dictates that all document in relation to tax, including money received or spent by the business, must be kept for five years from the date that the tax return was filed.

Tax documents include receipts, bank statement, paid invoices, cheque book stubs and more. Similar to accounting records, these should be kept in a registered office or other authorised location.

Insurance documents

By comparison to accounting and tax documents, insurance documents often have a shorter retention period. According to the Data Protection Act 1998, polices and claim correspondence must be retained for three years after lapse.

However, this doesn’t apply to insurance companies. Their business agreements and contracts must be stored for six years, according to the Limitation Act 1980.

Wage and employee documents

Employee records are likely to vary from one company to another. They often include income tax, pay slips, pay details, payroll, national insurance contributions, application forms, annual earning summaries, medical records, overtime details, expense accounts and more. Companies should follow the Employment Rights Act 1996 in addition to the acts mentioned above to make sure they’re in line with retention regulations.

In addition, the Data Protection Act 1998 dictates that wage records should be kept for six years. The act also states that other confidential personnel files should be kept for seven years following the end of the individual’s employment.

The implications of poor records management

As previously mentioned, there are large penalties for companies that don’t abide by record retention regulations – in some cases, they can reach up to half a million pounds. Even if you don’t run a large enterprise, it’s important to abide by and be familiar with the relevant acts to avoid crippling fines and in the event that the company grows to a larger size.

Records retention policies must also include archival and disposal strategies. Once statutory periods have passed and companies aren’t obligated to hold on to records, they may choose to retain them or archive them. Either way, records management services can help with proper disposal processes that don’t expose private information. They can also help save you time and reduce the burden on your team.

Maintaining records properly can seem like an arduous task, but once proper processes are put in place, it doesn’t have to be too time intensive. The responsibility shouldn’t fall on one person’s shoulders, either – proper records retention is incumbent on everyone in the company. Records retention policies work best when everyone involved has an understanding of what they need to do and why they need to do it. The potential fines might be enough but explaining the importance of record keeping for business services can go a long way to getting everyone on-side.

Explore more articles in the Finance category