MOBILEIRON SURVEY SHOWS ENTERPRISE MOBILITY IS SHIFTING FINANCIAL SERVICES CIOS TO A NEW MODEL OF IT

Published by Gbaf News

Posted on March 31, 2014

5 min readLast updated: January 22, 2026

Published by Gbaf News

Posted on March 31, 2014

5 min readLast updated: January 22, 2026

BlackBerry Expected to Lose Nearly One-third of Financial Services Market Share in Twelve Months

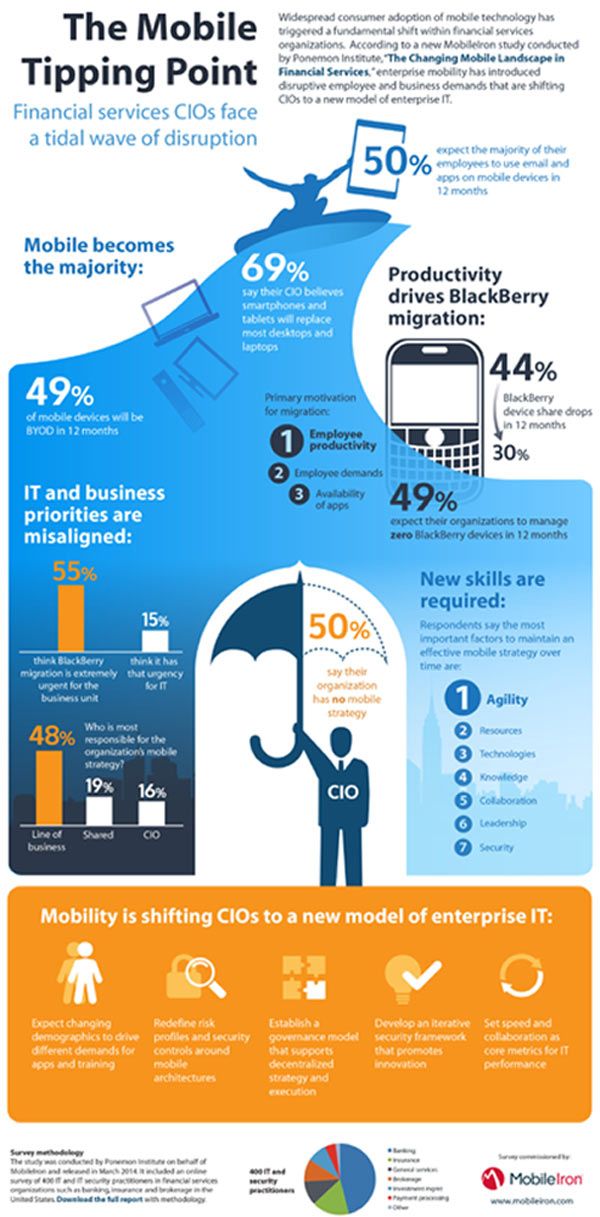

Widespread consumer adoption of mobile technology has triggered fundamental changes within financial services organisations.

A new MobileIron study conducted by Ponemon Institute shows that mobility has introduced disruptive business and employee demands that are causing CIOs to shift to a new model of enterprise IT. The study, called “The Changing Mobile Landscape in Financial Services,” was released today and surveyed over 400 IT professionals in the financial services industry about the future of BlackBerry, mobile apps, BYOD, mobile strategy, and the new IT capabilities required to succeed with enterprise mobility.

For more details, download the full report and register for the webinar.

2014 is the Year of the Mobile Majority

Mobile is booming in financial services:

Mobile is Replacing the Desktop

CIOs expect, though are not fully prepared for, a migration from traditional desktop and laptop devices to the new generation of mobile smartphones and tablets:

Employee Productivity is Driving BlackBerry Migration

Employees are pushing their IT departments to rapidly move from BlackBerry to a multi-OS environment:

IT and Business Priorities are Misaligned

Although financial services organisations are rapidly expanding their mobile investments, there is a substantial disconnect between IT and the lines-of-business on mobile strategy:

Agility is the New Security

Respondents believe that IT will need to add new skills, change existing processes, revise traditional mindsets, and shift to an agile model in order to succeed with enterprise mobility:

“Mobility is now a strategic initiative for many financial services CIOs,” said Ojas Rege, Vice President of Strategy at MobileIron. “However, mobility also catalyses a fundamental re-think of existing IT skills and approaches, and it creates an opportunity for the CIO to lead the development of a new model of partnership between the business, IT, and end users.”

Survey Methodology

The study was conducted by Ponemon Institute on behalf of MobileIron and included an online survey of over 400 IT and IT security practitioners in financial services organisations such as banking, insurance and brokerage in the United States. Download the report with complete methodology.

About Ponemon Institute

The Ponemon Institute© is dedicated to advancing responsible information and privacy management practices in business and government. To achieve this objective, the Institute conducts independent research, educates leaders from the private and public sectors and verifies the privacy and data protection practices of organizations in a variety of industries.

About MobileIron

A leader in security and management for mobile apps, content, and devices, MobileIron’s mission is to enable organizations around the world to embrace mobility as their primary IT platform in order to transform their businesses and increase their competitiveness. Leading global companies rely on MobileIron’s scalable architecture, rapid innovation, and best practices as the foundation for their Mobile First initiatives. For more information, please visit www.mobileiron.com.

Explore more articles in the Technology category