Manchester City Bank on success with new vietnamese partnership

Published by Gbaf News

Posted on July 3, 2014

3 min readLast updated: January 22, 2026

Published by Gbaf News

Posted on July 3, 2014

3 min readLast updated: January 22, 2026

City seals deal with Saigon Hanoi Commercial Joint Stock Bank

Barclays Premier League Champions, Manchester City, are delighted to announce a new Club partnership with Saigon Hanoi Commercial Joint Stock Bank (SHB).

Named the fastest growing Vietnamese Retail Bank by the Global Banking Finance Review, with over two million customers, SHB will become City’s Official Affinity Card Partner in Vietnam, Laos and Cambodia.

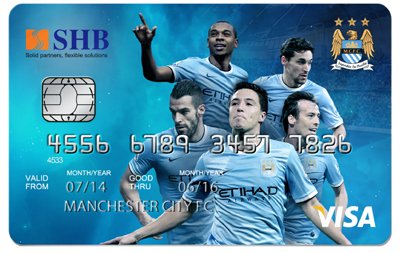

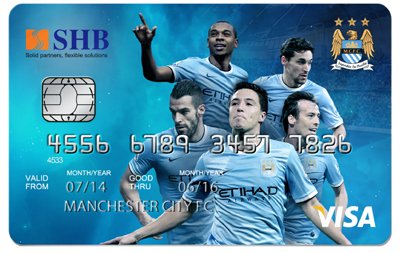

The ground-breaking deal will see the launch of the first-ever Manchester City Debit Card in the region, created to cater for City’s rapidly growing fan base in Asia.

Under the terms of the two year partnership, Manchester City branding, promoting the affinity card, will be present in over 400 of SHB’s branches across Vietnam, Laos and Cambodia, supported by an outdoor advertising, print and radio marketing campaign.

Incorporating state-of-the-art EMV chip technology, the SHB Manchester City Debit Card is designed with fans firmly in mind. Cardholders will be provided with a multitude of money can’t buy experiences, including opportunities to meet City stars such as Joe Hart, Vincent Kompany, David Silva and Fernandinho.

Benefits for cardholders also include the chance to win tickets to watch Manuel Pellegrini’s men in action in Manchester, exclusive behind the scenes Etihad Stadium tours, signed memorabilia and discounted club merchandise.

Commenting on the partnership, Tom Glick, Chief Business Officer for Manchester City, said:

Mancheser City Debit Card

“Following a string of recent accolades, including the Most Innovative Trade Bank in Vietnam, SHB’s reputation as a dynamic, forward thinking financial institution is richly deserved. With an average growth rate forecasted at over 30% per year, over the next five years, it’s an exciting time to team-up with a partner of SBH’s calibre, throughout the region.

“We have a fantastic fan base in South East Asia, which boasts some of the most enthusiastic City supporters in the world. The SHB Manchester City Debit Card will be the first of many innovative collaborations, geared towards embracing South East Asia’s passion for football, whilst providing SHB’s loyal customers with real value and once-in-a-life-time experiences.”

Mr. Do Quang Hien, Chairman of Saigon Hanoi Commercial Joint Stock Bank, added:

“Manchester City’s popularity and brand value in South East Asia has grown exponentially in recent years. Their success and playing style on the pitch has been embraced by millions of youngup-and-coming football fans across the region, who aspire to play and watch beautiful attacking football.

“SHB is a young, modern brand which shares the same aspirations and driving ambition for success as Manchester City. We are dedicated to developing great products that provide real and invaluable benefits for our customers. The SHB Manchester City Debit Card will not only bring fans closer to the Club they support, but also the game they love.”

The partnership builds on SHB’s expanding football portfolio, where they also sponsor Vietnam’s topflight V League 1 team, SHB Danang FC.

Explore more articles in the Banking category