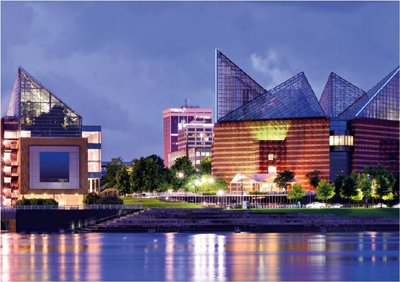

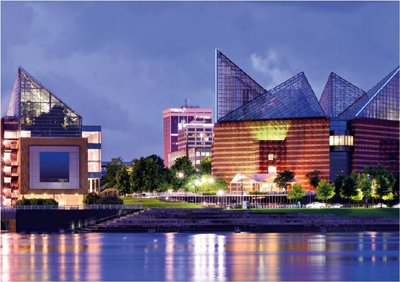

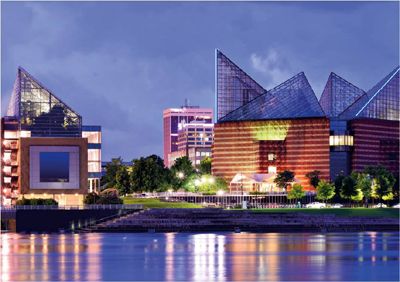

INVESTOR READY CITIES – HOW GOVERNMENTS CAN ENGAGE WITH INVESTORS AND INFRASTRUCTURE PROVIDERS TO BUILD 21ST CENTURY CITIES

Published by Gbaf News

Posted on June 10, 2014

4 min readLast updated: January 22, 2026

Published by Gbaf News

Posted on June 10, 2014

4 min readLast updated: January 22, 2026

To meet the four great challenges facing 21st Century cities (population growth, urbanisation, connectivity and digitisation), an unprecedented amount of development, infrastructure and connective technology is required. This can only be met with new and innovative funding and financing mechanisms, particularly international institutional finance, according to the Investor Ready Cities report released today by Siemens, PwC and Berwin Leighton Paisner (BLP).

The report finds that the ability to attract international investors (i.e. private equity houses, banks and pension funds) is vitally important, and in order to do this, cities must ensure institutional standards of probity, governance and investment quality. They must also ensure transparent processes and public buy-in and support.

Investor Ready Cities is designed to empower and enable cities to find innovative finance solutions. The report outlines new types of finance available to developed and developing countries, and illustrates these in a range of case studies including the Delhi Metro, Singapore’s water system and London’s Crossrail and Thameslink rail schemes.

In summary, the report finds:

The Investor Ready Cities report was launched in London last week after being showcased at the United Nations’ World Urban Forum in Medellin last month, at an event co-sponsored by UN Habitat. Commenting on the report, Robert Lewis-Lettington (Leader, Urban Legislation Unit) UN-HABITAT said:

“National and city governments are in urgent need of effective, proven guidance on urban development. The increase in the world’s urban population is creating new demand for services and infrastructure and will occur primarily in countries with the least resources and capacity to address this challenge. As we have seen over the past sixty years, public resources are not able to meet the entire needs of cities and private sector investment is a vital part of a successful strategy.

Investor Ready Cities – How Governments Can Engage With Investors And Infrastructure Providers To Build 21st Century Cities

“Infrastructure investments also need to be seen, not as one off projects, but as part of the process of shaping cities for future needs and challenges. Good quality planning within a predictable legal framework, and supported by a rational financial plan, can address many present challenges, and provide a basis for future proofing.

“This report provides a concise and accessible introduction to how cities and national governments can engage with investors and infrastructure providers. Its case studies provide useful lessons, not least because they span a wide range of public and private combinations. I also welcome the emphasis placed upon foundational elements, particularly governance, vision and leadership.”

Investor Ready Cities has been developed in partnership by three global businesses: Siemens, an engineering company and infrastructure provider; BLP, an international law firm advising investors and those seeking investment in urban development; and PwC, a network of firms helping organisations and individuals create the value in their investments.

Commenting at launch of the report in London, Mukhtiar Tanda, BLP Partner, Urban Development said: “In an increasingly connected world, it is vitally important to think creatively when catering for the smart and connected infrastructure required for 21st century cities. If these concepts are planned holistically from the outset, problems in attracting finance can be forestalled, and projects will be easier to deliver.”

Richard Abadie, PwC Partner, Capital Projects & Infrastructure said: “Strategic and financial investors are making asset allocation decisions globally and have many opportunities to deploy capital. So it is important that cities wanting investment for projects stand out from the crowd, and are clear as to how the value will be shared between investors and users.”

Julie Alexander, Siemens Director, Urban Development said: “Delivering urban infrastructure is one of the most complex tasks of a city government. Technical solutions need to be adapted to the local context and joined together through a long term vision based on social and economic equity. Providing that vision with sound legal foundations will attract the investment that is critical to its success.”

Explore more articles in the Top Stories category