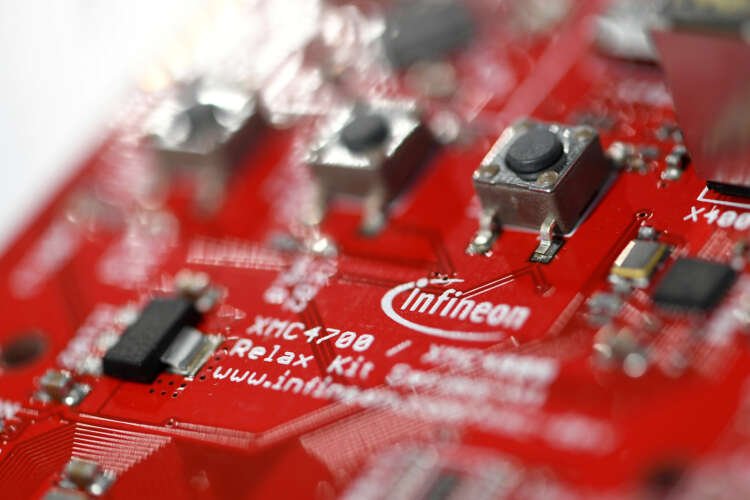

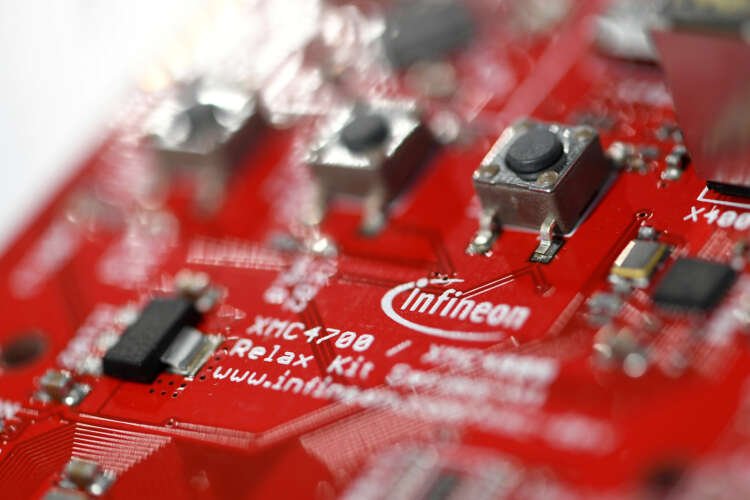

Infineon lifts full-year margin forecast, shares rise 7%

By Supantha Mukherjee and Miranda Murray

STOCKHOLM/BERLIN (Reuters) -Infineon, a maker of chips used in cars and data centres, on Thursday lifted its full-year profit margin forecast after reporting better-than-expected margins in the first quarter, as strong demand from carmakers led to higher prices.

Shares of the German company, which gets 45% of its business from automakers, were up 7%.

Carmakers have been buying chips to shore up inventories after a global chip shortage in the last two years hampered production, benefiting companies such as Infineon.

Demand for mobiles and personal computers is expected to fall again this year after gaining significantly in the initial pandemic years. Chipmakers like Intel that depend on consumer electronics have forecast a weak year ahead.

But automakers have stepped up buying to fill in the gap left by slowing demand from PC and mobile makers.

Sales of new cars in Europe are expected to increase 5% to 9.8 million vehicles this year, despite broader economic uncertainty.

Infineon’s rival STMicroelectronics has also forecast an upbeat year, citing strong demand from automotive and industrial customers.

Infineon’s quarterly adjusted, or “segment”, margin rose to 28% from 25.5% the previous quarter, beating expectations of 24.7%. The company raised its full-year segment margin forecast to 25% from 24%.

It maintained its full-year revenue outlook of around 15.5 billion euros, plus or minus 500 million euros, despite a less favourable exchange rate.

The company, which is searching for acquisitions to boost growth, said investments for the full year were still expected to be about 3 billion euros.

Some analysts have warned demand from the auto industry may weaken as economic headwinds increase.

“We remain of the view that the strength in automotive chips is unsustainable in an environment of weakening car demand and rising inventories, with order and revenue trends likely to weaken once the chips move out of shortage,” Jefferies analyst Janardan Menon said.

($1 = 0.9084 euros)

(Reporting by Miranda Murray in Berlin and Supantha Mukherjee in Stockhom, editing by Rachel More and Mark Potter)

Profit margin is a financial metric that indicates the percentage of revenue that exceeds the costs of goods sold. It reflects a company's profitability and efficiency in managing its operations.

A chip shortage refers to a situation where the demand for semiconductor chips exceeds supply, leading to delays in production across various industries, particularly automotive and electronics.

The automotive industry encompasses all companies and activities involved in the design, development, manufacturing, marketing, and selling of motor vehicles. It plays a crucial role in the global economy.

Explore more articles in the Top Stories category