How to Incorporate AI in Investment Risk Management Techniques

Written by

Sarfarazurrehman Shaikh

Many institutional investors struggle to make an efficient, purposeful shift in innovation toward artificial intelligence (AI) despite the reality that conventional techniques are no longer relevant in the modern landscape. But AI can transform investment risk management in meaningful ways, with machine learning (ML) models impacting various aspects of investing. No longer can professionals employ a one-size-fits-all style of AI adoption. The time has come to analyze the advantages and downsides of each model and determine the best fit for the preferred investment strategy.

How AI transforms investment risk assessment

Several areas are affected, and in some cases revolutionized, by the widespread adoption of ML models.

AI adoption in investment risk management

A 2024 Mercer study indicated that 91 percent of financial managers are in one stage of AI utilization within their specific institutions. Only 54 percent responded that they currently use the technology proactively, while another 37 percent merely cited plans to incorporate AI into their strategies at some point.

Additionally, 83 percent of investors surveyed in a Coinbase and EY-Parthenon study announced plans to increase their allocations to digital assets, or crypto holdings, in the coming year, with 59 percent responding that they will devote five percent or more of their total assets under management to this sector. This signals the transformation of digital assets beyond a niche investment class into an integral aspect of mainstream investment portfolios throughout the industry.

Within AI adoption, however, there is a category of concern with these shifts due to regulatory uncertainty, market volatility, and secure custody being the most cited potential roadblocks or obstacles. More than two-thirds (68 percent) of respondents agree that regulatory transparency is the key to continued market expansion.

Specific ML uses and models for the identification and mitigation of investment risk

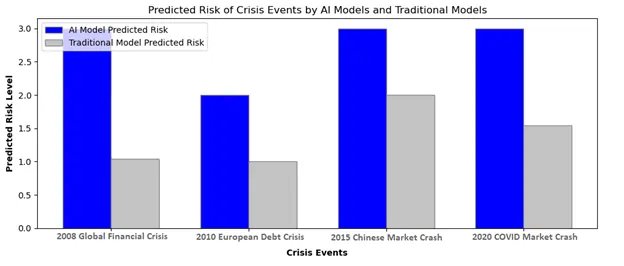

AI dramatically enhances the ability to identify systemic risks across a variety of asset classes and provides several means of mitigating those same risks. Advanced data analysis provides the ability to aggregate and evaluate extensive data from many sources, including market trends, economic signals, and global developments. This approach facilitates the detection of possible systemic threats that may affect multiple asset categories. ML models, such as neural networks and clustering methods, can recognize intricate patterns and complicated relationships within the data. These models help detect emerging threats that may go unnoticed using conventional analytical approaches. AI systems can identify anomalies and statistical outliers in market behavior, such as unusual trading volumes or price movements, which may indicate systemic investment risks (Figure 1).

Figure 1: Predicted risk of crisis events by AI models and traditional models. Graphic courtesy Sarfarazurrehman Shaikh.

Once potential risks are appropriately identified, the algorithms and models have numerous tools to mitigate or prevent potential financial damage.

Over the past several years, investors have focused on learning and proving the versatility and potential of AI and ML models in the financial world, shifting the onus to the maximization of the technology’s potential through the identification of specific systems that best accomplish these goals throughout the industry. Deep learning models, including convolutional neural networks (CNNs) and recurrent neural networks (RNNs), can identify complex patterns in extremely large datasets, making them particularly helpful in the analysis of emerging market data and large-scale systemic investment risk factors.

There are two beneficial unsupervised clustering algorithm techniques. K-means clustering groups similar data points into groups or ‘clusters,’ with ‘k’ representing the necessary quantity of separate clusters. For example, if the user sets ‘k’ to three, the data will be separated into high-risk, low-risk, and neutral classes. Hierarchal clustering attempts to create a pecking order by initially treating individual data points as their own clusters, only to merge those points based on their similarities within a tree-line structure known as a dendrogram. In a dendrogram, each data point is shown at the bottom on its own, with similar points combined into groups as the user moves up the ‘tree.’

Isolation forests, an anomaly detection model, are renowned for their efficiency and simplicity. The removal of anomalies from complex, robust datasets makes it easy to identify potential systemic risks. Autoencoders are neural network-based models that compress and reconstruct data to identify unusual patterns.

The answer to which AI model is best suited for equity investment risk analysis depends on the specific goals of the investment firm.A firm trying to predict stock price movements would benefit from utilizing a long short-term memory network (LSTM) because it can capture dependencies and make accurate predictions via historical patterns. A gradient boosting machine (GBM) can provide classification and assess regression tasks such as credit risk prediction. The key to enhancing equity investment risk analysis, improving predictive accuracy, and ensuring compliance with regulatory standards is not merely using AI and ML but choosing the proper model based on these criteria.

An AI-based model for dynamic investment risk management

Research supports the viability of AI-based dynamic investment risk management as a paradigm-shifting force in financial risk analysis. Restrained by static assumptions and historical biases, conventional models fail to forecast and prevent extreme market fluctuations, while AI models provide refined methods of applications of deep and machine learning for evaluating risks dynamically. For example, an AI-driven investment risk management system successfully combined these approaches to deliver real-time, dynamic risk management and accurate predictions of future economic activities and fluctuations. The predictive models utilized include supervised methods, such as random forests and LSTM networks, and reinforcement techniques, including Deep Q-Networks (DQN) and Proximal Policy Optimization (PPO).

This research demonstrates how AI-driven investment risk management solutions enhance portfolio robustness via real-time data analysis, predictive analytics, and adaptive hedging. Nevertheless, concerns about data dependability, model interpretability, and regulation exist. It is imperative for financial institutions and banks to ensure the implementation of good governance frameworks, transparency, and ethical AI practices to support the proper use of AI in managing risks.

Leading corporations continue to expand their investments even as AI permanently changes how professionals conduct business. The investment risk management field is certainly no exception. But while many financial professionals have accepted and adjusted to AI’s presence, the responsibility is shifting to meaningful adoption and relevant applications. Using AI no longer means a generalized awareness of ChatGPT and other technologies. The next era in AI evolution belongs to organizations that balance numerous ML models and their applications across platforms to ensure their continued relevance in an expanding and increasingly technologically aware industry.

About the Author:

Sarfarazurrehman Shaikh is a technology leader with over 20 years of experience in the fintech and proptech industries, mainly in investment risk analysis and management. Shaikh has experience working with multinational companies, global banks, and building disruptive start-ups across India, the UAE, and the United States. He holds a bachelor’s degree in computer engineering from Pune University and a specialization in entrepreneurship from Harvard Business School Online. Connect with Shaikh on LinkedIn.

Artificial intelligence (AI) refers to the simulation of human intelligence in machines programmed to think and learn like humans, enabling them to perform tasks such as problem-solving and decision-making.

Machine learning is a subset of AI that involves the use of algorithms and statistical models to enable computers to improve their performance on a specific task through experience.

Investment risk management is the process of identifying, assessing, and prioritizing risks associated with investment decisions to minimize potential losses and maximize returns.

Portfolio management is the art and science of making decisions about investment mix and policy to match investments to objectives, balancing risk against performance.

Explore more articles in the Top Stories category